For a great guide on the differences between Medicare Advantage plans and Medigap plans visit this post where you can get our free guide. Also called Medigap Medicare Supplement insurance plans are sold by private insurance companies.

Why Medicare Advantage Plans Are Bad 7 Top Complaints

The primary difference between the Medigap and Medicare Advantage plans come at a different cost.

Advantages of medigap over medicare advantage. They also allow you to see any doctor in the. The table below compares Original Medicare with a Medigap and Medicare Advantage. Another advantage of a Medicare Advantage plan is a mandatory out-of-pocket maximum.

When you are healthy the other advantage of Medicares private health plans really comes into play. 10 rows Medigap. Medigap plans have fuller coverage all the way around but typically cost more.

If you are interested in joining a plan make sure to speak to a plan representative for more information. Generally speaking Medigap plans have higher premiums than Medicare Advantage plans. That being their extra benefits.

For years with low use of medical care a Medicare Advantage plan approach will be less expensive. Medicare Advantage plans are used as an alternative to Original Medicare and provides coverage for health care services. The Medigap policy can no longer have prescription drug coverage even if you had it before but you may be able to join a Medicare drug plan Part D.

Medicare has substantial deductibles and. There is no debate when in comes to which plan is more comprehensive. The Pros and Cons of Switching to a Medicare Advantage Plan.

Medicare Advantage plans typically have lower premiums than Medigap policies and cover the same benefits as Original Medicare but they also provide benefits not covered by Original Medicare such as prescription drugs eyeglasses dental care and gym memberships. You cant have both Medicare Advantage and Medigap. To put it simply Medigap plans are used in addition to Original Medicare and provides coverage for health care expenses.

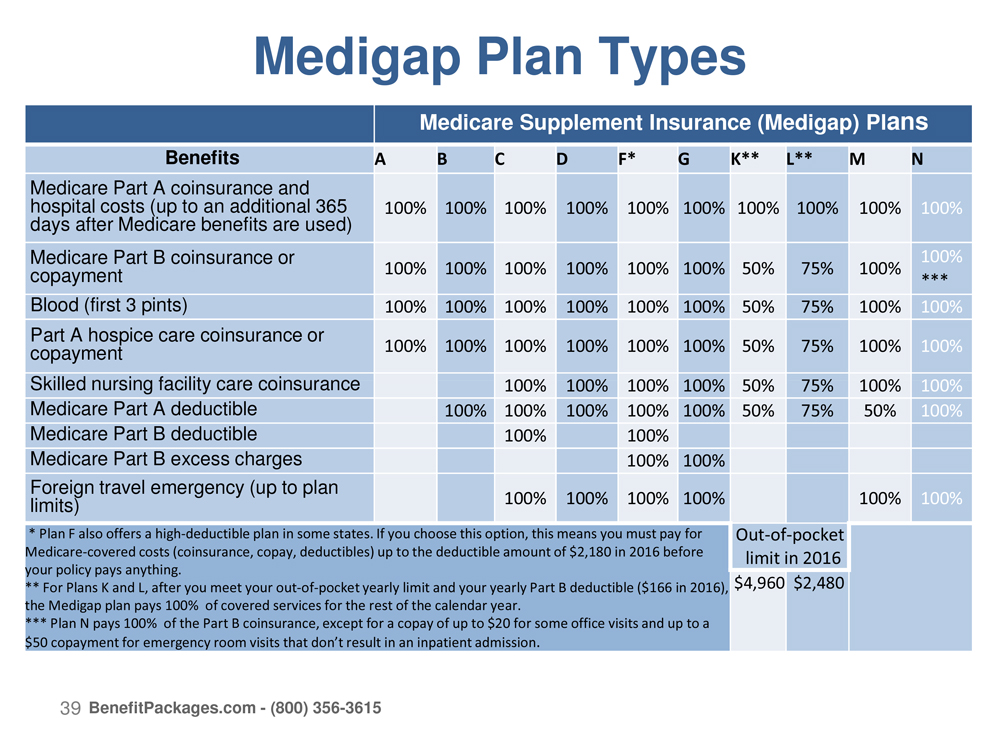

8 rows Medicare Advantage and Medigap plans offer different coverage options. Medicare Advantage also referred to as Medicare Part C plans often include benefits beyond Medicare Parts A and B. A fundamental difference between Medicare Advantage vs.

