Click My coverage and costs Click the My documents link to the far right of the page. In this video from TaxSlayer Pros Training Videos Series we will go over the 1095-A.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page.

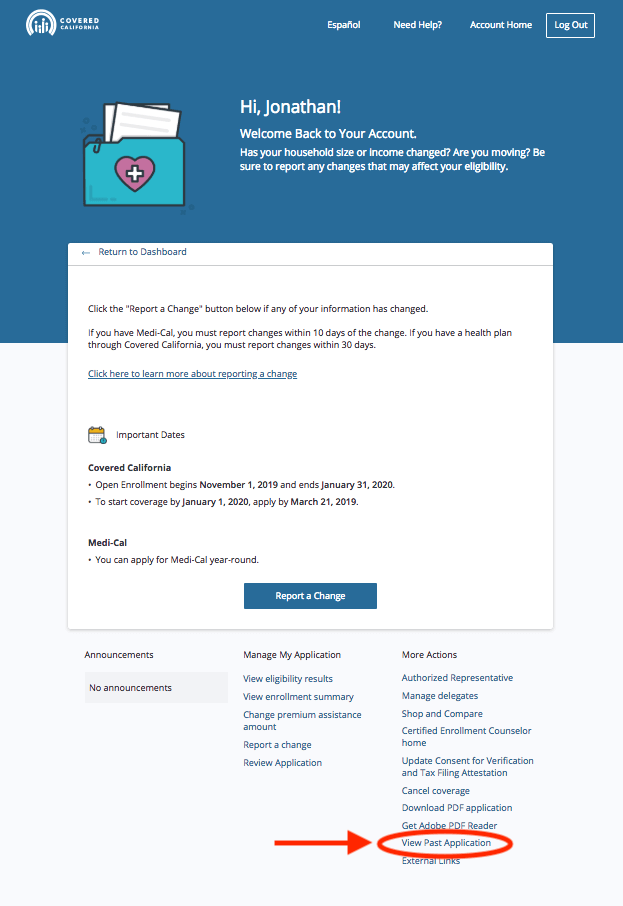

Find my 1095 a. You will have to login to your Covered California online account. The downloaded PDF will appear at the bottom of the screen. Videos you watch may be added to.

If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. Log in to Marketplace account. You can get all your MA Form 1095-As going back all years.

Before you file make sure your 1095-A. Click the link in the Tax documents section. Download all 1095-As shown on the screen.

The Form 1095-As have already been posted online. The Form 1095-A only reports medical coverage not catastrophic coverage or stand-alone dental and. Find your 1095-A in the list of documents its probably near the top of the list.

Select Tax Forms from the menu on the left. Log in to your HealthCaregov account. Enter your ID and password to sign on.

Internet Explorer users. Click the green Start a new application or update an existing one button. Get screen-by-screen directions with pictures PDF or follow the steps below.

If you dont have your user name and password. How do I get my 1095 a form from Kaiser. Click your name in the top right and select My applications coverage from the dropdown.

If playback doesnt begin shortly try restarting your device. Click Save at the bottom and then Open. You can also find the information on your 1095 yourself or request another copy from the Marketplace.

When you follow these steps be sure to choose your 2018 application not your 2019 application. Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. How to find your 1095-A online Log in to your HealthCaregov account.

View or download each Form 1095-A. How to find download your 1095-A Tax Form from HealthcaregovIf you need any further assistance please give us a call at 844 696-3975You can always lea. How to find your 1095-A form or do your taxes without it.

Find your Form 1095-A online. Heres how to find IRS Form 1095-A on the Massachusetts Health Connector website. Select your 2014 application be sure youre not choosing your 2015 coverage application Select Tax forms from the menu on the left.

This information is only for the state of Massachusetts. If you receive health coverage for yourself or your family through the Health Insurance Marketplace you will receive a Form 1095-A from your insurer after the year ends. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A If your form is accurate youll use it to reconcile your premium tax credit.

If your form didnt come by mail or you cant find it check your online Marketplace account. 1095-A Health Insurance Marketplace Statement Overview - YouTube. Click on Select and then View Magically your 1095-A will download to your computer.

Download and print the form. First you must be able to log into your Mass Health Connector online account. When the pop-up appears select Open With and then OK.

If you cant find your 1095-A check online. Other states that use healthcaregov will find their 1095-A. Under Your Existing Applications select your 2020 application not your 2021 application.

How to find Form 1095-A online. Call the Health Connector at 1-877-623-6765.