Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement or a self-employment ledger. Covered California eligibility for a health plan with a subsidy or tax credit is dependent upon several factors.

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

When Do Medi Cal And Covered California Implement The New Fpl Chart Each Year Health For California Insurance Center

1 2014 through March 31 2014 an individual who submits a completed application receives an eligibility determination and makes a plan selection by the 15th of each month will receive a coverage-effective date of the first day of the following month as long as the persons full premium payment is received.

What is the income eligibility for covered california. Income Eligibility Guidelines for Free and Reduced-price Meals or Free Milk in Child Nutrition Programs. One of which you are not offered group health insurance through an employer that is considered affordable with minimum value standard. Any financial help you get is based on what you expect your household income will be for the coverage year not last years income.

Health coverage is considered unaffordable exceeded 824 of household income for the 2020 taxable year Families self-only coverage combined cost is unaffordable. Medi-Cal has always covered low-income children pregnant women and families. If you make 601 of the FPL you will be ineligible for any subsidies.

Income numbers are based on your annual or yearly earnings. On January 1 2014 California expanded Medi-Cal eligibility to include low-income adults. Proof of Income Proof of Citizenship or Lawful Presence Proof of California Residency and Proof of Minimum Essential Coverage.

How do I know if I qualify. When you applied for Covered California healthcare you estimated that your family income would be 25000 a year. However when you do your taxes in April you discover your household income was actually 35000 year.

During the last three months of the initial Covered California open-enrollment period from Jan. ACA California requires US citizens US nationals and permanent residents to have health coverage that meets the minimum requirements. In order to qualify for federal tax credits or a subsidy in California you must make between 0-600 of the FPL.

The exchange enables eligible individuals and small businesses to purchase private health insurance coverage at federally subsidized rates. When you complete a Covered California application your eligibility for Medi-Cal will automatically be determined. The persons first and last name and company name.

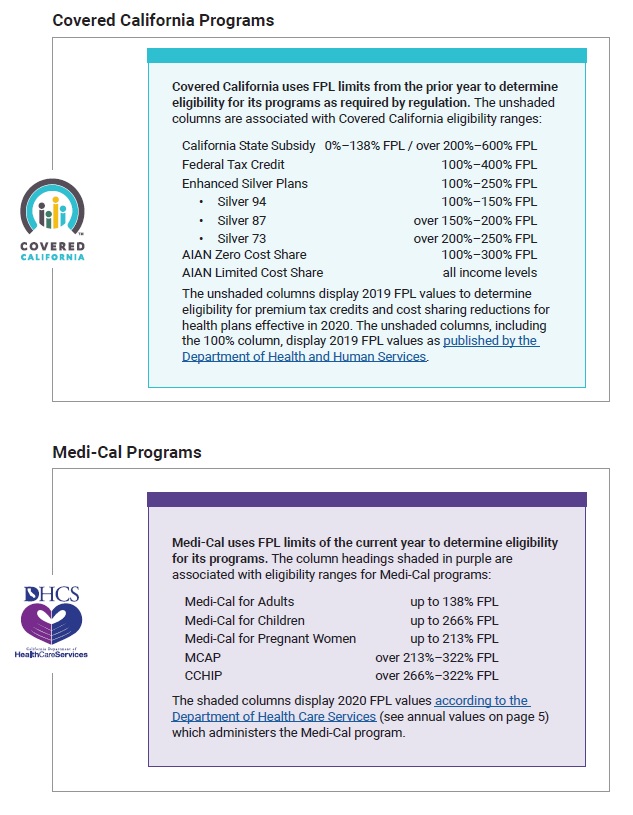

Some families get a thousand dollars a month in savings even those making up to 154500 a year. Federal Tax Credit 100600 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL AIAN Zero Cost Share 100300 FPL AIAN Limited Cost Share all income levels. California State Subsidy 0138 FPL over 200600 FPL Federal Tax Credit 100400 FPL Enhanced Silver Plans 100250 FPL Silver 94 100150 FPL Silver 87 over 150200 FPL Silver 73 over 200250 FPL AIAN Zero Cost Share 100300 FPL AIAN Limited Cost Share all income levels.