Medigap is when you the Medicare beneficiary pay out-of-pocket costs. Compare this to Medicare Advantage. Private Medicare-approved health insurance companies offer these plans.

Higher monthly premiums On average Medigap plans come with higher monthly premiums than Medicare Advantage plans. Medicare Advantage plans can be full of extra benefits like prescription drug coverage dental hearing and vision coverage. Remember that there are several different kinds of plans.

For years with high use of medical care including hospitalizations the total cost including premiums of a Medicare Supplement Plan G approach will usually be less expensive. Instead they work in tandem with Medicare Part A and Part B to give you more comprehensive and predictive coverage. Medigap Medicare Advantage Cost-sharing Pays part or all of certain remaining costs after Original.

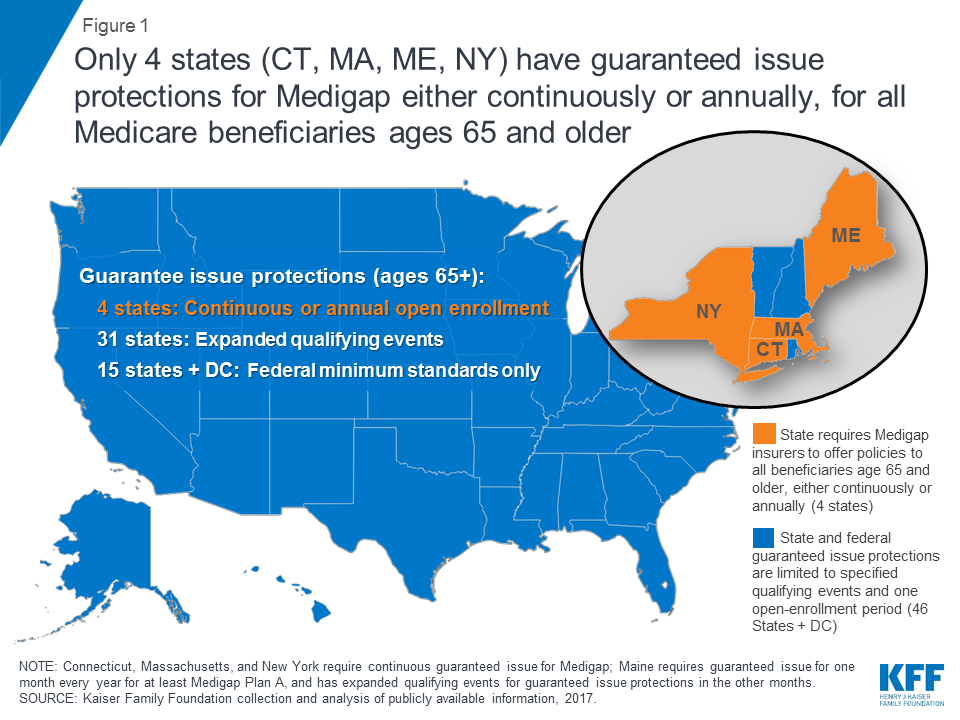

Over these years they have helped my family with its Medicare-related issues and I cannot imagine going through the Medicare Maze without them. Some states provide additional special rights. The main advantages of enrolling in a Medigap plan include.

04162021 4 min read Summary. The most common extra benefit is a prescription drug plan Medicare Part D plan. With Medicare Advantage most costs are paid when you use health services via copayments or coinsurance.

Danielle has armed Boomer Benefits with exceptional staff and because of that the entire company has rightfully earned the reputation of excellence that it has. For example someone turning 65 in Michigan can expect to pay around 120month. Medigap plans do not replace your Original Medicare benefits.

With Medicare supplement insurance plans you pay most costs in advance. If you joined a Medicare Advantage Plan when you were first eligible for Medicare you can choose from any Medigap policy. Is it better to have Medicare Advantage or Medigap.

Unlike Original Medicare with or without Medigap coverage Medicare Advantage plans can add additional benefit. Medigap has some advantages over a Medicare Advantage plan. How it relates to Original Medicare Parts A B.

Medigap plans are mandated to pay their share of the cost when Medicare covers its portion. Each plan has its own. For most people who enroll in Medicare Parts A and B buying Medigap insurance is a good choice -- unless you enroll in a Medicare Advantage MA plan.