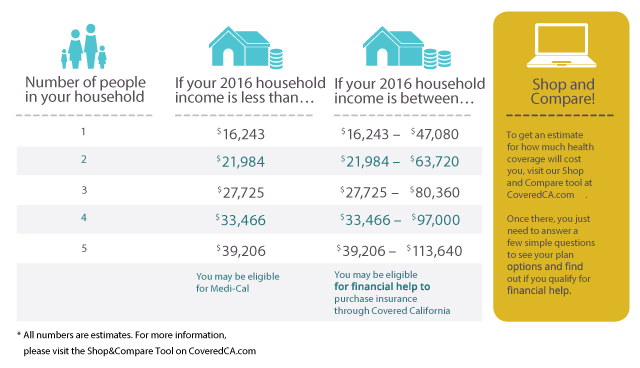

Women must be pregnant as of the application date a California resident not a recipient of no-cost Medi-Cal or Medicare Part A and Part B uninsured or covered by private insurance with a separate maternity deductible or co-payment of more than 500 and meet certain income guidelines. To see if you qualify based on income look at the chart below.

Income Guidelines Eaffordablehealth

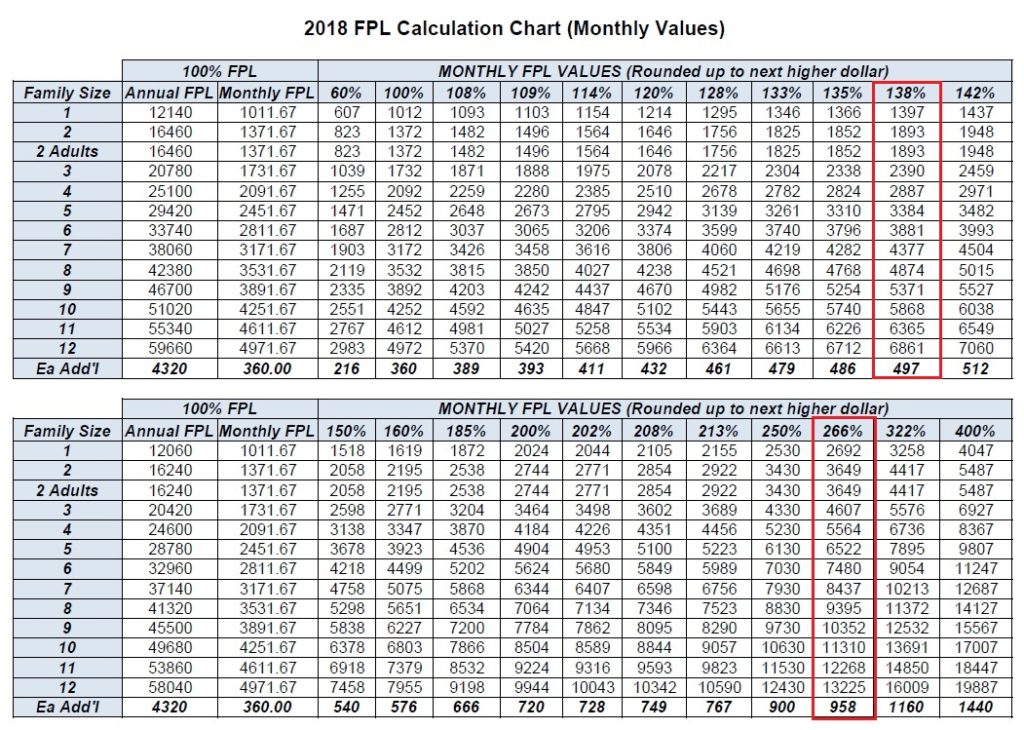

However Children qualify for Medi-Cal when their family has a household income of 266 or less.

