At this time none of the 10 Medicare supplement plans available cover hearing aids. Both Original Medicare and Medigap however cover diagnostic hearing exams balance tests and Medicare covers cochlear implants.

Medicare Doesn T Cover Hearing Aids But Retirees Have Options Kiplinger

Medicare Doesn T Cover Hearing Aids But Retirees Have Options Kiplinger

Medicare does not normally cover hearing aids therefore Medigap plans dont either.

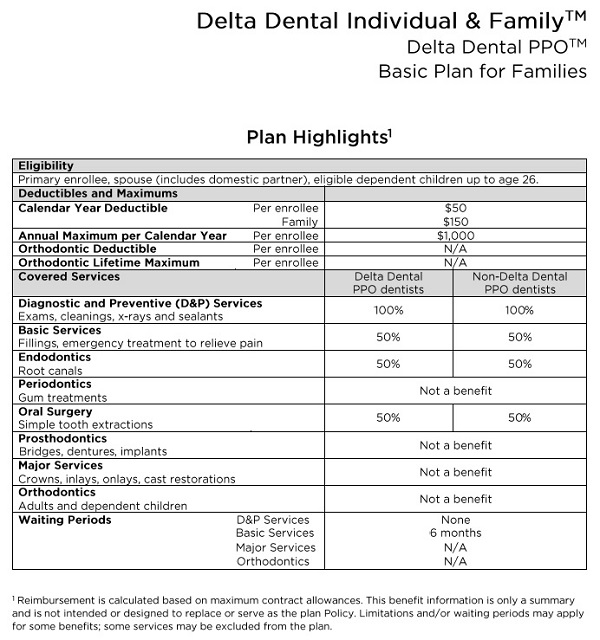

What medicare supplement plans cover hearing aids. These plans help you cover out-of-pocket costs when you have Medicare A and B. The allowance is a specified amount of money that is deducted from the final cost of the hearing aids. Neither Original Medicare or Medigap covers traditional hearing aids fittings for hearing aids and hearing exams.

