How to find your 1095-A on Covered California Step 1. The Form 1095-A also tells you how much premium assistance tax credits or APTC your health plan got on your behalf during 2014.

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

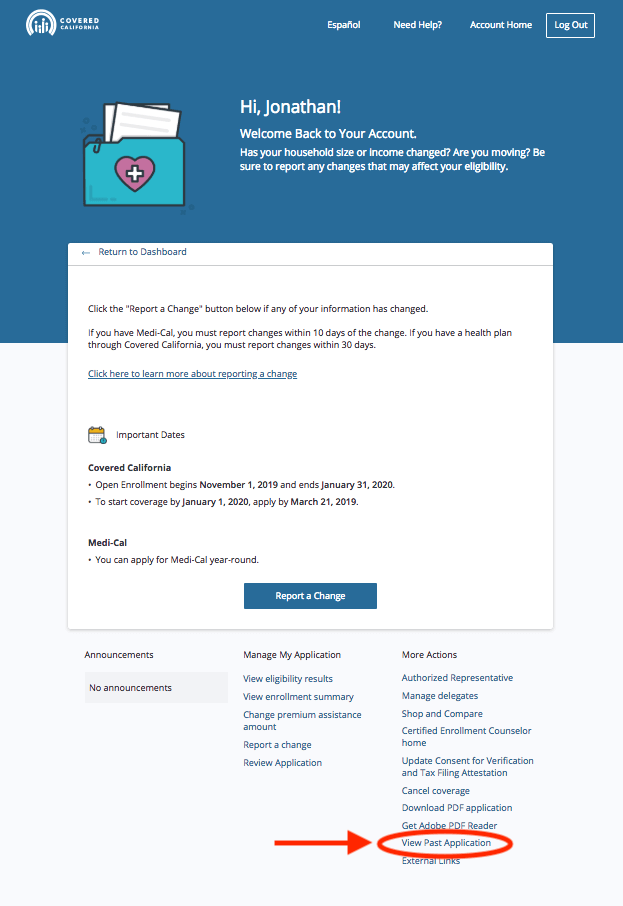

Find the link called View Past Application in the bottom right-hand column and click on it.

Covered california 1095 a. Form 1095-A is used to report important information to the Internal Revenue Service IRS about your health insurance bought through Covered California. You were enrolled in a minimum coverage plan also known as catastrophic plan. If you were a customer of Covered Ca you can not correctly file your taxes without a 1095A.

IRS Form 1095-A IRS Form 1095-A is an important federal tax document that serves as proof of coverage for individuals to claim the premium tax credit reconcile any Advanced Premium Tax Credit APTC received and to file an accurate tax return for the 2020 tax yearThe amount displayed on the IRS Form 1095-A reflect how much was paid to Covered California. It is your proof that you had health insurance in place so that you wont be subject to a tax penalty. The California Form FTB 3895 California Health Insurance Marketplace Statement.

Covered California states that they started processing the 2016 1095-As as of January 5 2017. Covered California sends this form to individuals who enrolled in coverage with Covered California except for individuals who enrolled in a minimum coveragecatastrophic plan. Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members.

The web address for the Covered California Account Login is. If you dont have a login and password call 800-300-1506. You were enrolled in the Medi-Cal program.

Form 1095-A Covered California Statement. You will have to login to your Covered California online account. During tax season Covered California sends two forms to members.

