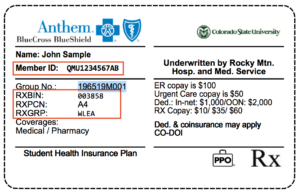

Tier 0 Drugs covered under health care reform Tier 1 Preferred Generic drugs Tier 2 Non-Preferred Generic drugs Tier 3 Preferred brand name drugs Tier 4 Non-preferred brand name drugs Tier 5 Preferred Specialty drugs Tier 6 Non Preferred Specialty drugs Specialty drugs filled by a specialty pharmacy and limited to a 30-day supply are prescription medications that often require special storage handling and close monitoring by. These drugs have the highest co-payment and are often brand-name drugs that have a generic version available.

Janis E Carter Health Net Health Net Medicare Advantage Sales Product Training Proprietary Confidential Restricted Distribution For Training Purposes Ppt Download

Janis E Carter Health Net Health Net Medicare Advantage Sales Product Training Proprietary Confidential Restricted Distribution For Training Purposes Ppt Download

Tier 4 non-preferred drugs.

What are tier 6 select care drugs. Tier What drugs are included Tier 0 Drugs covered under health care reform Tier 1 Preferred Generic drugs Tier 2 Non-Preferred. Express Scripts Medicare offers insulin at an affordable and predictable price with our Saver and Choice plans. These are usually generic drugs that offer the best value compared to other drugs that treat the same conditions.

Generally each drug is placed into one of six member payment tiers. These are the highest cost drugs including some injectables. Your plan might let you know when your prescription drug is moved to a higher cost-sharing tier.

Tier definitions Tier 1 drugs have the lowest cost share. They may be preferred drugs based on their effectiveness and value. Tier 6 Select Care Tier Drugs Value and Choice plans only NEW.

Tier 1 Preferred generic drugs - 0 co-pay. For most plans youll pay 0-5. Select Care Drugs 000 copay Gap Coverage Phase After the total drug costs paid by you and the plan reach 4130 up to the out-of-pocket threshold of 6350.

You pay the same copays that you paid in the Initial Coverage Stage for drugs in Tier 1 Preferred Generic and Tier 6 Select Care Drugs or. Includes specialty drugs often used to treat serious illnesses. This drug tier usually includes select care drugs to treat specific medical conditions common among seniors like diabetes high blood pressure high cholesterol and osteoporosis.

These drugs offer the lowest co-payment and are often generic version of brand name drugs. For generic drugs in all other tiers you pay. For brand-name drugs you pay.

Your medicines may be split up into 3-tier 4-tier or 5-tier groupings according to your insurance plan. These prescription drugs are higher in cost than tier 2. Preferred Generic Tier 1 Non-Preferred Generic Tier 2 Preferred Brand Tier 3 Non-Preferred Brand Tier 4 Preferred Specialty Tier 5 and Non-Preferred Specialty Tier 6.

Tier 3 Preferred brand-name drugs - 25 of retail cost-sharing. This formulary will tell you what tier your drug is in. These drugs offer a medium co-payment and are often brand name drugs that are usually more affordable.

Medicines are typically placed into 1 of 5 tiersfrom Tier 1 generics to Tier 5 highest-cost medicinesdepending on their strength type or purpose. 25 30 day supply 31 day LTC 25 generic. Of the cost plus a portion of the dispensing fee.

These prescription drugs are sometimes higher in cost than tier 3. These are generic drugs used to treat diabetes and high cholesterol. To find out exactly what your costs will be for a prescription log in to your member account to quickly find your plans Evidence of Coverage.

The copayment may actually be lower than tier 1 drugs. Tier 5 specialty. Tier 3 drugs have a higher cost share.

These drugs offer the greatest value compared to others that treat the same conditions. O Tier 2 drugs have a higher cost share than Tier 1. For most plans youll pay 25 to 33 of the retail cost for drugs in this tier.

Part D Seniors Savings Model. Enjoy the convenience of getting your medications by mail through PPS or Costco Mail Order shipped. Tier 6 Select care drugs.

Tier 4 Nonpreferred Drugs 93100. Drugs in this tier generally cost more than other drug tiers but may include both generic and brand-name drugs. Tier 3 preferred brand.

Tier 2 Generic drugs - 10 co-pay. As an example a plan may form drug tiers this way. Select Care generic adherence medications These Tier 6 medications are limited to select generic medications that are part of the patient safety and quality measures for adherence used by the Centers for Medicare and Medicaid Services CMS and adapted from Pharmacy Quality Alliance PQA.

The lower the tier the lower your share of the cost. Tier 5 Specialty Drugs 33 30 day supply only 33 30 day supply only 33 30 day supply only Tier 6 Select Care Drugs. Tier 6 Select Care.

These are the most expensive drugs on the drug list. Share of the drug cost will depend on what tier a drug is on. Tier 2 drugs have a medium cost share.

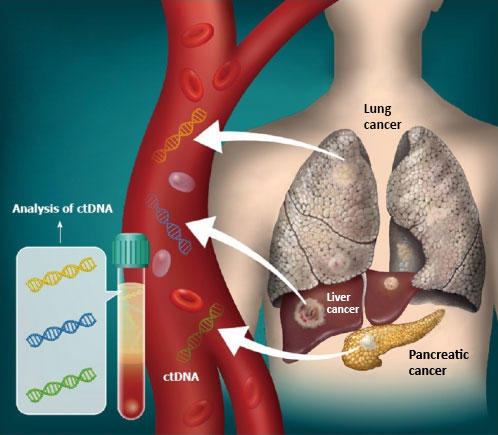

They can be generic or brand name. Specialty drugs are used to treat complex conditions like cancer and multiple sclerosis. Of the cost whichever is lower.

