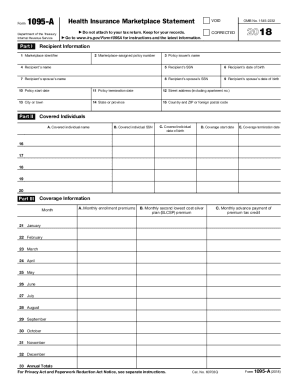

If you or anyone in your household enrolled in a health plan through the Health Insurance Marketplace in 2014 this tax season youll get a new Form 1095-A Health Insurance Marketplace Statement. Download all 1095-As shown on the screen.

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

Under Your Existing Applications select your 2020 application not your 2021 application.

Health marketplace 1095 a form. The healthcare 1095 A Form is designed to gather your tax information related to the federal subsidy that you could get in 2016 and the actual costs of your health insurance plan. It comes from the Marketplace not the IRS. As the form is to be completed by the Marketplaces individuals cannot complete and use Form 1095-A available on IRSgov.

Form 1095-A is provided here for informational purposes only. Health Insurance Marketplaces furnish Form 1095-A to. STEP 1 Log into your Marketplace account.

Health Marketplace 1095 A Form. Select Tax Forms from the menu on the left. The 2016 subsidy is also known as the Premium Tax Credit PTC.

If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. How to check your Form 1095-A If anyone in your household had Marketplace health insurance in 2018 you should have already received Form 1095-A Health Insurance Marketplace Statement in the mail. Update the latest health news daily.

Individuals to allow them to. Marketplace health insurance 1095a form. If you bought health insurance through one of the Health Care Exchanges also known as Marketplaces you should receive a Form 1095-A which provides information about your insurance policy your premiums the cost you pay for insurance any advance payment of premium tax credit and the people in your household covered by the policy.

How to find your 1095-A online Log in to your HealthCaregov account. STEP 3 Select Tax Forms from the menu on the left. Keep it with other important tax.

Health Insurance Marketplaces must file Form 1095-A to report information on all enrollments in qualified health plans in the individual market through the Marketplace. Form 1095-A and your tax return. Forms 1095-B and 1095-C or other documentation used to determine healthcare coverage should not be attached to the return but should be kept for your records.

Form 1095-A 2020 Page 2 Instructions for Recipient You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace. Form 1095-A is a form that is sent to Americans who obtain health insurance coverage through a Health Insurance Marketplace carrier. A 1095-A Health Insurance Marketplace Statement is a form you receive from the Health Insurance Marketplace or Health Insurance Exchange at healthcaregov if you and your family member s purchased health insurance through the Marketplace for some or all of the year.

Store this form with your important tax information. This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC. Take the premium tax credit reconcile the credit on their returns with advance payments.

If the taxpayer expects to receive Form 1095-A from the Marketplace you should wait to file the taxpayers Individual Income Tax Return until after Form 1095-A has been received. It was established to provide people who bought health insurance plans via the health insurance marketplace with cheaper coverage. If your form is accurate youll use it to reconcile your premium tax credit.

If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. 3 things to know about Form 1095-A If you cant find your 1095-A check online. STEP 4 Under Your Forms.

Youll get it in the mail by early February and use it to file your 2014 federal income tax return. Health Insurance Marketplaces use Form 1095-A to report information on enrollments in a qualified health plan in the individual market through the Marketplace. How to find your Form 1095-A online 2.

What Is Form 1095-A. Find out how to use your Form 1095-A once you have it. Youll use it to fill out Form 8962 Premium Tax Credit and.

If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A. STEP 2 Under Your Existing Applications select your 2020 application not your 2021 application. IRS to report certain information about individuals who enroll in a qualified health plan through the Health Insurance.

If there are errors contact. Health Insurance Marketplace Statement. Form 1095-A online Learn more about health coverage and your federal income taxes.

Do not file a Form 1095-A for a catastrophic health plan or a separate dental policy called a stand-alone dental plan in these instructions.