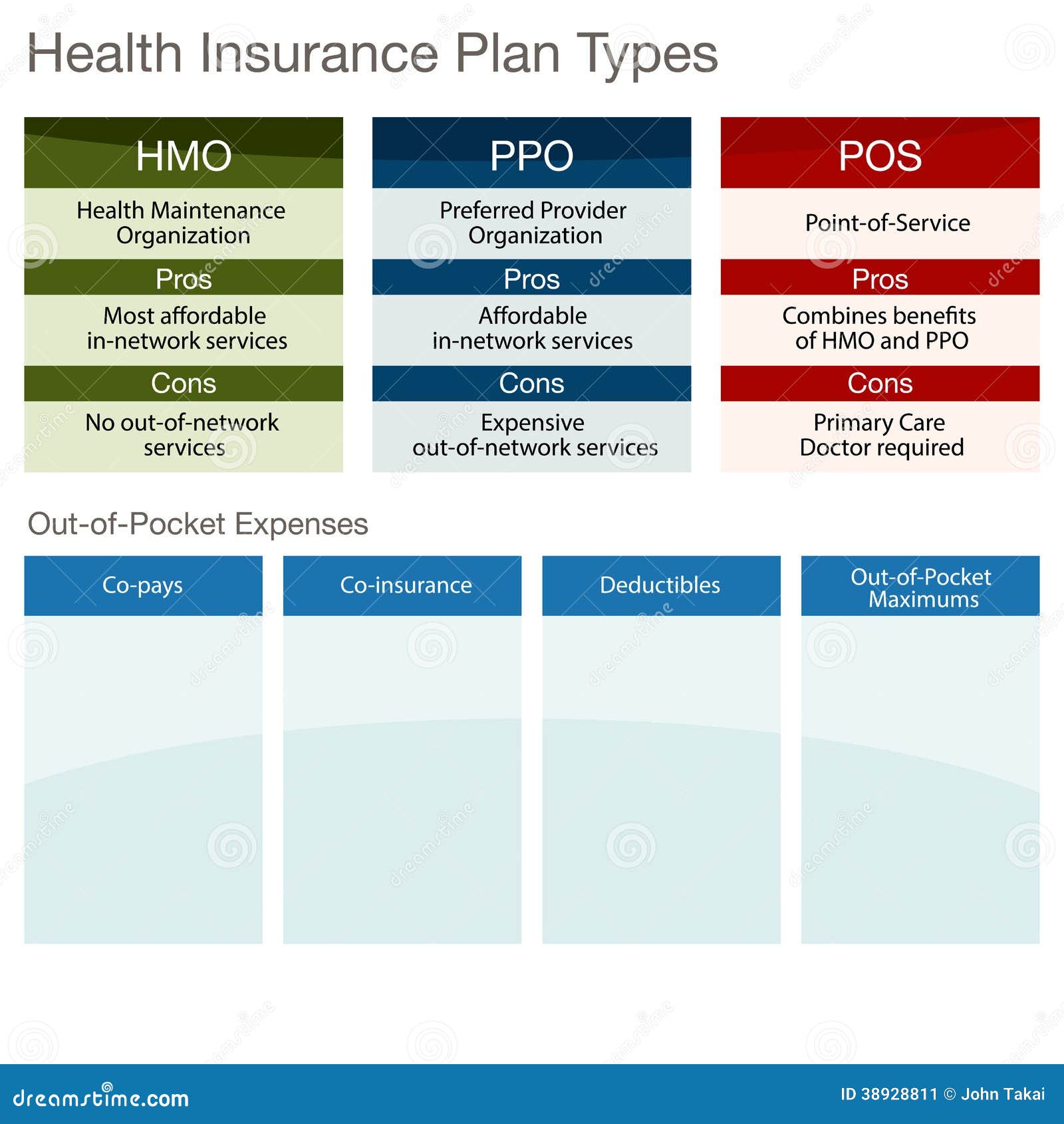

Advantage plans have a lot of restrictions on these benefits. Patients who have Plans C or F will have the deductible covered. Some Medicare Advantage plans Medicare Part C may cover hearing aids however.

