Easily compare short-term health insurance plans. Cancel anytime without penalties.

Understanding Short Term Limited Duration Health Insurance Kff

Understanding Short Term Limited Duration Health Insurance Kff

These plans can last 30 days to close to a year.

Short term health insurance illinois reviews. Short term plans are usually the best affordable health insurance options since they are cheaper than most other health insurance plans and are open for enrollment all year. Nothing in this Section precludes an insurer from providing. UnitedHealthcare is ranked number six on Best Company.

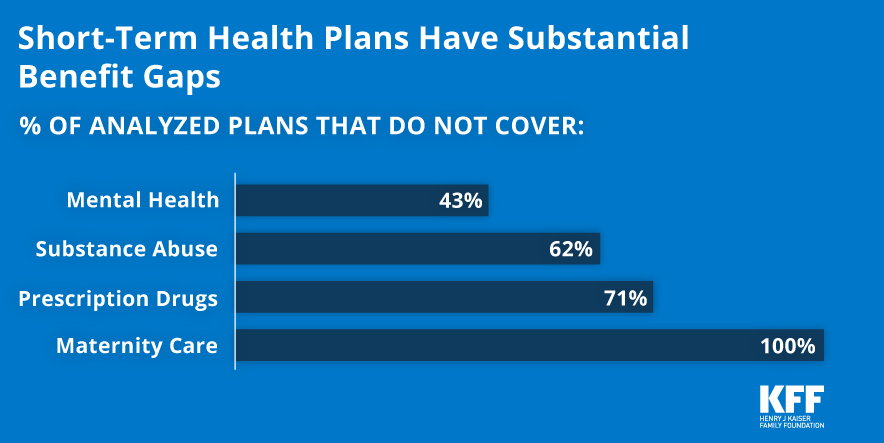

They knew the premiums were much more affordable than ACA-compliant plans because short-term insurance covers far less. Plans are not guaranteed issue plans so youll need to go through underwriting for approval. The Indiana Department of Insurance conducts rate reviews for short-term plans which must be filed using the states basic actuarial memo outline.

Best health insurance companies 2021. Short term health insurance offers you just the kind of flexible fast coverage you need for those dynamic times of change in your life. Maintaining some form of health insurance even if limited and temporary is better than having no protection at all and short term plans are much more affordable than their ACA-compliant.

When you need coverage for a short period of time. Coverage for up to 3 years depending on the state. Short-term coverage can also.

D Nothing in this Section precludes an insurer from providing disclosures in addition to those required in subsections b and c. If you need temporary health coverage outside of open enrollment but you havent had a qualifying life event short-term coverage can be a good option to meet your coverage needs. Pivot Health rated Excellent by thousands on TrustPilot.

Get covered fast as soon as the day after application. Short-term limited-duration health insurance coverage policy includes the issuance of a new short-term limited duration health insurance policy by an issuer to a policyholder within 60 days after the expiration of a policy previously issued by the issuer to the. See any doctor on open-network plans.

The amended version of the legislation limits short-term plan duration to less than 181 days and prohibits renewals. Time Limits on Short-Term Healthcare Coverage. Even if that federal change does happen Illinois residents still may not be able to subscribe to year-long plans.

Which insurers offer short-term plans in Indiana. It would be easy to speculate various reasons. Recent changes at the state level however now limit the amount of time in which a person can stay covered under a short-term plan.

The Blue Cross and Blue Shield of Illinois SelecTEMP PPO Plan is an affordable short-term health insurance plan that provides individuals and families essential protection against unexpected accidents or illness. With short term medical plans 1 you can. As of late 2020 there are at least seven insurance companies offering short-term healthcare policies in Indiana.

The average cost of short-term health insurance is 124 a month compared to 393 for an unsubsidized ACA-compliant plan. 8 We found plans. The Affordable Care Act created an annual open enrollment period when anyone can buy major medical health insurance.

See any doctor on open-network plans. HB2624 SB1737 which was approved by lawmakers in 2018 and sent to the governor in late June implemented state-level guidelines for short-term health plans. Easily compare short-term health insurance plans.

The benefits of short term health insurance. READ FULL REVIEW. Telehealth included as a non-insurance benefit.

In the past it was not uncommon for someone to buy 30 60 90 or 180 days of temporary health insurance this this is now essentially limited to a fixed 90-day window. Blue Cross Blue shield. Its more likely that residents will be allowed a maximum time period of.

This plan utilizes the Blue Cross Blue Shield PPO network of doctors and hospitals and provides coverage from 1 month 11 months. Short Term Health Insurance In Illinois. The Trump administration wants to extend that time period to 364 days.

For coinsurance plans run from 20 to 30 of the covered amount. It has an overall score of 7210 and a user star rating of 315. Best health insurance provider overall.

Illinois residents have access to short term health plans that can last up to three months per federal guidelines. Deductibles begin at 1000 and run as high as 10000 for plans with less expensive premiums. Best for short-term policies.

Jeannes policy was just 274 per. An entity selling a short-term limited-duration health insurance coverage policy in Illinois must display the disclosure in subsection b on the webpage where a prospective purchaser would purchase coverage. How Much Do Short-Term Plans Typically Cost in Illinois.

Short-term health insurance in Illinois is limited to six months. Many people take advantage of this insurance option when theyre between jobs waiting for a new coverage plan to begin waiting to qualify for Medicare coverage or lacking any other form of. Short Term and Enhanced Short Term.

Cancel anytime without penalties. UnitedHealthcare offers two kinds of short-term health insurance plans. Short term health insurance is a unique type of coverage that is designed to protect individuals from the financial strain of medical costs when they need to fill the gaps between other health care plans.

Pivot Health rated Excellent by thousands on TrustPilot. Telehealth included as a non-insurance benefit. Coverage for up to 3 years depending on the state.