You can qualify for a premium tax credit if your individual income falls between 12880 and 51520 or 100 and 400 of the FPL. The basic math is 4X the Federal Poverty Level FPL as determined by the government.

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

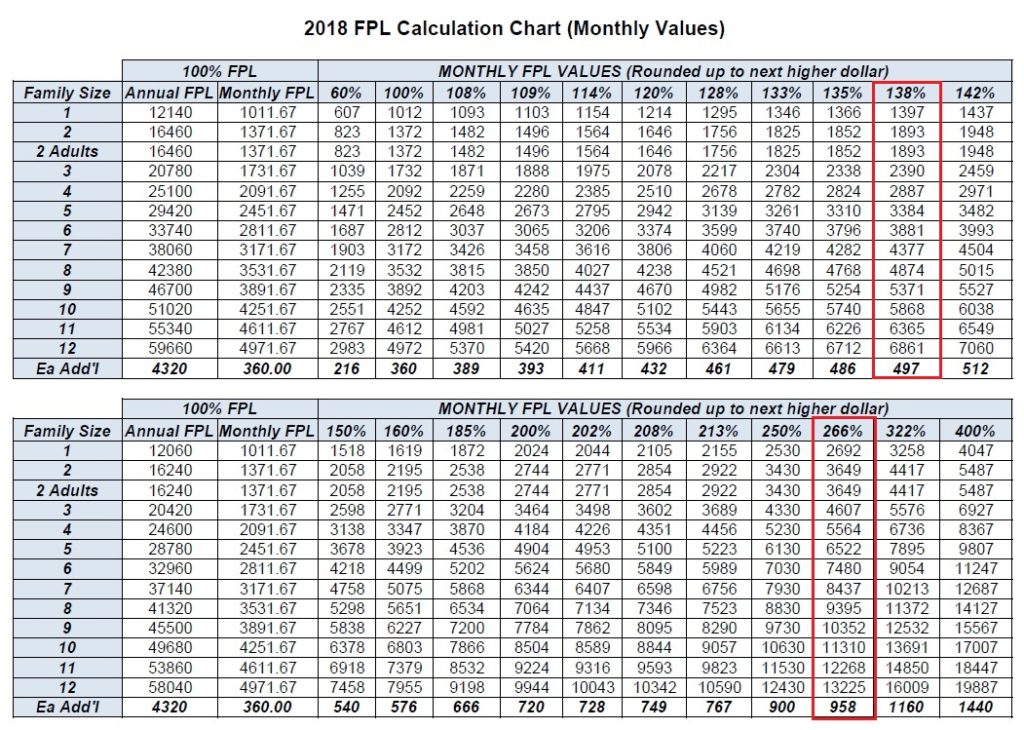

Resources Data and Analysis for California Originally published July 2014.

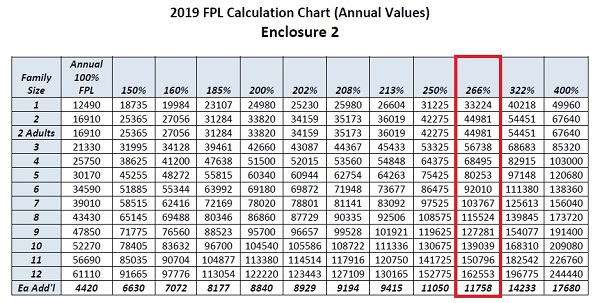

Affordable care act income limits for 2020. See Stay Off the ACA Premium Subsidy Cliff. 23 In March 2021 the federal government enacted the American Rescue Plan Act which expanded the eligibility requirements for subsidies. In general you may be eligible for tax credits to lower your premium if you are single and your annual 2020 income is between 12490 to 49960 or if.

But do not include Supplemental Security Income SSI. The income cap for subsidy eligibility does not apply in 2021 or 2022 Premium subsidies normally arent available to people with income ACA-specific MAGI above 400 of FPL although as noted above thats not the case for 2021 and 2022. For Marketplace coverage in 2020 the poverty level used is 12490 for a single adult and 25750 for a family of 4.

The federal poverty line. For a family of four that number equaled 104800 a year. In addition to the maximum income to receive the premium subsidy theres also a minimum.

The Affordable Care Act definition of MAGI. The IRS announced the 2020 shared-responsibility affordability percentage on July 22 in Revenue Procedure 2019-29. If you claim a net Premium Tax Credit for 2020 you must file Form 8962.

In 2020 for example thats a family of four with an income between 26200 and 104800 a year. Estimating your expected household income for 2021. Therefore for 2020 plan year the most you can charge employees for the lowest-priced self-only plan is 978 of their household income.

Older adults often pay higher premiums and a higher percentage of their income for ACA health plans compared with younger adults. Select your income range. You can probably start with your households adjusted gross income and update it for expected changes.

Phaseout levels After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies. What is the maximum income for ObamaCare. You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or.

The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below. 2020 2021 Federal Poverty Levels FPL For Affordable Care Act ACA Maximum Income. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy.

Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. The average monthly premium for a benchmark plan the second-lowest-cost silver plan in 2020 is 388 for a 27-year-old enrollee and 1520 for a family of four. Under the Affordable Care Act eligibility for income-based Medicaid 1 and subsidized health insurance through the Marketplaces is calculated using a households Modified Adjusted Gross Income MAGI.

IRS Suspends Requirement to Repay Excess Advance Payments of the 2020 Premium Tax Credit. 3 Americans in this income range are caught in the trap where they make too much for Medicaid but not enough to afford private health plans. Based on your income you may qualify for tax credits when you enroll in health insurance in the state of California.

For 2021 those making between 12760-51040 as an individual or 26200-104800. This limit is down from 986 percent in 2019. Because employers dont usually know their employees household income the IRS created 3 safe harbors for determining affordability.

And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. Part of the Labor Centers Covid-19 Series.

If you have excess advance Premium Tax Credit for 2020 you are not required to report it on your 2020 tax return or file Form 8962 Premium Tax Credit. Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. Form W-2 affordability test.