Most people will select Plan F or Plan G. Both plans require you to first have Original Medicare but the enrollment guidelines for Plan F changed at the beginning of 2020.

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Medicare Supplement Plan F and Plan G are nearly identical.

What is the difference between medicare plan f and g. In addition to the above coverage Plan F also covers Medicare Part B deductible payments. Medicare Supplement Plan N Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges. Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

Whats the Difference Between Medicare Plan F and Plan G. What is the difference between Plan F and G. 8 Zeilen After you pay your deductible you have no other out-of-pocket costs just like the Plan F.

Plan F covers the Medicare Part B deductible and Plan G doesnt. This means the first dollar is covered by Medicare. This means that you will have to pay 183 annually before Plan G begins to cover anything.

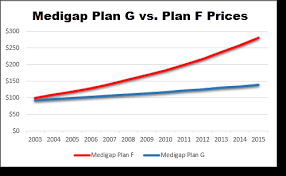

With a Plan G the only cost you have to pay out of pocket is the Part B deductible. All you have to pay is your monthly premium. First Plan G has lower premiums than Plan F.

Technically Plan F is better because it offers first-dollar coverage. 8 Zeilen The only benefit Plan F offers that Plan G doesnt is coverage for the Medicare Part B. However the one cost that Plan G does not cover the Part B deductible is often less than the annualized premium difference between the two plans.

If you first became eligible for Medicare on or after January 1 2020 you cannot enroll in Medicare Plan F. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. After youve met the deductible Plan G will cover the rest just like Plan F.

Although the plans have several similarities there is one key difference between Plan F and Plan G. Is Medicare Plan G better than Plan F. Medicare Plan G is not better than Plan F because Medicare Plan G covers one less benefit than Plan F.

What is the difference between Medicare Supplement Plans F G. Plan G will offer a high deductible option beginning January 1 2020. Plan G does not.

Get advice from our licensed insurance agents at no cost or obligation to enroll. When you compare the lower premium benefit of Plan G you can save 500 or more. In Florida one company charges an annual premium of 2738 for Plan F and 2496 for Plan G a difference of 242.

There are two big differences between Medicare Plan F and Plan G. Shop 2021 Medicare plans. Plan G may be a good option if you are new to Medicare and cant enroll in Plan F.

The only difference in coverage between the two is that Plan G doesnt cover the Medicare Part B deductible. With Medicare Plan F youre getting the plan with the most coverage available. Second you will pay a 203 Part B deductible in 2021.

Anzeige Protect the best years ahead. Anzeige Protect the best years ahead. The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits.

Medicare Supplement Plans F and G are identical with the exception of one thing. The decision is really not complicated. As a result Plan G holders generally save a little money.

In Washington a Plan Fs premium is 2568 and the Plan G1896 a difference. Shop 2021 Medicare plans. Get advice from our licensed insurance agents at no cost or obligation to enroll.

It leaves you to pay the Part B deductible whereas Medigap Plan F covers that deductible. You have no deductible no coinsurance and no copays. Call us at 1-800-728-9609 to get a quote from a solid A rated company you will know and trust or submit a Medicare Supplement quote request and we will call you.

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. Another big difference between Medicare Plan F and Plan G is who is eligible to enroll.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)

/doctor-using-digital-tablet-talking-to-patient-151333491-57ebe1b75f9b586c35336cd9.jpg)