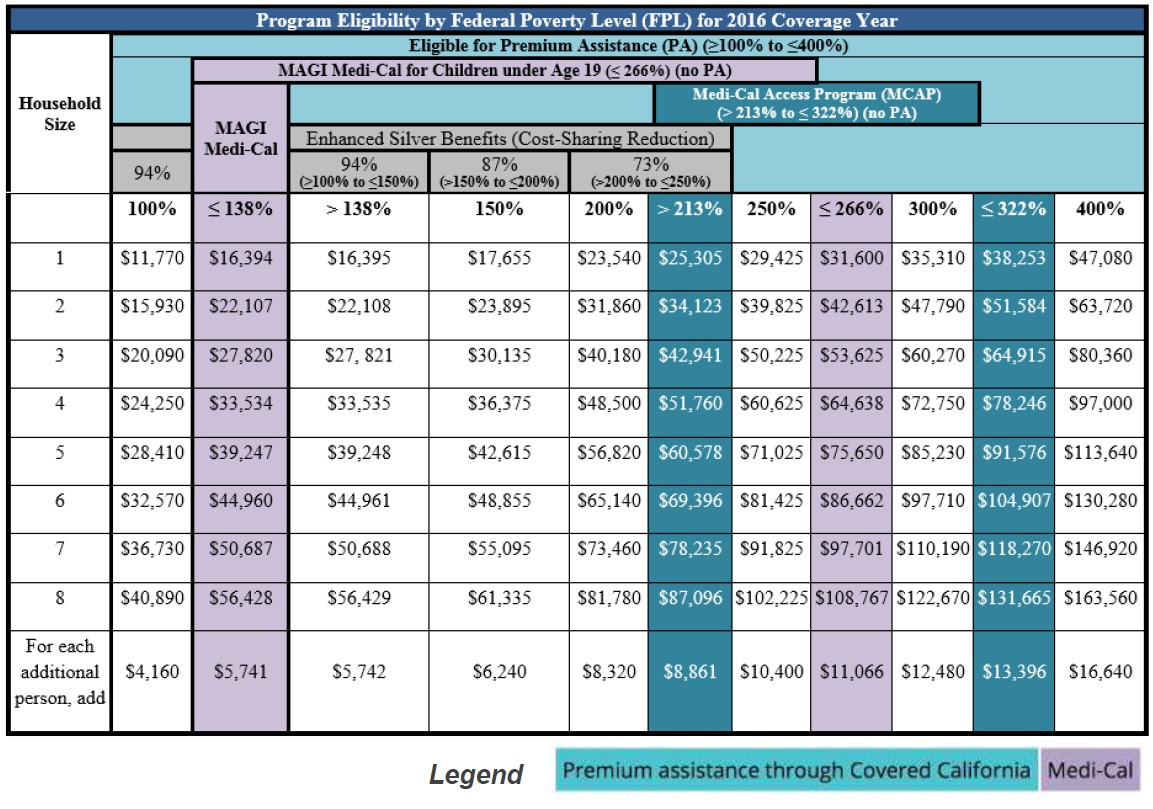

COVERED Household Size For each additional person. Add 100 S15930 S20090 S24250 S32570 96730 S4160 MAGI Medi- Cal 13800 S16394 S22107 S27820 93534 99247 S56428 Program Eligibility by Federal Poverty Level FPL for 2016 Coverage Year Eligible for Premium Tax Credit PTC 2100 to. If someones Medi-Cal coverage is cancelled due to increased income or decreased household size does that person qualify for special enrollment into Covered California.

Unless you qualify to be exempted you could pay tax penalties if you go for more than two months without any coverage. Exemptions Processed by Covered California. Even an individual earning close to 75000 may qualify for financial help.

Income is below the tax filing threshold. Eligibility for its programs as required by regulation. The unshaded columns are associated with Covered California eligibility ranges.

For more information about the new state subsidies please review the design documents which have more details about the program. Covered California is the health insurance marketplace in the US. State of California established under the federal Patient Protection and Affordable Care Act ACA.

You can start by using your adjusted gross income AGI from your most. Dates covered and the net income from profitloss. This means that you received 250 a month more than you should have.

Columns are associated with Covered California eligibility ranges. In order to be eligible for assistance through Covered California you must meet an income requirement. Short coverage gap of 3.

To see if you qualify based on income look at the chart below. Household is synonymous with family and means a group of related or unrelated individuals who are not residents of an institution or boarding house but who are living as one economic unit sharing housing and all significant income and expenses. Covered California will accept a clear legible copy from the allowable document proof list from the following categories which you can click on for more details.

When you calculate your income youll need to include the incomes of you your spouse and anyone you claim as a dependent when you file taxes.

Individual Health Insurance Eligibility Covered California

Covered California Income Limits Explained

Covered California Income Limits Explained

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Q A Covered California Archives

Covered California Q A Covered California Archives

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Versus Medi Cal Pfeifer Insurance Brokers

Covered California Health Insurance Income Guidelines

Https Hbex Coveredca Com Toolkit Webinars Briefings Downloads Fpl Webinar Slides Final Pdf

How To Get The Most 2018 Covered California Tax Credit

How To Get The Most 2018 Covered California Tax Credit

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Https Hbex Coveredca Com Toolkit Renewal Toolkit Downloads 2016 Income Guidelines Pdf

Covered California Updates Income Reporting Former Foster Youth

Covered California Updates Income Reporting Former Foster Youth

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

Fpl Federal Poverty Income Chart Covered Ca Subsidies Tax Credits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.