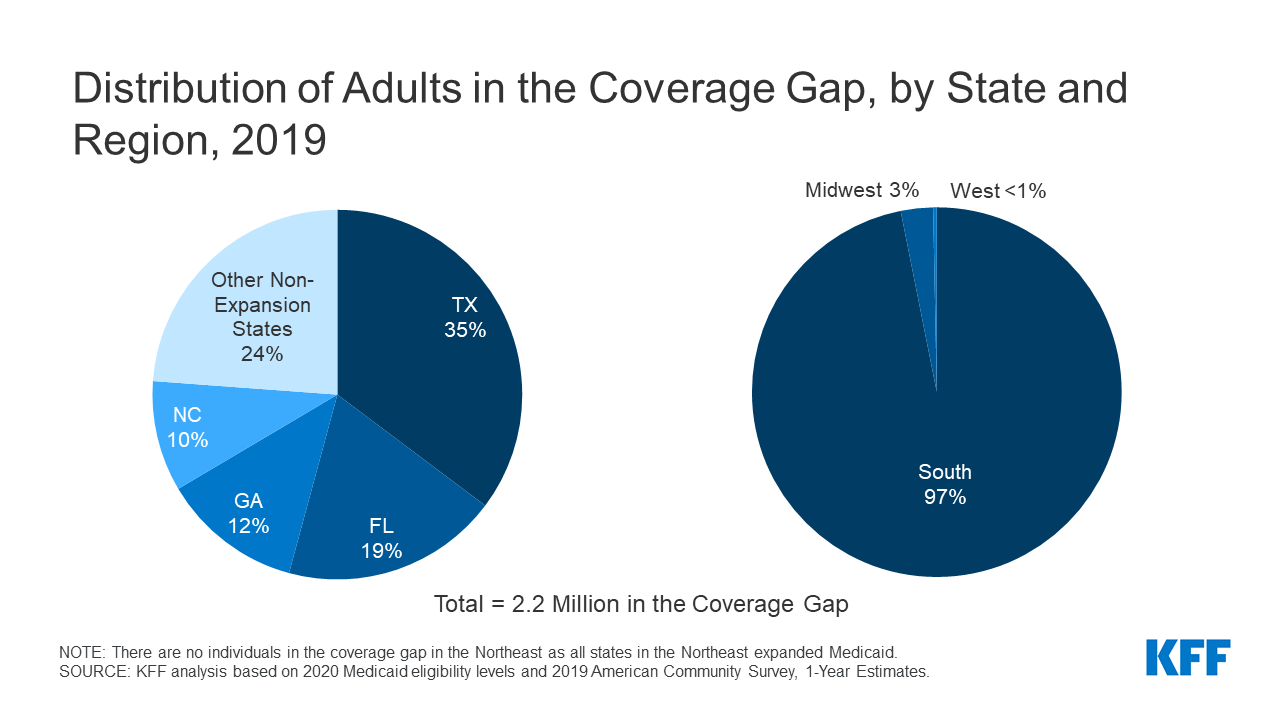

Both high deductible plans under Plan F Plan G also include coverage. Plans E H I and J which are no longer available for sale but are still valid for use also provide this benefit.

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Find your best rate from over 4700 Medicare plans nationwide.

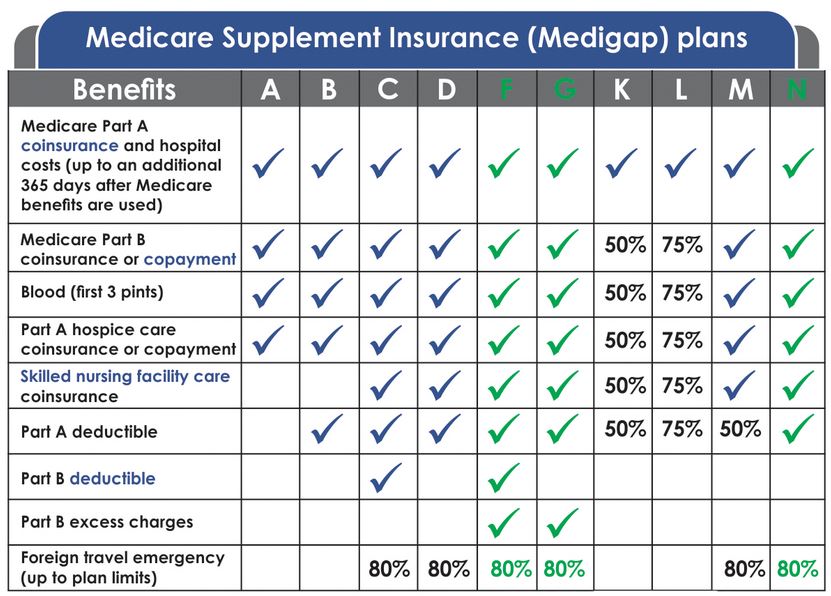

Medicare plan g foreign travel coverage. Medigap Plans C D E F G H I J M or N cover the following. In many cases a foreign hospital will bill your plan for you so you want to travel with your Medicare Advantage card. Longer than 60 days youre no longer covered by your supplement.

