A health savings account HSA combines high deductible health insurance with a tax-favored savings account. Money in the savings account can help pay the Plan deductible.

We believe technology should work smarter not harder.

PORTAL.e5dc5615a7704968b679d79607db78e3.png)

Smart choice health savings account. Smart and Stacked Benefits Card Whether you have an FSA HSA HRA Dependent Care Commuter Transportation account or all of them SmartCares Benefits Card is all you need. Dont have an account. When combined with a qualified High Deductible Health Plan HDHP an individual Choice Health Savings Account HSA can make your healthcare costs more affordable while reducing your income tax liability.

What is a Health Savings Account. In 2021 eligible plans that count as an HDHP must have a minimum deductible of 1400 for individuals and 2800 for families. UMB In the News.

ALIGHT SMART-CHOICE ACCOUNTS PNC - Health Savings Account Investment Options Fund name Ticker symbol Morningstar category YTD 1yr 3yr 5yr 10yr Since inception Expense ratio American Funds Invmt Co of Amer R6 RICGX Large blend 216 1320 1133 1305 952 1420 030 American Funds New Perspective R6. Enroll today in a UMB HSA. Health Savings Accounts empower you to save more spend smarter and invest in your healthcare.

HSAs are tax-advantaged member-owned accounts that let you save pre-tax 1 dollars for future qualified medical expenses. It smartly knows from which account to pull and tracks reimbursements automatically. Benefit Health Account balances and details Recent transactions and details Ability to fund HSA account from checkingsavings account.

OPTUMBank Logo An HSA is used to save for qualified medical expenses for you and your eligible dependents both now and in the future. Save money on taxes grow your nest egg. Our modern HSA platform helps you maximize your health care savings.

UMB will continue to be the custodian of HSA but it will no longer be associated with American Airlines. To protect your personal information we collect your password on a separate page. 100 free health savings accounts for individual and families.

Once this deductible is met the insurance starts paying. Health savings accounts HSAs give applicants a. Schedule of Benefits - AETNA Smart Care W Optional Health Saving Account 37097KB Summary of Benefits Coverage SBC - AETNA Smart Care W Optional Health Savings Account 27059KB Benefit Plan - AETNA Choice 75874KB Schedule of Benefits - AETNA Choice 37349KB.

Health savings accounts can really help cut your healthcare costs and you have hundreds of options. Sign up with us today. However an HSA has big tax benefits.

You not your employer or insurance company own and control the money in your HSA. Your account will then be transitioned to an individual Smart-Choice account. A Health Savings Account is a smart way to lower your actual cost for health care now and throughout your life.

Best of all we make the process simple. One benefit of an HSA. If your employment ends you will have access to your current Smart-Choice HSA account through the end of month.

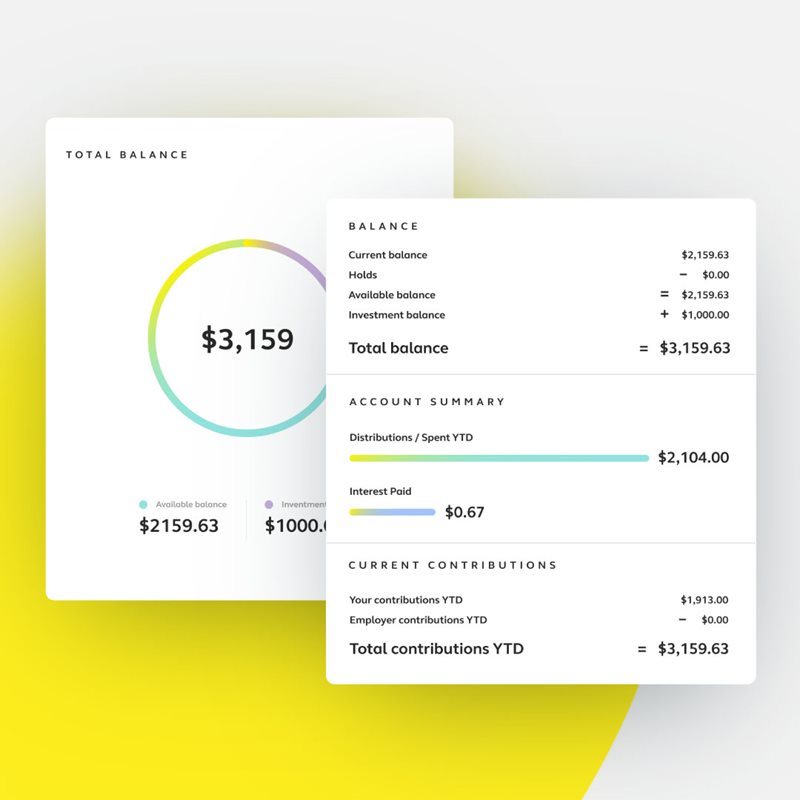

It works like a regular bank account. Money left in the savings account. Smart-Choice Mobile provides the following functionality.

Consumer Reports shows you how to choose the best health savings account. To help your workforce get the most of their health care dollars arm them with tools and resources to maximize their money. The Smart-Choice Accounts Mobile App goes where you go whether to simply check your balance at work or submit your claim at the doctors office.

Thats because the money in your account is not taxed when you save it and not taxed when you use it to pay for eligible health care expenses. Take charge of your healthcare spending. The app provides a single access point for participants to manage their consumer driven healthcare and other tax favored benefit accounts.

With the cost of healthcare continuing to surge nationwide individuals and families are smart to look for new ways to stash money. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses. Save smart its easy with an OPTUMBank Health Savings Account or HSA.

Individuals establish an HSA to pay for eligible out of pocket medical dental and vision expenses not. The UMB health savings account HSA helps you better manage healthcare costs today and in the future with easy access to funds dedicated customer service and the tools you need to make the most of your money. Heres how Health Savings Accounts HSAs work.

The app also allows you to take important actions wherever you are such as submitting claims to get reimbursed taking a photo of your receipt to submit with a claim paying bills contributing to your account recovering over payments and more. Why MyChoice TM Accounts. Health Spending Accounts HSAs provide a safety net for spenders and a long-term wealth management tool for saversand covers everyone in between.