March 17 2021 at. Wellness HSA Family 125112 and 250224.

Hsa Insurance Plans Medical Sharing Plans Get A Free Quote

Hsa Insurance Plans Medical Sharing Plans Get A Free Quote

Affordable HSA Plans In Indiana.

Affordable hsa plans. Anthem Blue Cross Aetna UnitedHealthOne and also Humana characteristic reasonably priced Indiana HSA plans along with small monthly premiums along with comprehensive benefits. An HSA is tax-favored savings account that is used in conjunction with a high-deductible HSA-compatible health insurance plan to make healthcare more affordable and to save for retirement. Shop us first and save with 200 plans to choose from starting as low as 12903 a month.

You can now use your HSA for over-the-counter medicines and even feminie hygiene products. Virginia residents can pay for qualified medical expenses with pre-tax dollars and save for retirement on a tax-deferred basis. This year the Hoosier State contributes 39 of the CDHP Consumer-Driven Health Plan deductible.

Also be aware that Kaiser may offer ACA-compliant. Nationwide more than 10 million men and women utilize HSA plans upward through 8 thousand within 2009. HSA Plus Cost Efficient Benefit Plan is excited to introduce HSA Plus.

We offer our stand-alone Health Spending Account HSA as an alternative to traditional insurance group plans. The Affordable Care Act ACA has brought with it some interpretation challenges for HSAs. The HSA has no premiums flexible limits and controls employee benefit costs.

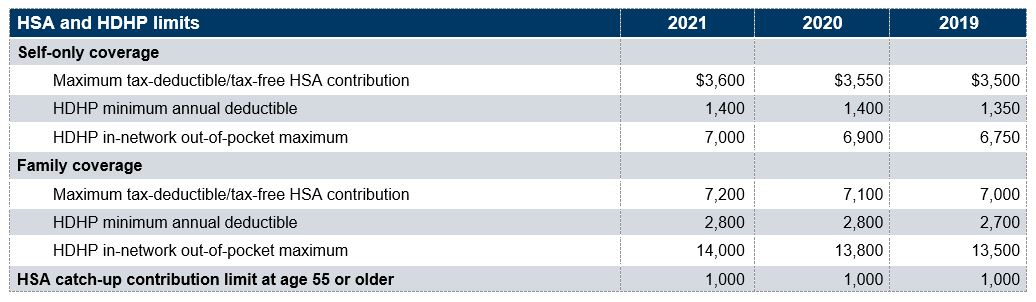

The underlying HDHP see below for definition plan must have a minimum deductible of 1400 for single coverage and 2800 for family coverage. If you find you need more information or when you are ready to move forward with choosing a health insurance plan well help you select the plan that best matches your specific needs. 55 and older can contribute an extra 1000.

In order to make contributions to an HSA you must be enrolled in an HSA-qualified high-deductible health plan. Plans initial contribution and employer annual contribution are shown below. Your HSA plan also comes with no hidden fees and you can get the 325 monthly plan fee waived if you maintain an HSA balance of 2000 or more.

Amounts can slightly vary depending which plan you are enrolled in. You are a large incorporated business owner who wants to provide supplemental coverage to your employees in addition to their group benefits plan in order to attract and retain top talent and promote employee wellness. For 2019 a Health Savings Account can be paired with any plan with an annual deductible of more than 1350 for self-only coverage or 2700 for family coverage AKA any High Deductible Health Plan HDHP.

To us that means an HSA that is affordable for all employers and that covers the unique everyday health and dental needs of all their employees. Health benefits should no longer reward and protect only those working in public service or for large corporations. Our product portfolio includes.

High-deductible plans dont start paying until after youve spent at least 1400 for an individual or 2800 for a family of your own money on health care expenses although deductibles vary by plan. You can only get an HSA if youre enrolled. A 1000 catch-up contribution is allowed for contract owners that have reached age 55.

An Indiana HSA will be an affordable choice for your conventional detailed health plan. March 17 2021 at 1102 am. Minimum Deductible for HDHP 1300.

HSA Insurance - Affordable Health Insurance Shopping for Health Insurance. HSA only works with brand name insurance providers to deliver solid affordable plans for individuals families and businesses. For 2018 HSA annual contribution limits are 3500 for an individual and 7000 for a family.

It was not immediately clear that all HSA compatible plans would satisfy the actuarial requirements for plans offered through the ACA exchanges yet it appears that most high-deductible plans do satisfy the Essential Health Benefit EHB requirements. The main advantages of an HSA. Low price Health Savings Accounts HSAs around Indiana tend to be available.

Posted on September 29 2011 by indianacities7. The maximum allowed out-of-pocket expenses are 6900 and 13800 respectively. The maximum deductible is 7000 for an individual or.

