Advertentie Compare Top Expat Health Insurance In Netherlands. An HSA can help pay for qualified medical expenses such as copays deductibles coinsurance and dental and vision costs.

What Is A Health Savings Account Hsa Jefferson Bank

What Is A Health Savings Account Hsa Jefferson Bank

Despite regular commentary to the contrary HSAs are still widely available and advantageous to many American health insurance consumers.

Hsa eligible health care plans. How to find an HSA-eligible HDHP When you compare plans on HealthCaregov HSA-eligible HDHPs are identified on plan cards by an HSA-eligible flag in. Health savings account HSA contribution limits for 2021 are going up 50 for self-only and 100 for family coverage the IRS said on May 21 giving employers that sponsor high-deductible health. HSAs and high-deductible health plans were created as a way to help control health care costs.

For 2019 the IRS defines a high deductible health plan as any plan with a deductible of at least 1350 for an individual or 2700 for a family. You can also filter to see only HSA-eligible plans by using the Filter. HSA-eligible plans can also be a good choice for young healthy people people who are willing and able to gamble that theyre not actually going to need to pay that high deductible or out-of.

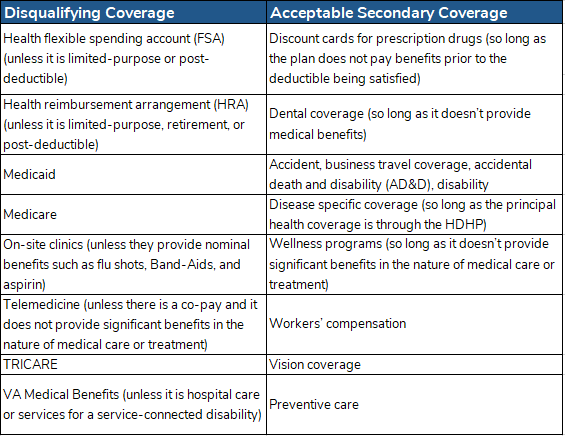

Another health plan that isnt HSA-qualified including a spouses health plan or a supplemental health plan. The type of account you have may determine whose costs are covered and which costs are eligible. If youre covered by a qualified health plan the next step is to make sure youre not covered by any disqualifying plans or programsThese include.

Health Savings Accounts HSAs are tax-advantaged savings accounts that until recently most health sharing members did not have access to. Being enrolled in Medicare Medicaid or TricareYou can still be HSA-eligible if your spouse is enrolled in one of those plans. Why were health savings accounts created.

You can use your HSA to pay for IRS-qualified out-of-pocket medical expenses. Minimum deductible The amount you pay for health care items and services before your plan starts to pay Maximum out-of-pocket costs The most youd have to pay if you need more health care items and services Individual HDHP. Get the Best Quote and Save 30 Today.

By combining your sharing plan a specially designed MEC plan and an HSA youre setting yourself up for considerable savings potential. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Once you meet your deductible your HDHP starts to cover your medical expenses as outlined in your plan.

No and HSA doesnt exempt you from having to have health insurance coverage. For a health plan to be HSA-qualified it must meet the following criteria for 2018. Even 1 out of 7 Gold plans are HSA qualified in rating areas where Gold HSA plans are offered.

Everyone gets a 3-month short-term coverage exemption each year. Start by clicking your state. Find the Best High Deductible HSA Plans Health Insurance and Health Care Sharing Plans To view all the available plans click your home state on the map below.

You can continue to use your HSA funds to cover copays and coinsurance. The CARES Act affects your HSA funds. You can purchase health insurance now though and you would not owe the fine for this year.

- Free Quote - Fast Secure - 5 Star Service - Top Providers. HSA - You can use your HSA to pay for eligible health care dental and vision expenses for yourself your spouse or eligible dependents children siblings parents and others who are considered an exemption under Section 152 of the tax code. Here well discuss why most HDHP arent eligible and why it matters if you cant have an HSA.

The minimum deductible must be no less than 1350 for individual plans and 2700 for families. Yes there are exceptions for coverage for accidents disability dental care vision care long-term care permitted insurance preventive care certain prescription drug plans limited-purpose health flexible spending arrangements FSAs limited-purpose health reimbursement arrangements HRAs suspended HRAs post-deductible health FSAs or HRAs and. Get the Best Quote and Save 30 Today.

Advertentie Compare Top Expat Health Insurance In Netherlands. When you view plans in the Marketplace you can see if theyre HSA-eligible For 2019 if you have an HDHP you can contribute up to 3500 for self-only coverage and up to 7000 for family coverage into an HSA. To be eligible to open an HSA you must have a special type of health insurance called a high-deductible plan.

Health savings accounts HSAs are only available to members enrolled in a PEBB consumer-directed health plan CDHP. AL AK AZ AR CA CO CT DE FL GA HI ID IL IN IA KS KY LA ME MD MA MI MN MS MO MT NE NV NH NJ NM NY NC ND OH OK OR PA RI SC SD TN TX UT VT VA WA WV WI WY DC. Integrate a Health Savings Account HSA into your health care strategy.

The vast majority of high deductible health plans dont apply based on 2016 exchange plans. Maximum out-of-pocket cost for the annual deductible and expenses such as copays cant exceed 6650 for. One benefit of an HSA is that the money you deposit into the account is not taxed.

HSAs or Health Savings Accounts offer excellent financial benefits but not many people are eligible for them according to IRS rules. A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for certain medical expenses with money free from federal taxes. In fact about one-quarter of all Bronze plans in those areas are HSA eligible.

For plan year 2020 the minimum deductible for an HDHP is 1400 for an individual and 2800 for a family. To submit an HSA claim visit HealthEquitys website.

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

How To Set Up Get The Most From A Health Savings Account Austin Benefits Group

Hsa Vs Fsa What S The Difference Quick Reference Chart

Hsa Vs Fsa What S The Difference Quick Reference Chart

Hsa Planning When Both Spouses Have High Deductible Health Plans

Hsa Planning When Both Spouses Have High Deductible Health Plans

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Healthcare Hsa Vs Fsa Understanding The Difference Alliance Health

Health Savings Accounts What You Need To Know Bim Group

Health Savings Accounts What You Need To Know Bim Group

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

Health Savings Accounts What You Need To Know Brinson Benefits

Health Savings Accounts What You Need To Know Brinson Benefits

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsas Fsas Eligibility And Contribution Limits Hays Companies

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.