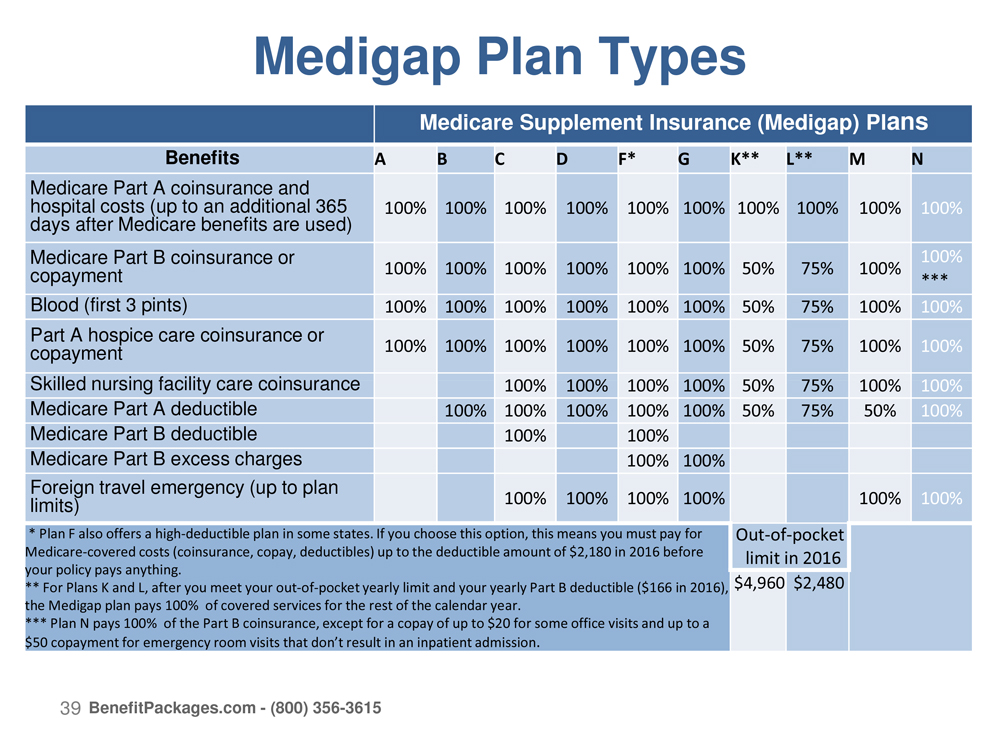

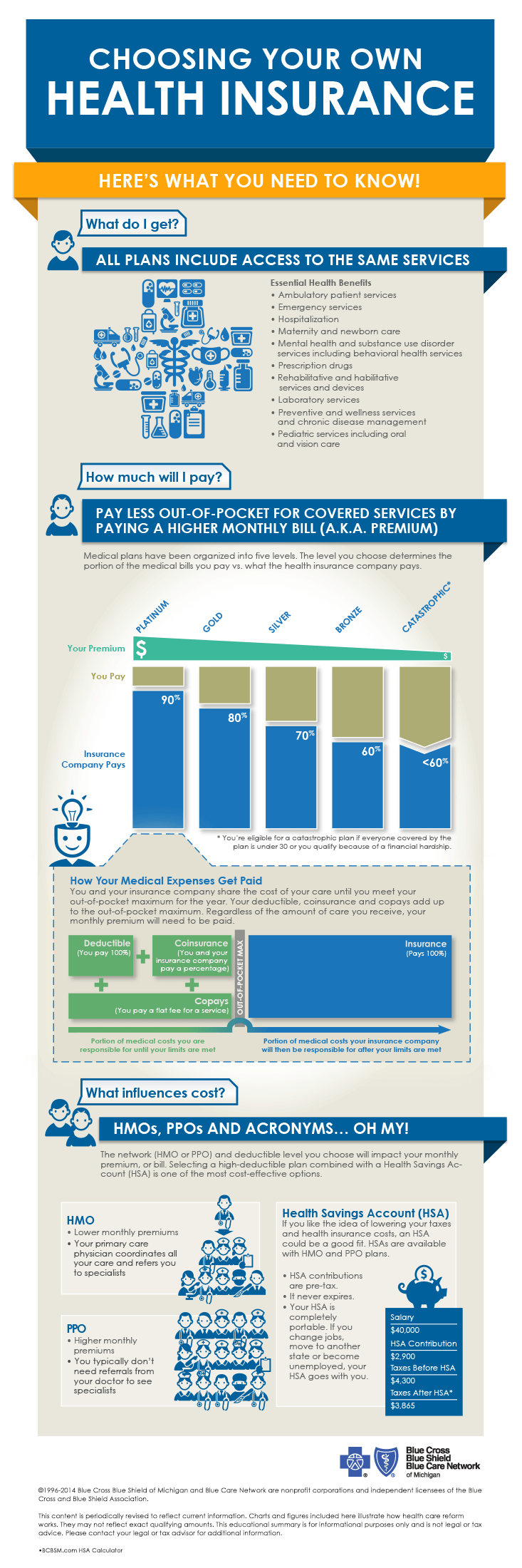

Learn more about Medicare. Some Medigap plans can cover the 20 Medicare Part B coinsurance and your Part B deductible if you need a diagnostic hearing and balance exam or cochlear implant. Medicare Supplement plans are supplemental health insurance plans that can be purchased to help cover costs Original Medicare doesntsuch as copays coinsurance or deductibles.

This is because Medicare Supplement or Medigap policies may provide benefits through various partnerships with medical equipment. Learn More about Medigap Get a Medigap. Original Medicare which includes Part A or hospital insurance and Part B which is medical insurance doesnt cover hearing aids or exams for fitting hearing aids.

Although Original Medicare benefits do not cover hearing tests or hearing aids it is possible that you could receive either full coverage partial coverage or a reimbursement for expenses related to hearing aids through a supplemental insurance plan. Medicare doesnt cover hearing aids or exams for fitting hearing aids. Original Medicare the name for Medicare Part A and Part B does not pay for hearing aids typically but it may cover hearing exams.

Does Medicare Advantage cover hearing aids. Check with your plan provider. Do Medicare plans cover hearing aids.

