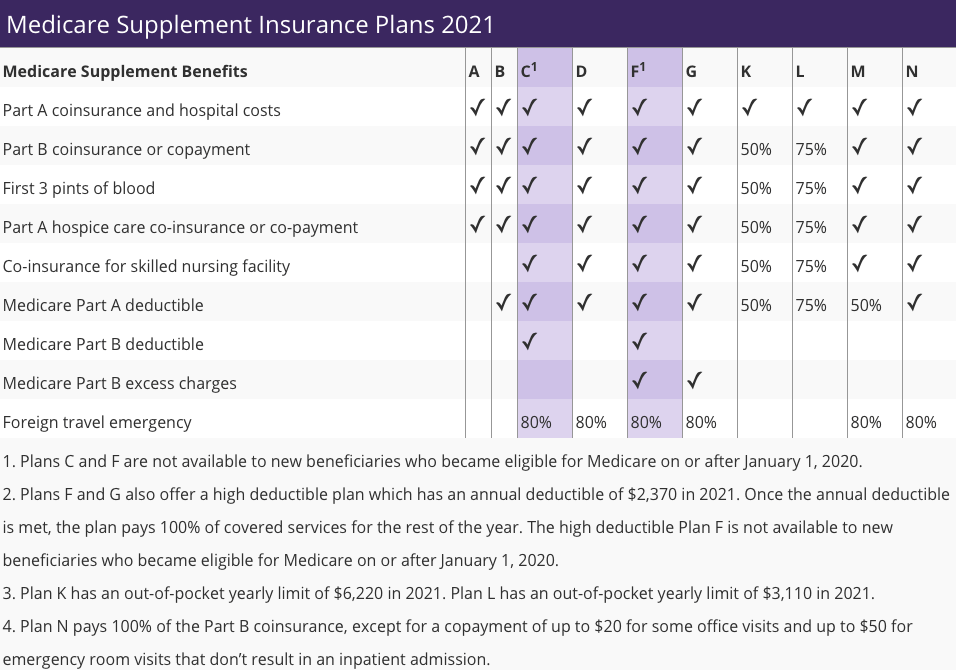

Cost in the medigap plan f vs g comparison In the medicare plan g vs f evaluation cost is offered by private insurers who have the liberty of fixing their own costs. As you can see in the Medigap comparison chart Plan F covers all the gaps in Medicare.

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Medicare Supplement Plans Comparison Chart Compare Medicare Plans

Annons Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more.

Medicare plan f and g comparison. The main difference is that Plan F covers the Medicare Part Bdeductible while Plan G doesnt. This means that you will have to pay 183 annually before Plan G begins to cover anything. In some cases the difference in premiums between the two plans may be so large that you could save money by choosing Plan G even after the Part B deductible.

With this option you must. Both plans also have a high-deductible option. Plan G may be a good option if you are new to Medicare and cant enroll in Plan F.

Even though it has similar coverage Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F. See the latest 2021 Benefits covered by the Medicare Plan F Plan G and Plan N that are available. Annons Shop Medicare plans from Aetna Humana UnitedHealthcare Wellcare Cigna Kaiser more.

12 rader Plans F and G also offer a high-deductible plan in some states. Plan F covers more than Plan G as it includes the Medicare Plan B deductible. Ultimately Plan G has the same benefits as the Plan F except for coverage for the Part B deductible 203 for.

Real Talk Medicare designs Medicare Plan F vs. There are two big differences between Medicare Plan F and Plan G. The average Plan F premium in 2018 was 16914 per month.

Medicare Supplement Plans F and G are identical with the exception of one thing. Plan F and Plan G are the two most popular Medigap plans. 16 rader Most people will select Plan F or Plan G.

Up to 80 of the cost of medically necessary care while youre traveling in a foreign country One major difference is that Medigap Plan G does not cover the Medicare Part B deductible which Medigap Plan F does cover. Plan N Comparison Chart for reviewing and comparing Medicare Plans coverage Medigap. When you compare the lower premium benefit of Plan G you can save 500 or more.

1 Medigap Plan G is the second most popular Medigap plan and it is quickly growing in popularity. However Plan G is also a comprehensive plan. However when it comes to the monthly premium if you think lower is better then Plan G may be better for you.

As mentioned earlier in the medicare plan g vs f comparison Medigap Plan F provides coverage for Medicare Part B deductible 198 as of 2020 while Medigap Plan G does not. Plan G enrollment spiked 39 percent in recent years. First Plan G has lower premiums than Plan F.

However Plan G does not cover the Medicare Part B. The only difference in coverage between the two is that Plan G doesnt cover the Medicare Part B. Find affordable quality Medicare insurance plans that meet your needs.

In 2021 the Part B deductible amount is 203 per year. Plan G is only slightly different so it is also a popular seller. However once the Part B deductible for Plan G is paid for you essentially have Plan F.

When you compare Plans F and G side by side youll immediately notice that Plan G has only one difference. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183. The Part B deductible.

2 Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers except for the Medicare Part B deductible. Second you will pay a 203 Part B deductible in 2021. Plan F prices have also jumped substantially since the introduction of the act that discontinued their availability to new Medicare beneficiaries.

Find affordable quality Medicare insurance plans that meet your needs. Plan F is the best plan and Plan G is the 2nd. When it comes to coverage Plan F will give you the most coverage since its a first-dollar coverage plan and leaves you with zero out of pocket costs.

Medigap Plan G provides a person with coverage for some parts of healthcare that original Medicare does not cover. So the answer to the question depends on you. Medicare enrollees must have this chart to compare Medigap plans effectively.