Neither does the expansion of Medicaid under the ACA. The Affordable Care Act s ACA premium subsidies premium tax credits have no asset test.

The Health Insurance Marketplace Calculator updated with 2021 premium data and to reflect subsidies in the American Rescue Plan Act of 2021 provides estimates of health insurance premiums and.

Do i qualify for aca subsidy. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. Currently qualification is based on whether your income falls between 100 and 400 of. Californians meanwhile will start seeing the enhanced subsidies on April 12 and existing enrollees will automatically begin receiving them on May 1.

This tool provides a quick view of income levels that qualify for savings. If your income falls below the federal poverty level you may not qualify for subsidies but you are more likely to qualify for Medicaid. You are a US citizen or.

But you must also not have access to Medicaid or qualified employer-based health coverage. To qualify for Obamacare subsidies you must meet the following criteria. If you already enrolled in an ACA plan and got a subsidy you can change your plan and get the added savings.

The PTC is a significant monthly discount 512 on average that allows you to qualify for better coverage. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. The act also created a new special enrollment period that extends through Aug.

Well make it easy. It doesnt matter how much money people have in the bank or the stock market or how much their homes are worth. How do you know if you qualify for a premium subsidy on your ACA policy.

If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. The income limit for ACA subsidies in 2021 for individuals is between 12880 and 51520. Certain individuals may qualify at different levels.

Its against the law for your employer to fire or retaliate against you for reporting violations regarding their offered insurance. In both cases eligibility is simply based on income. Medicaid is the national healthcare program for low-income individuals and families.

To qualify for a subsidy your household income must be between 100 and 400 of the FPL. But if your employer-sponsored plan isnt you may qualify for a Marketplace subsidy depending on your income level. So for instance a 21-year-old with an income of 19320 who was eligible for a subsidy of about 3500 under the Affordable Care Act would get 4300 under the new plan assuming the cost of his.

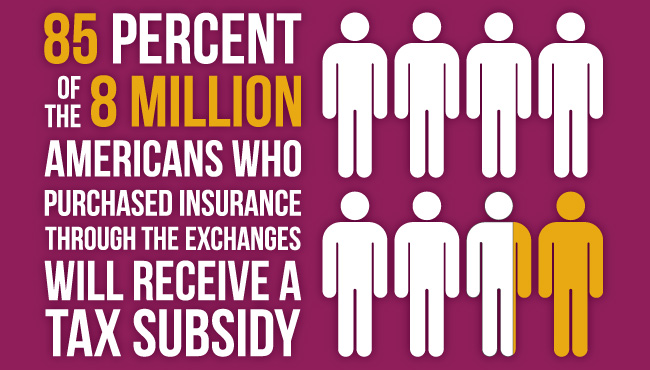

Current consumers will save an average of. You qualify for subsidies if pay more than 85 of your household income toward health insurance. You also have certain protections against retaliation related to your insurance.

The types of assistance offered under the Affordable Care Act are. Make Sure You Get the Subsidy You Deserve. 23 Families of four with a household income between 26500 and 106000 can also qualify for premium subsidies.

Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. You are currently living in the United States. Premiums will drop on average about 50 per person per month or 85 per policy per month.

Learn more about who to include in your household. People must purchase their insurance from Healthcaregov or their states ACA exchange to qualify for subsidies. 20 rows You must make your best estimate so you qualify for the right amount of savings.