These drugs have 0 copay and are commonly prescribed to treat ongoing health conditions like diabetes or high cholesterol. Some BlueMedicare plans have Tier 6 Select Care Drugs. This list shows prescription drug products in tiers.

You will pay 35 or less for select insulin medications from any network pharmacy in all stages up to the Catastrophic Coverage Stage. O Tier 1 drugs have the lowest cost share for you. Check your benefit summary to see what your cost-share is for the drugs in each tier.

Receive 100 day supplies of Select Care-Tier 6 medications on this list through mail order at NO COST. Some are newer more expensive generic drugs. A drug tier is a group of medications included within a similar price range.

After initial coverage limit reached. Select Care Medications Alphabetical List of Eligible Tier 6 Drugs NEW Prescription Benefit for 2020. Tier 4 Non-preferred brand name drugs - 35 of retail cost-sharing.

Heres a breakdown of the tiers in your plan.

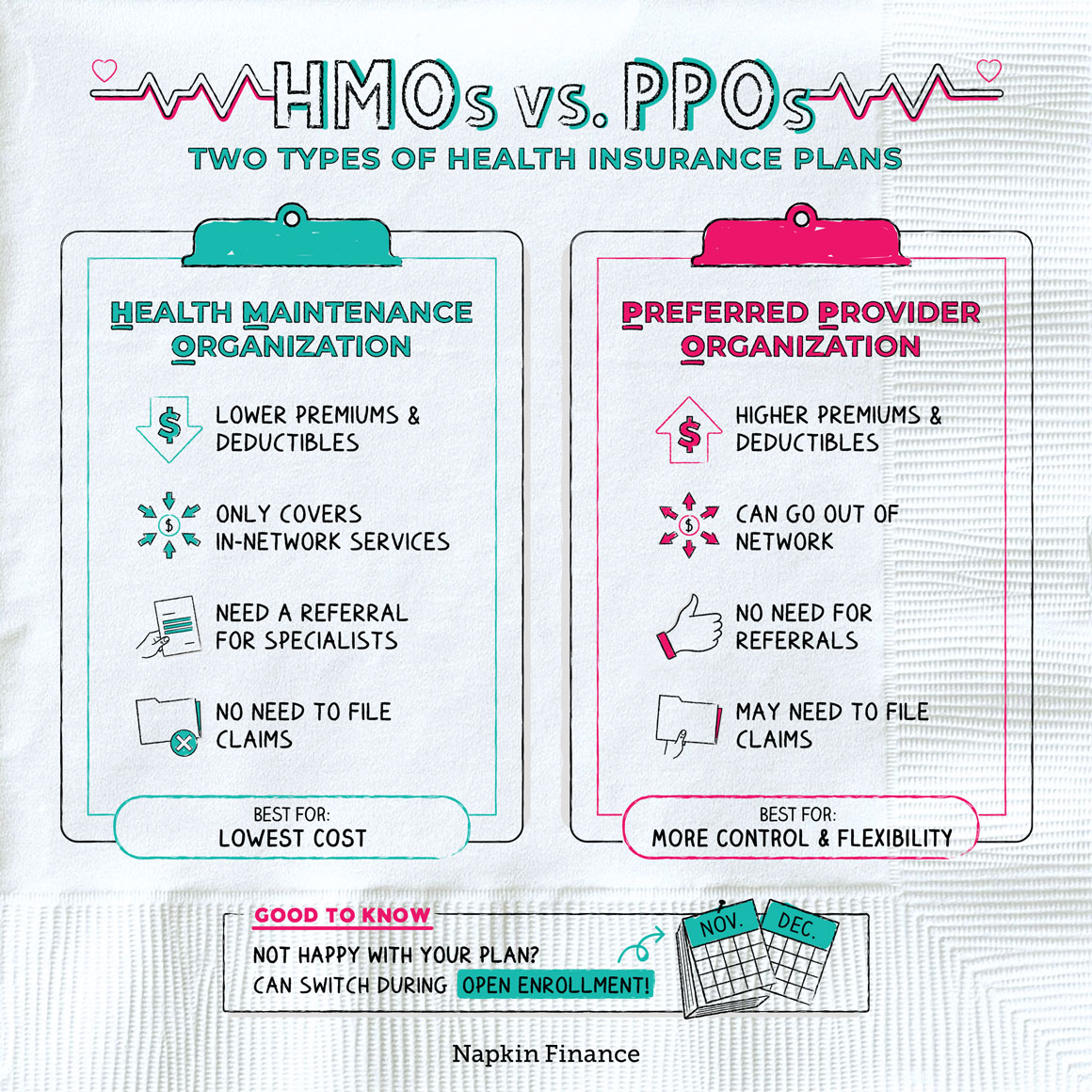

Hmo Vs Ppo Health Insurance Plans Napkin Finance

Hmo Vs Ppo Health Insurance Plans Napkin Finance