Annons Find affordable quality Medicare insurance plans that meet your needs. Medicare drug plans dont cover prescription drugs you buy outside the US. In this situation you pay a 250 deductible and 20 percent of the cost of the medical treatment you receive up to a lifetime maximum of 50000.

However beyond that Medicare coverage while traveling in a foreign country is sparse with just a few limited exceptions. Foreign travel emergency care if commencing within the first 60 days of travel provided Medicare does not otherwise cover it. Medicares Limited Foreign Travel Coverage Exceptions.

Some Medigap policies provide coverage for travel abroad. Medicare Supplement plans include additional benefits that will provide you foreign travel emergency coverage. These plans provide foreign travel coverage for up to 80 percent of the medical expenses you encounter while traveling abroad after you meet a 250 annual deductible.

Most Medicare Supplement or Medigap plans include a foreign travel benefit. Check to see if yours does. Which Medicare Supplement Plans Cover Foreign Travel.

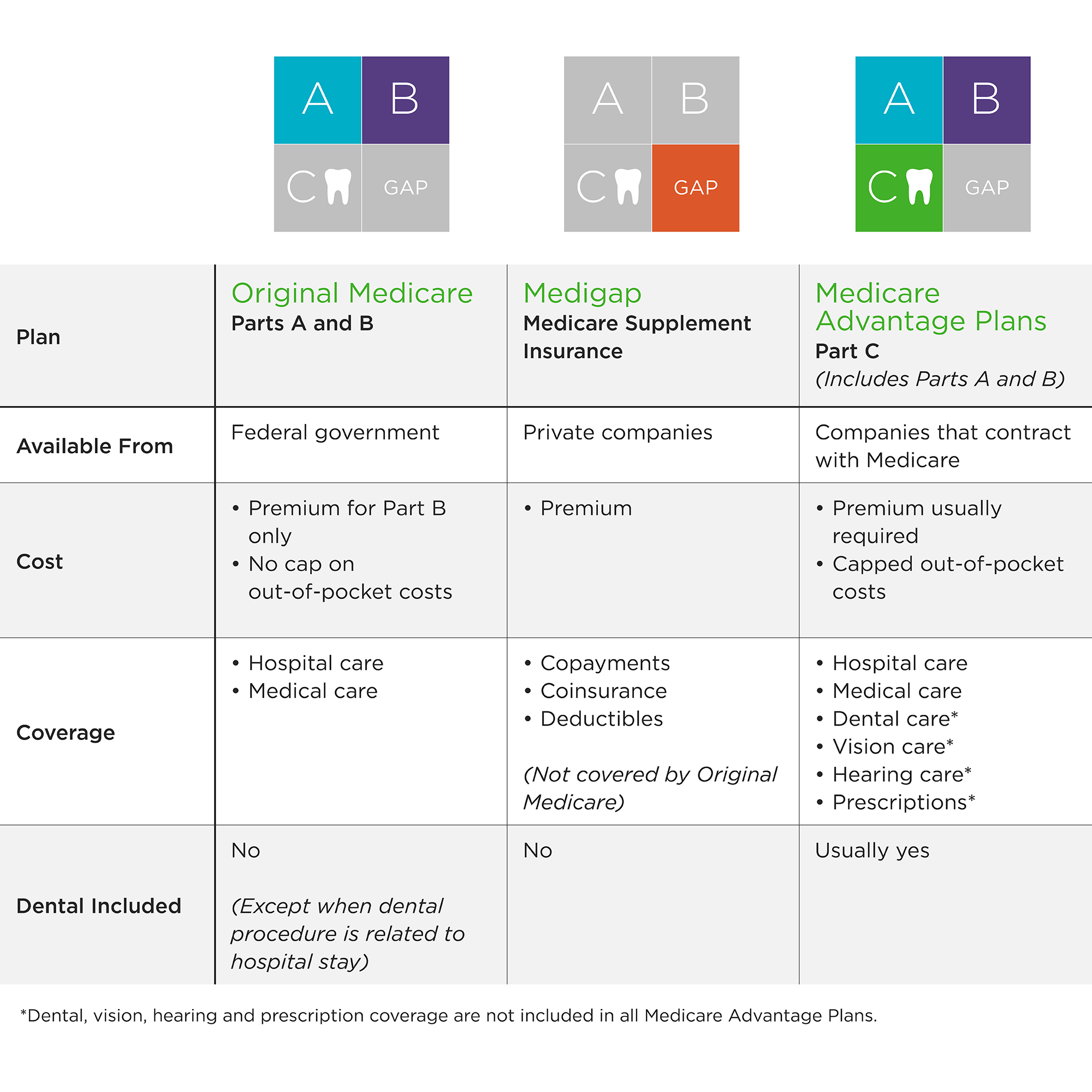

If youre adding a Medigap planto supplement your Original Medicare six of the Medigap plan design optionsprovide coverage for medical emergencies outside the United States. Medicare Advantage Plans may also cover emergency care abroad. Covers foreign travel emergency care if it begins during the first 60 days of your trip and if Medicare doesnt otherwise cover the care.

Because Medicare has limited travel medical coverage outside the US you may choose to buy a travel insurance policy to get more coverage. Certain Medicare Supplement Insurance Medigap plans do offer some coverage for foreign travel emergency health care. There is a chance that foreign healthcare providers will not bill your carrier.

After you meet a 250 Deductible glossary for the year. Plans C D E F G H I J M and N. Medigap Plans C D F G M and N each provide foreign travel emergency care coverage which you should keep in mind as you travel overseas.

By the way you can not currently buy Medigap Plans E H I and J. How can I make sure Im covered while abroad or away. Some Medigap supplemental insurance policies those labeled C D F G M or N cover emergencies or urgently needed treatment abroad if the need for care begins during the first 60 days of your trip.

This insurance also covers foreign travel. Plans C D F G M and N. Check with your policy for specific coverage rules.

Its important to note that you only have a 50000-lifetime reserve towards expenses incurred while abroad and once youve been out of the US. Medicare Foreign Travel with Medicare Advantage. Medicare supplement insurance Medigap policies may cover you when you travel outside the US.