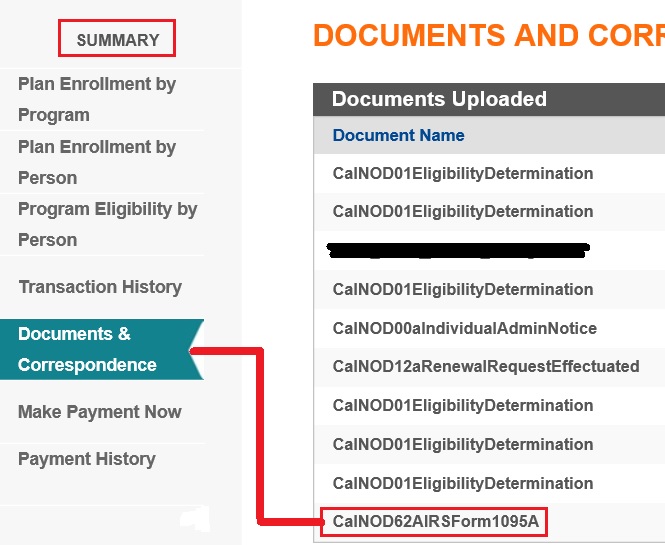

If you enrolled in a health plan through. Login to your Covered California online accountYou will find the 1095-A form in your Documents and Correspondence folderTo get there click on the. Documents to Confirm Eligibility.

The form should be in the consumers Covered California account SummaryDocuments and CorrespondenceCalNOD62A_IRSForm1095A_2016 by the end of January. Its the only place where you can get financial help when you buy. You were enrolled in employer health coverage through Covered California for Small Business CCSB.

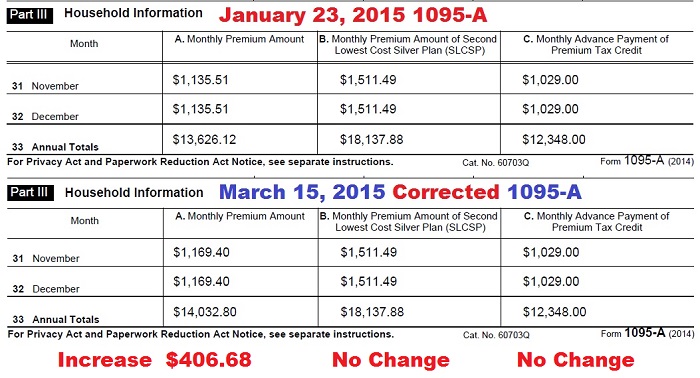

Click on Eligibility Results. Without it you can not properly complete IRS Form 8962 which is now required of all tax filers. Keep in mind that sometimes an IRS Form 1095-A or Form FTB 3895 might look incorrect but not have a mistake.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. One of the most important documents that it provides is a 1095a tax form. You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page.

The Form 1095-As have already been posted online. It shows how many months you had health insurance and how much Advanced Premium Tax Credit APTC you received. These individuals may receive a Form 1095-B or 1095-C directly from their health insurance company.

What If I Received a Letter From Covered California. In addition to submitting documents Covered California will provide a variety of documents every year. Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895.

It is used to fill out IRS Form 8962 Premium Tax Credit. Use the California Franchise. The form should also be mailed out to consumers at the address listed for receiving.

The 1095-A Form is a Covered California statement that is needed to file your Federal Income Tax Return. This form is used when filing taxes to verify that you had health. This is a tax form that Covered California will provide to show how much premium assistance was received during the year.

Filing an Appeal or a Complaint. After logging in youll be on the Consumer Home Screen. The 1095A is a tax document that lets the IRS know how much Covered Ca tax subsidy you were eligible for and how much tax subsidy you received.

The federal IRS Form 1095-A Health Insurance Marketplace Statement. Look for the list of links in the bottom-center of the page. This will happen even if you got financial help listed in Coverage Information section Column C on both forms during those months.

For example if you didnt pay your monthly premium and your health plan ended then a 0 will appear for each month you did not pay.

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

1095 A Tax Credits Subsidies For Form 8962 Attaches To 1040 Covered Ca

Where Is The Covered California 1095 A

Where Is The Covered California 1095 A

Covered California Ftb 3895 And 1095a Statements 2020

Fillable Online Irs Form 1095 A Talking Points Covered California Fax Email Print Pdffiller

Fillable Online Irs Form 1095 A Talking Points Covered California Fax Email Print Pdffiller

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Forgot To Add Pediatric Dental To 1095 As

Covered California Forgot To Add Pediatric Dental To 1095 As

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.