These plans also known as Medigap generally have no hearing-aid coverage. You can find specific plan information in the Evidence of Coverage EOC. No Medicare Supplement also known as Medigap plans dont cover hearing aids.

In fact 88 of Medicare Advantage plans cover hearing aids in 2021. If youre a veteran you have another route to take in searching for help to pay for hearing aids. However some Medicare Advantage plans do but not all.

The only hope for our aging seniors with hearing impairment could be an inclusion in the Medigap plan to cover for the hearing aids. Otherwise the Medicare Supplement plan does not cater to the hearing aid devices or services. Medicare Advantage plans must cover everything that Original Medicare Part A and Part B covers besides hospice care which Part A still covers which means medically necessary diagnostic hearing and balance tests may be covered under your Medicare Advantage plan.

But if you have a Medicare Advantage plan from a private insurance company it might cover some of the cost of hearing aids. What Medicare Pays For Hearing Aids According to the Centers for Medicare and Medicaid Medicare Part B covers diagnostic hearing and balance exams if your doctor or other health care provider orders these tests to determine whether you need medical treatment. While Medigap wont pay for hearing aids themselves it can help you save money on your overall health care.

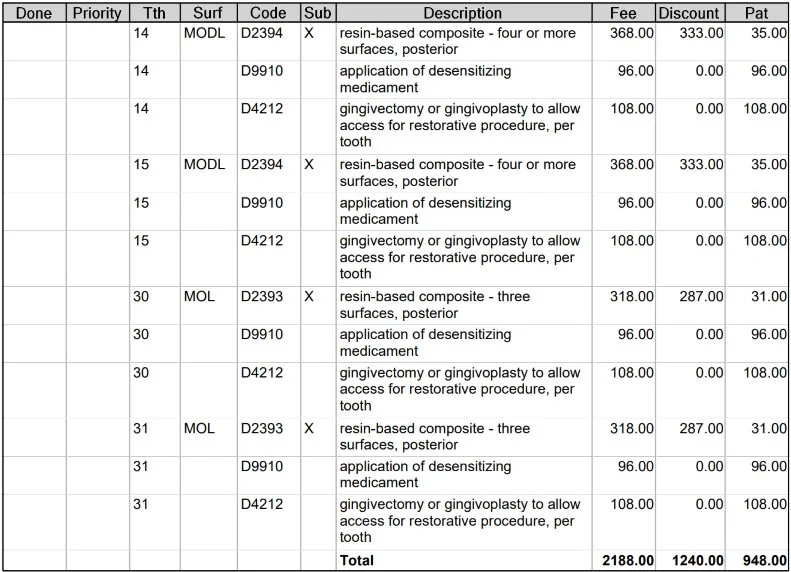

The Department of Veterans Affairs VA. Some plans like the Aetna Medicare Value Plan offer discounts or allowances for hearing aids. Your costs in Original Medicare You pay 100 for hearing aids and exams.

So if you opt for only Original Medicare and you need a hearing aid youll be paying 100 out-of-pocket for your device and any exams related to getting it. Medigap is a supplemental health plan standardized by Medicare but offered by a variety of private companies. The majority of major insurers who offer Medicare Advantage plans have at least one plan that covers hearing aids.

Depending on which Medicare plan you have enrolled in benefits can either be included in the plans premium or by paying an additional premium to get an optional. That can go a long way toward saving up for hearing aids. Or better still a free hearing aid program by the federal government to supplement Medigap.

If you purchased your Anthem plan through us you can contact our Client Care Team and they will help you with the claim. If a patient has a hearing problem due to a medical condition and has been referred by a doctor a Medigap policy could help cover the 20 per cent out-of-pocket cost of the hearing examination. Dental eyewear and hearing coverage is offered through a network plan or as a direct member reimbursement DMR.