Find out before you go Before you travel outside the US talk with your Medigap plan. Most Medicare Advantage plans provide you with worldwide emergency coverage. If you have Medicare Supplement Plan C D F G M or N you have additional protection for overseas travel.

Many of the Medigap plans include a foreign travel emergency benefit. Medigap Foreign Travel Coverage Your Medicare Supplement Plan may cover foreign travel emergency care. Medigap plans C through G M and N cover 80 of the cost of emergency care abroad.

Centers for Medicare Medicaid Services CMS reports that out of the 10 available Medicare supplement plans designated plan A through N six offer foreign travel coverage. Annons Find affordable quality Medicare insurance plans that meet your needs. Pays 80 of the billed charges for certain Medically necessary emergency care outside the US.

Learn more about your Medigap plan options. Youll be responsible for a separate 250 deductible. Find your best rate from over 4700 Medicare plans nationwide.

Six plans Medigap plans C D F G M and N include the benefit. Medicare Supplement plans C D E F G H I J M and N that cover travel pay for 80 of the cost of medically necessary emergency care outside of the US. Some Medicare Supplement also known as Medigap insurance plans do offer coverage for out-of-country travel.

With so many people on the move these days this benefit is a priority for those who travel for work or leisure. Foreign travel emergency care is covered if it begins during the first 60 days of the excursion. If you are covered under Original Medicare then you will still have access to medical care from almost any doctor or hospital in the US.

When you travel outside the US the following Medigap Plans provide you with foreign travel emergency coverage. Medicare Supplement insurance can cover international care Several Medicare Supplement insurance plans provide an international coverage benefit. Plans C D F G M and N cover medical emergencies while traveling as long as medical care starts within 60 days of leaving the United States.

Medigap plans C D F G M and N all provide emergency coverage in foreign countries. Plan G is also one of the Medigap plans that include foreign travel. Medigap plans C D F G M and N generally cover some type of travel-abroad emergency help.

Foreign travel emergency coverage with Medigap policies has a lifetime limit of 50000.

/GettyImages-1169329658-221557146abf40d39b4ded8311e8c970.jpg)

/vsp-vision-carecopy-90433708ceb04461a8b0b823cbbc9c8e.jpg)