You are the dog owner and now have full control of the capital as part of your Indiana HSA plan. Minimum Deductible for HDHP 1350. To be able to fund an HSA you must have what the government considers a high-deductible health plan HDHP or a plan with a minimum deductible of 1400 for individuals or 2800 for families.

Retirement Hacks Get triple the tax benefits with an HSA and find an affordable health plan while youre at it Last Updated. Wellness HSA Single 62556 and 125112. An HSA or Health Savings Account is a special type of tax-advantaged savings account designed to help you pay for out-of-pocket medical expenses.

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Everything You Need To Know About Affordable Healthcare Plans For 2021 Lifehack

Everything You Need To Know About Affordable Healthcare Plans For 2021 Lifehack

Why Offer A Health Savings Account In A Section 125 Cafeteria Plan Core Documents

Why Offer A Health Savings Account In A Section 125 Cafeteria Plan Core Documents

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

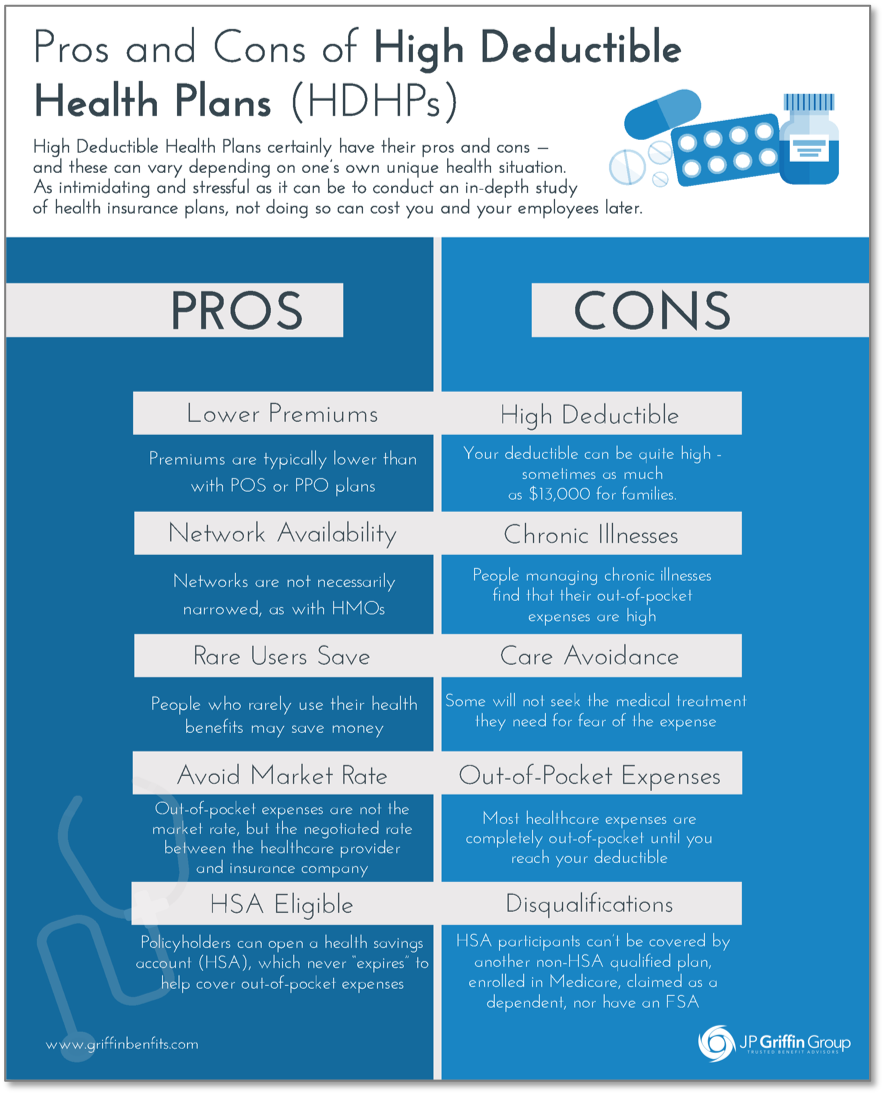

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

2021 Health Savings Account High Deductible Health Plan Figures Set Mercer

2021 Health Savings Account High Deductible Health Plan Figures Set Mercer

Hsa And Medicare Can You Have Both Boomer Benefits

Hsa And Medicare Can You Have Both Boomer Benefits

The Magic Of Health Savings Accounts Recovering Women Wealth

The Magic Of Health Savings Accounts Recovering Women Wealth

2020 Health Savings Account Mercer

2020 Health Savings Account Mercer

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.