If for example you had a medical and dental plan while employed but not a vision plan you can keep one or both plans under COBRA but you couldnt add a vision plan. Life insurance and disability benefits are not considered medical care COBRA does not cover plans.

Summary of the COBRA Premium Assistance Provisions under the American Rescue Plan Act of 2021 President Biden signed HR.

Cobra dental insurance plans. COBRA-covered group health plans that are sponsored by private-sector employers generally. COBRA also provides healthcare coverage to spouses and children depending upon that person. Whos covered under COBRA insurance.

Dental and vision care. Its a federal law that was created in 1985. However you can only continue plans you were actually enrolled in while employed.

The dental insurance premium rates for COBRA dental insurance are based upon the amount which the University contributes for active employee insurance and include a 2 administrative fee allowed under COBRA. Its a way to continue to get health or dental insurance from your former employer. However you cannot choose new coverage or switch to a different plan from the one you held prior to your change in employment.

COBRA stands for Consolidated Omnibus Budget Reconciliation Act. Box 833 Belmont CA 94002-0833 888 837. But if you only had medical then you would not qualify for dental andor vision with COBRA.

However you cannot choose new coverage or switch to a different plan from the one you held prior to your change in employment. Along with medical and vision benefits dental coverage is included under COBRA. 5 dental insurance options during COVID-19 If you lose your employer dental insurance you have options including individual dental plans COBRA and more.

COBRA applies to medical vision and dental plans offered by your employer. Is dental insurance covered under COBRA. Are governed by the Employee Retirement Income Security Act ERISA.

COBRA offers medical coverage for their employees who have lost their health insurance due to loss of their employment. What Is COBRA Insurance. However you cant choose new coverage or switch to a different plan from the one you had prior to your change in employment.

COBRA insurance may provide you with temporary health coverage after you leave a job or due to another event that qualifies you. The COBRA health insurance law allows you and your beneficiaries to continue on the exact same health benefits that you had with the group health plan. As part of the American Rescue Plan Act of 2021 the federal government will pay COBRA insurance premiums for individuals and their covered relatives that.

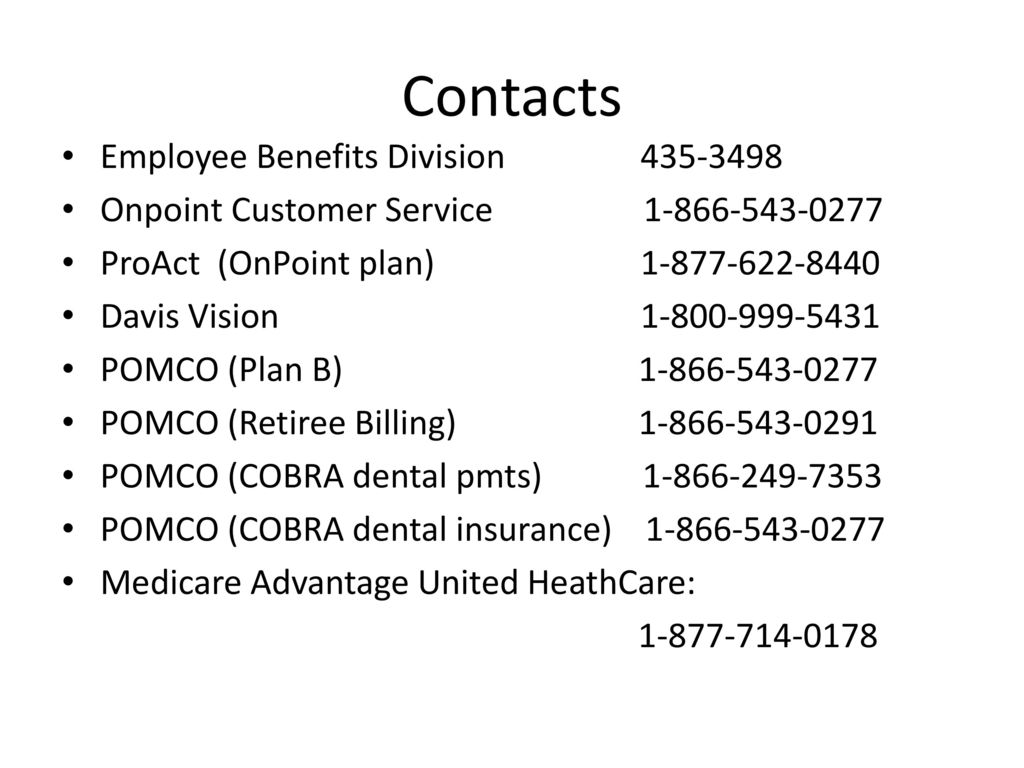

692 forms to the corresponding dental carriers COBRA unit and the Vision Plan Direct Payment Authorization STD. Dental Insurance is subject to the same COBRA rules as the medical insurance. Get COBRA Dental Insurance.

COBRA Carrier Contact Information for State-Sponsored Dental and Vision Plans. That provide only life insurance or disability benefits. Wolfpack Insurance Services Inc.

COBRA requires employers that have more than 20 employees to offer continued insurance coverage for 18 months after your last day on the job. COBRA coverage is only a short-term solution so its a good idea to explore other options. For example if you declined a dental plan you cannot obtain the coverage once you become COBRA-eligible.

This law subsidizes the full COBRA premium for Assistance Eligible Individuals for periods of coverage from April 1 2021 through September 30 2021. Employer sponsored health care plans generally consist of dental insurance vision insurance prescription plans and health savings accounts. What is COBRA insurance.

The dental care benefits you may continue are the same benefits you would receive as an active employee enrolled in the GHI Preferred Dental Plan. Dental insurance can be thought of as a method of providing financial assistance to seek regular dental care. Along with medical and vision benefits dental coverage is included under COBRA.

If for example you had a medical and dental plan while employed but not a vision plan you can keep one or both plans. The Consolidated Omnibus Budget Reconciliation Act of 1985 allows workers and their qualified dependents the right to continue their employer-sponsored health insurance for a short period of time if that insurance would stop due termination of employment reduction in hours or changes within their immediate family. There is also no change in benefits when your dependent enrolls in COBRA.

Dental coverage is included under COBRA along with medical and vision benefits. If for example you had a medical and dental plan while employed but not a vision plan you can. So if you had medical dental and vision with your employer your coverage will be the same through COBRA.

1319 the American Rescue Plan Act of 2021 ARP on March 11 2021. The COBRA act only provides health insurance plans that match your old plan from your employer. Are dental benefits covered under COBRA.

COBRA coverage has limits. This type of COBRA coverage. Please mail the Dental Plan Enrollment Authorization STD.

703 forms to VSP. This section summarizes your rights and obligations under the continuation coverage provisions of the law. If your spousedomestic partner is also covered under the New York State Dental Insurance Program.

Understanding what COBRA insurance is and how it works can help you better decide if its right for you. Usually COBRA allows them to stay covered under their employers plan albeit at a higher cost. Besides the time limit referred to above there are a couple of other.

Is dental insurance covered under COBRA. COBRA stands for the Consolidated Omnibus Budget Reconciliation Act. Whether you are retiring newly self-employed or find yourself between jobs transitioning off an employer dental plan.