There is a 60 day special enrollmentwindow that is triggered by moving out-of-state. They do this through the use of out-of-network coverage.

Does My Health Insurance Cover Me In Another State Picshealth

Does My Health Insurance Cover Me In Another State Picshealth

This way you can enroll in a new plan and avoid paying for coverage you wont be able to use in your new state.

Does my health insurance cover me in another state. All you need to complete the MA HealthCare certification are three pieces of data. Most domestic health plans provide limited coverage overseas and wont cover prescriptions abroad says Margaret Wilson MD chief medical officer of UnitedHealthcare Global which is part of. The State Department advises contacting your insurance.

This way you can enroll in a new plan without a break in coverage and avoid paying for coverage you cant use in your new state. Because most plans are tied to a specific state. Health insurance plans and benefits vary across the US.

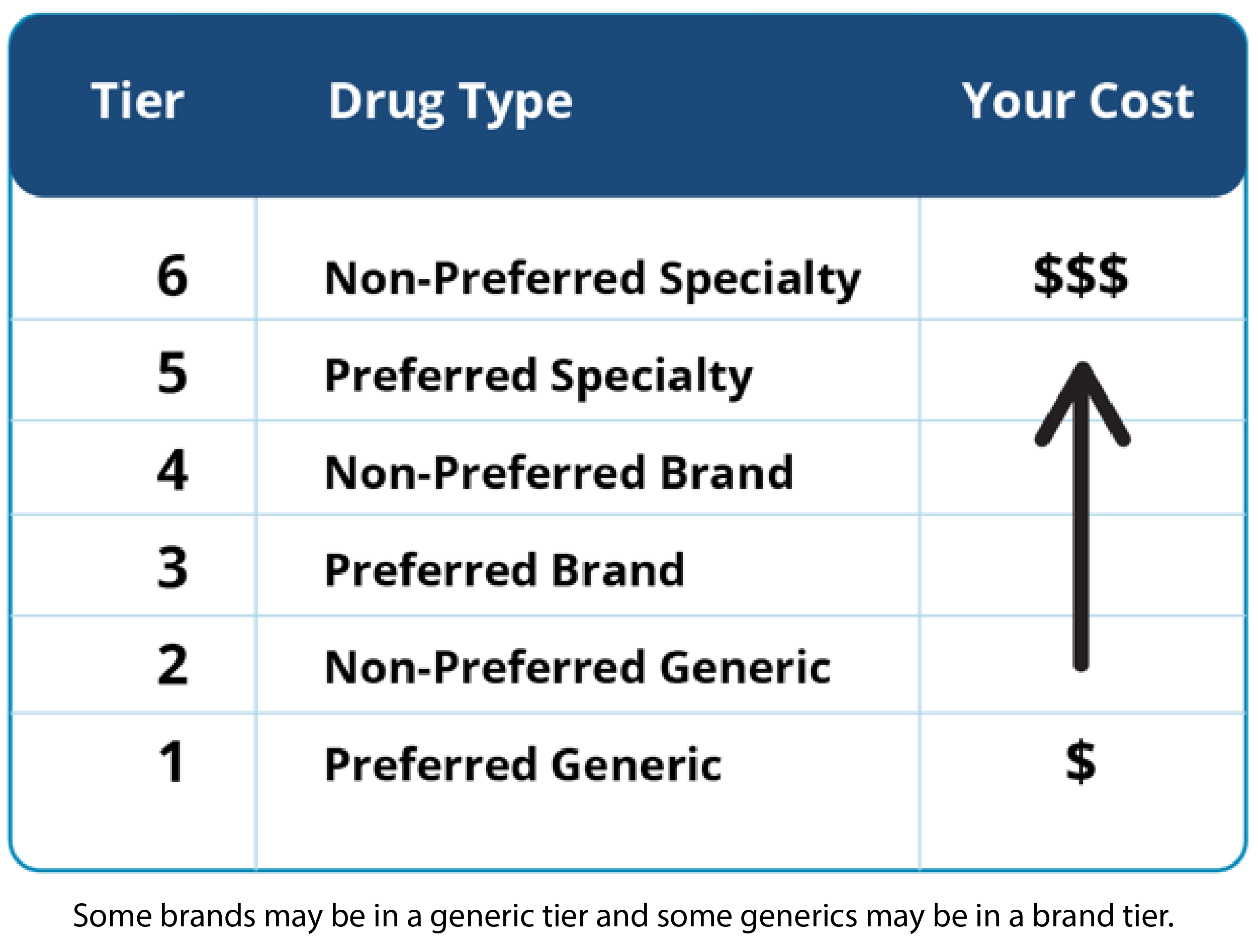

But once you have the coverage you can use it nationwide which allows Medicare beneficiaries a lot of flexibility including the option to live in another state for part of the year. For that you need a Medicare Part D prescription drug plan. When you travel to other states often your health insurance will cover you depending on your carrier their network and type of claim.

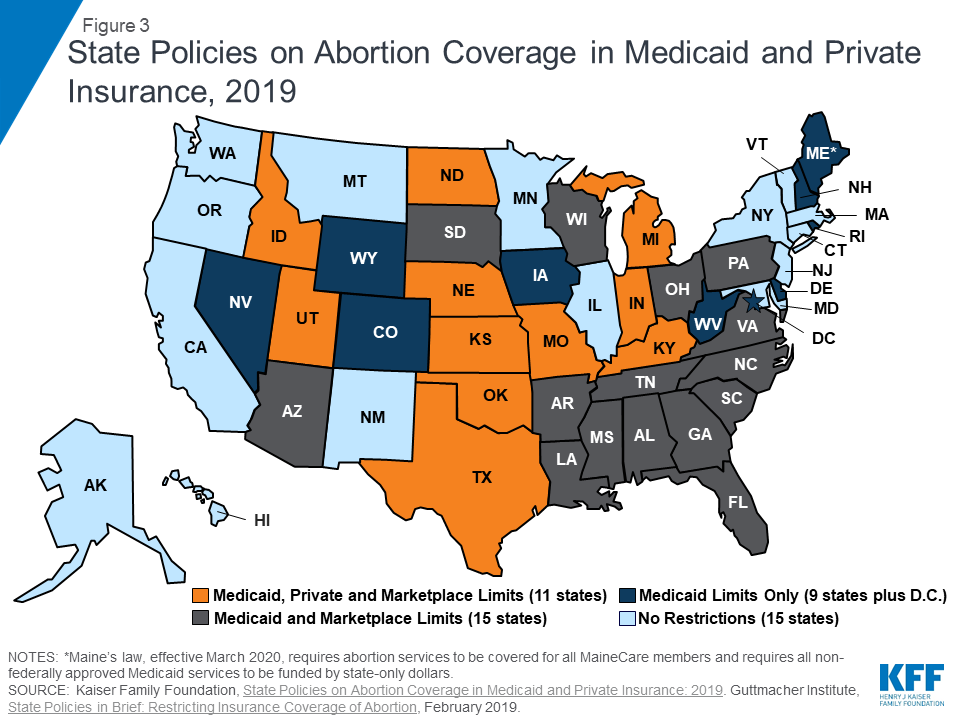

The term multi-state health insurance might lead you to believe that you would be covered out of state for your medical insurance but some multi-state plans restrict the coverage areas or may not cover you out of state. There are no changes to this law for 2019. If you move to another state you will need buy a health insurance plan in that state.

