When benefits for gender affirmation surgery and hormone therapy are available coverage may vary according to benefit design. Effective May 1 2019 Horizon BCBSNJ will change the way we consider certain professional claims based on revisions to our medical policy Gender Reassignment Surgery.

Https Www Bcbsri Com Sites Default Files Polices Gender Reassignment Surgery Pdf

I am a transgender male and will be having gender change surgery.

Does blue cross blue shield cover gender reassignment surgery. We also dont limit sex-specific recommended preventive services based on your sex assigned at birth gender identity or recorded gender. Our gender-affirming care benefits are based on the World Professional Association for Transgender Health WPATH guidelines. In some instances employer groups choose to not cover transition-related gender confirmation care and services.

Coverage for Gender Identity DisorderGender Dysphoria Treatment. Gender reassignment surgery is a term used to describe multiple medical andor surgical treatments related to alleviating gender dysphoria. Blue Care Network HMO and POS members.

If you have an HMO or POS plan there are some additional services youll need approval for. The gender dysphoria ICD-10 codes F640-F649 gender identity disorder is not a symptom of another mental disorder. The member has a consistent stable gender identity that is well documented by their treating providers and when possible lives as their affirmed gender in places where it is safe to do so.

Is that surgery covered by bcbstx and what prequalifications will I need for that surgery. Im in Texas myself and dont really trust any of the MtF GCSGRS surgeons here but thru exhaustive searching discovered that Dr. LANSING As reported last week in Between The Lines Blue Cross Blue Shield of Michigan has announced it will eliminate coverage of gender reassignment surgery in its single payer insurance program effective immediately.

Coverage for Sex Reassignment Surgery SRS for Gender Identity Disorder. Blue Cross Blue Shield of Texas wants to cover gender reassignment surgery in plans sold on HealthCaregov. Gender affirmation surgery and hormone therapy may be specifically excluded under some health benefit plans.

Billieann over 6 years ago. This is important because it ensures you have access to psychotherapy hormonal therapy and medically necessary surgical services. It is a psychological concept and sociological term not a biological one.

This document addresses gender reassignment surgery also known as sex reassignment surgery gender or sex confirmation surgery or gender or sex affirmation surgery which is one treatment option for extreme cases of gender dysphoria a condition in which a person feels a strong and persistent identification with the opposite gender accompanied with a severe sense of discomfort in their own gender. These procedures may include the following. Freestanding substance use disorder facilities.

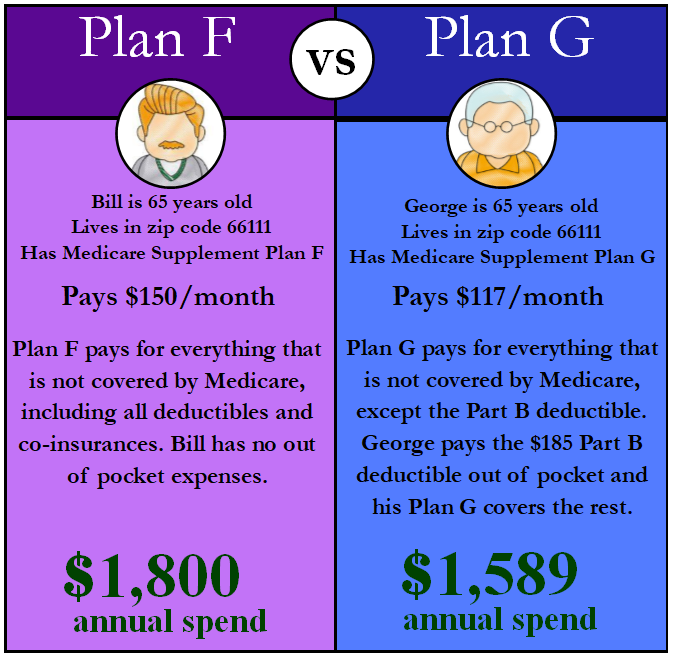

It depends on the health insurance plan. We offer a safe inclusive community for transgender and gender non-conforming folks as well as their loved ones to find support and information. Procedures or services to create and maintain gender specific characteristics masculinization or feminization as part of the overall desired gender reassignment services treatment plan may be considered medically necessary for the treatment of gender dysphoria ONLY.

And the states largest insurer noted the change in the. Please refer to the Members Benefit Booklet for availability of benefits. So Do Health Insurance Plans Cover Sex Reassignment.

Empire Blue Cross Blue Shield Gender Reassignment Surgery Guideline Welcome to the TransPulse Forums. That decision has the Coalition for Gender Equality calling for a re-examination of the decision. Coverage for Gender Reassignment Surgery.

If you cant find the information you are looking for call our Gender Services Consultant at 651-662-8511 or call the customer service number on the back of your member ID card. Kathy Rumer in Philadelphia PA well-respected lots of good reviews few bad reports -- all surgeons have some problem cases so you gotta look at everything and make a judgement call I know someone who had here surgery there and is well pleased happens to be. Some benefit designs for gender affirmation surgery may include benefits for.

Coverage for Gender Reassignment Surgery. Gender is a term that refers to the psychological and cultural characteristics associated with biological sex. Wellmark Blue Cross Blue Shield.

Covered procedures when medical necessity criteria are met. Gender identity refers to an individuals awareness of being male or female and is sometimes referred to as an individuals experienced gender Gender. Here are some examples.

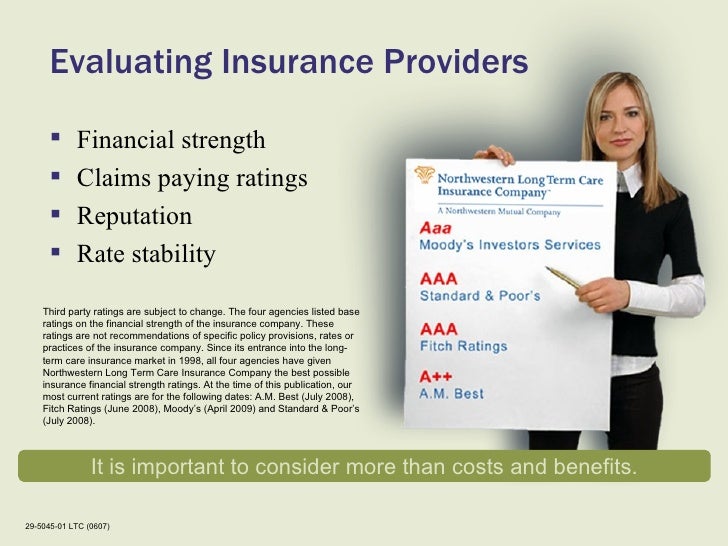

This description from Aetna and this one from Blue Cross Blue Shield of Tennessee are good examples of how private health insurers might cover some aspects of the gender transition process but not all. Access our Medical Policy Manual to review this medical policy content¹. Procedures that may be cosmetic such as removing scars or excess tissue from your eyes or abdomen.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)