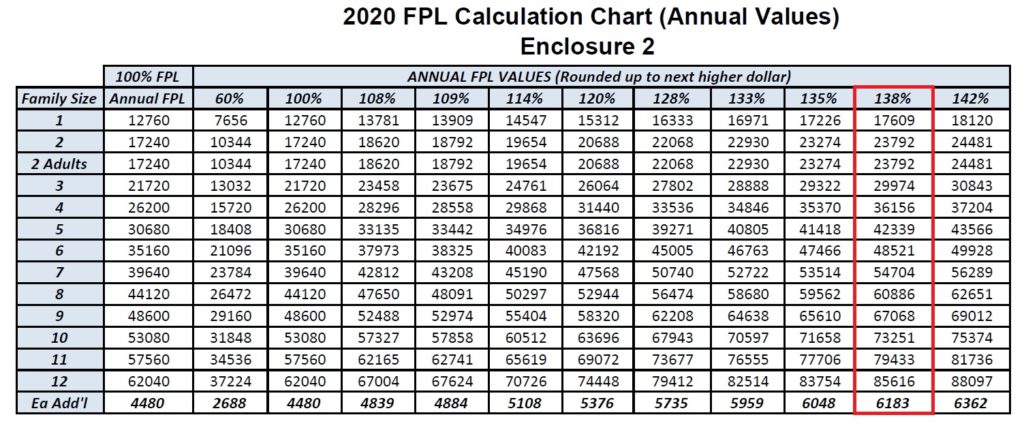

California medical insurance income guidelines. This means a single adult now has to have an annual Modified Adjusted Gross Income MAGI of 17237 to be eligible for Covered California if they apply for health insurance in 2019. MCAP is also available to women who have other health insurance plans that doesnt cover maternity services or with a maternity-only deductible or copayment greater than 500. The all important Covered California premium tax credit eligibility income 138 of the FPL for a single adult increased from 16754 for 2018 to 17237 in 2019.

16644 - below this annual income you are eligible for Medi-Cal. 150000 - 49085 x025 252288. California also will offer new subsidies in 2020 aimed at making health coverage more affordable for middle-income individuals and families.

The DHCS 2020 FPL income chart lists a higher amount of 17609 for a single adult and 23792 for two adults. If you live with a spouse or another adult your combined income cannot be more than 22108 a year. 25 of gross income that exceeds filing threshold.

Covered California listed the single adult Medi-Cal annual income level 138 of FPL at 17237 and for a two-adult household at 23226. Policies and Guidelines. The unshaded columns are associated with Covered California eligibility ranges.

In order to qualify for Medi-Cal adults must have a household income of less than 138 of the FPL. In order to qualify children must be under 19 years old. Medi-Cal Provider Billing and Policies.

This brings the couples income limit to 2081 month 1481 month for the applicant spouse and 600 month as a maintenance needs allowance for the non-applicant spouse. 100 of health insurance premium for self and dependents not to exceed taxable income 12 of self-employment tax deduction Well talk about the deductions later on but these are the three that are common for self-employed. Your household income must not exceed more than 138 percent of the federal poverty level FPL based on your household size.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. MCAP is for middle-income families who do not have health insurance and whose income is too high for no-cost Medi-Cal. MCAP is for middle-income families who do not have health insurance and whose income is too high for no-cost Medi-Cal.

Income above this number may make you eligible for premium assistance through Covered California. Here are the key income guidelines for a single person. Its the only place where you can get financial help when you buy health insurance from well-known companies.

Medi-Cal Drug Enteral Nutrition Incontinence and Medical Supplies Contracting. If your family has income at or below 138 of the Federal Poverty Level FPL 266 of FPL if youre a child you may be eligible for Income-Based Medi-Cal If you qualify for SSI Supplemental Security Income you are automatically eligible for SSI-Linked Medi-Cal. Income numbers are based on your annual or yearly earnings.

MCAP is also available to women who have other health insurance plans that doesnt cover maternity services or with a maternity-only. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL. Get information on manufacture pricing what the guidelines and procedures are and help with billing issues.

For example if you live alone your income cannot be more than 16395 a year. Covered California uses FPL limits from the prior year to determine eligibility for its programs as required by regulation. When only one spouse of a married couple applies for regular Medi-Cal the income limit is a combination of an income limit for the applicant spouse plus a maintenance needs allowance for the non-applicant spouse.

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Medi Cal Income Levels For 2020

Medi Cal Income Levels For 2020

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Metallic Plan Benefits Covered California Health For Ca

Metallic Plan Benefits Covered California Health For Ca

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

What Are Income Limits That Will Allow You To Qualify For Medi Cal Or Coveredca Health Plans Income Health Plan How To Plan

The California Guide To Health Insurance Subsidies

The California Guide To Health Insurance Subsidies

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

Covered California Official Website Assemblymember Jim Cooper Representing The 9th California Assembly District

2018 Medi Cal Monthly Income Eligibility Chart

2018 Medi Cal Monthly Income Eligibility Chart

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Health Insurance Income Guidelines

What Is The Maximum Income To Qualify For Medi Cal California S Medicaid Program Quora

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.