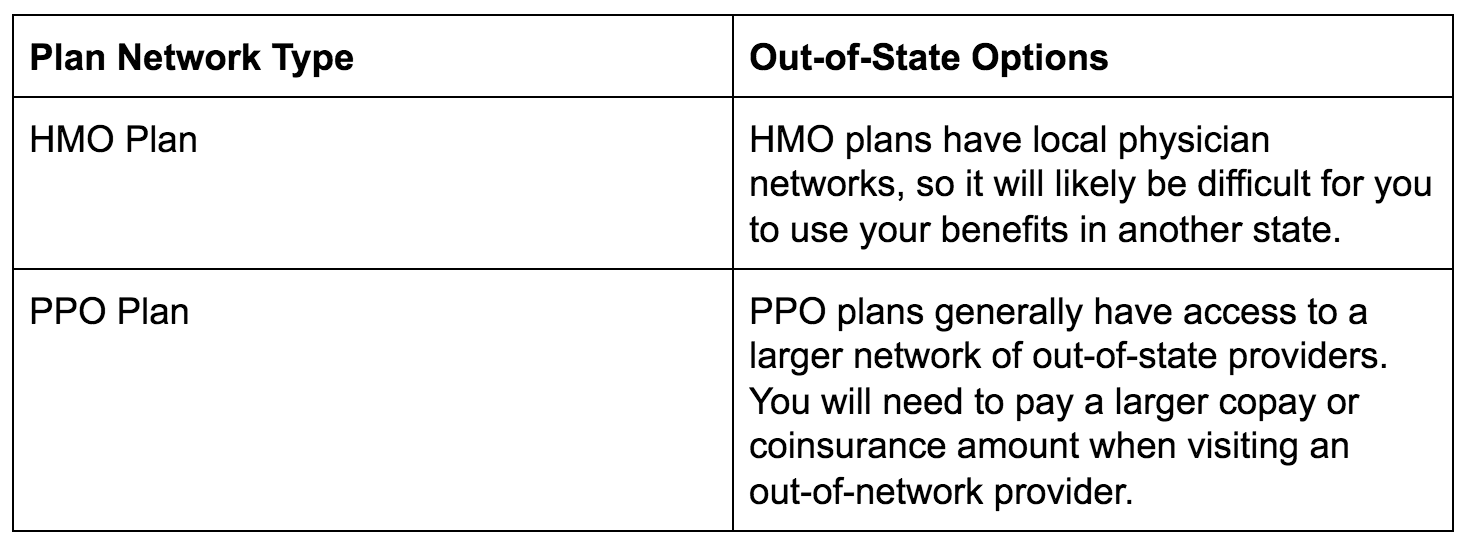

However if it is a simple office visit coverage may depend on the specific network coverage that you have and what providers your insurer uses out of your area. Original Medicare plus a Medigap plan will cover most costs but not prescription drugs. However some plans mainly PPO and POS plans offer health insurance coverage for medical care outside of the insured persons home state.

Only some MSP plans offer coverage nationally or across different states. Typically your health insurance will cover you in other states if it is an emergency or life-threatening situation. If your insurer offers Marketplace plans in the state he is moving to he may simply be able to transition to another plan from that insurer.

However a simple office visit may be treated differently. The level of medical coverage available for international travel can vary widely depending on your domestic health care provider and plan. Answer Only multi-state plans cover you outside of your state.

For example a life-threatening procedure is generally covered. He can also apply to the Marketplace to have coverage start on the day the plan will endto ensure no coverage gap. To make sure you stay covered report your move to the Marketplace as soon as possible.

If you recently moved to a new state you cant keep a health insurance plan from your old one. If your new employers health insurance plan allows you to add dependents and not all do -- you can put your daughter on the policy and keep her there until she turns 26. However if she is out-of-state she may find that none of her local medical providers participate in your insurance network.

To make sure you stay covered report your move to the Marketplace as soon as possible. The current administration has said that they may want to change this but as a health. Some plans allow you to get requests and referrals out-of-state some plans have separate out-of-network cost sharing amounts some dont cover any costs beyond emergency.

Other than that only emergency services and drugs are covered. OK so you are a MA resident filing a MA Form 1 but your insurance is through your parents insurance coverage based out-of-state that it is in PA is irrelevant. Moving to another state may warrant finding new health insurance as some plans may terminate upon the move or may not provide coverage in the new state.

RELEVANT ONLY TO MASSACHUSETTS RESIDENTS. When you move to a new state you cant keep a health insurance plan from your old state. Under current law you will need to buy health insurance in state in which you have your permanent address.

If coverage transfers is it still prudent. How to report a move to a new state. The name of the insurance company - from your insurance card.

Because each state has its own Medicaid eligibility requirements you cant just transfer coverage from one state to another nor can you use your coverage when youre temporarily visiting another state.

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/56459043/634631412.0.jpg)