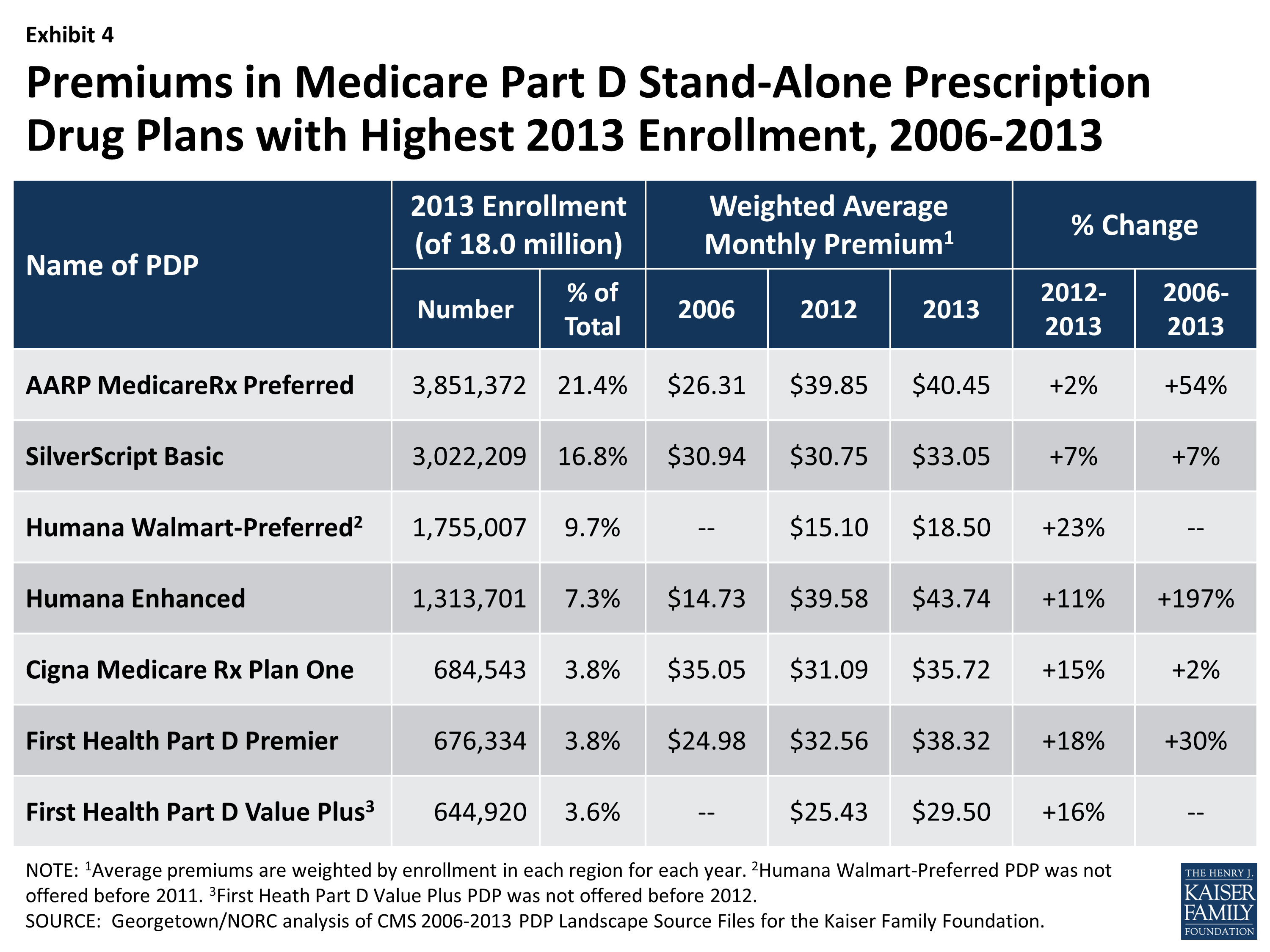

Does Medicare pay for hearing aids. However some seniors may not be eligible for those plans and the plans may have a higher premium than those that dont offer hearing aid coverage. These insurers include Humana Aetna and Blue Cross Blue Shield.

All Medigap plans will cover all or part of your Part B coinsurance and copays for these diagnostic services but only Plan F and C will cover your Part B deductible 203. Medicare does not cover hearing exams hearing aids or exams for fitting hearing aids.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)