Videos you watch may be added to the TVs watch history and influence TV recommendations. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network.

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

Medicare Advantage Plans Hmo And Ppo Abc Medicare Plans

More flexibility to use providers both in-network and out-of-network.

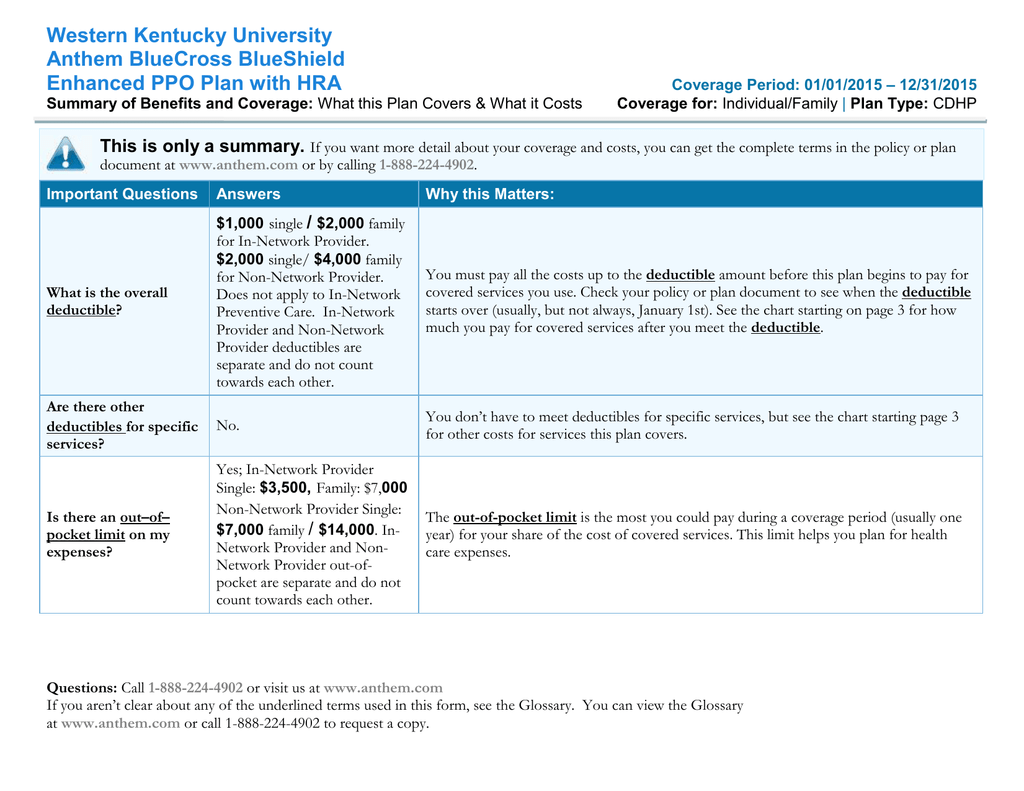

Ppo vs hmo medical. As with HMO plans there is a network of Medicare-preferred healthcare service providers that offer. PPOs typically allow you to see both in-network and out-of-network providers but you may pay more for out-of-network care. Out-of-pocket medical costs can run higher with a PPO health plan as well so they are a more expensive option than an HMO.

A PPO is a type of insurance plan that uses a defined network of medical providers to meet your health care needs. However PPO plans offer greater flexibility. HMOs may be better for you if you dont mind having to utilize specific doctors but if you have a large family or are a heavy healthcare user a PPO may be your best option.

PPO stands for preferred provider organization. A PPO plan can be a better choice compared with an HMO if you need flexibility in which health care providers you see. The difference between them is the way you interact with those networks.

PPO plans share many features with HMO plans. To avoid this cancel and sign in to. With a PPO you have the flexibility to visit providers outside of your network.

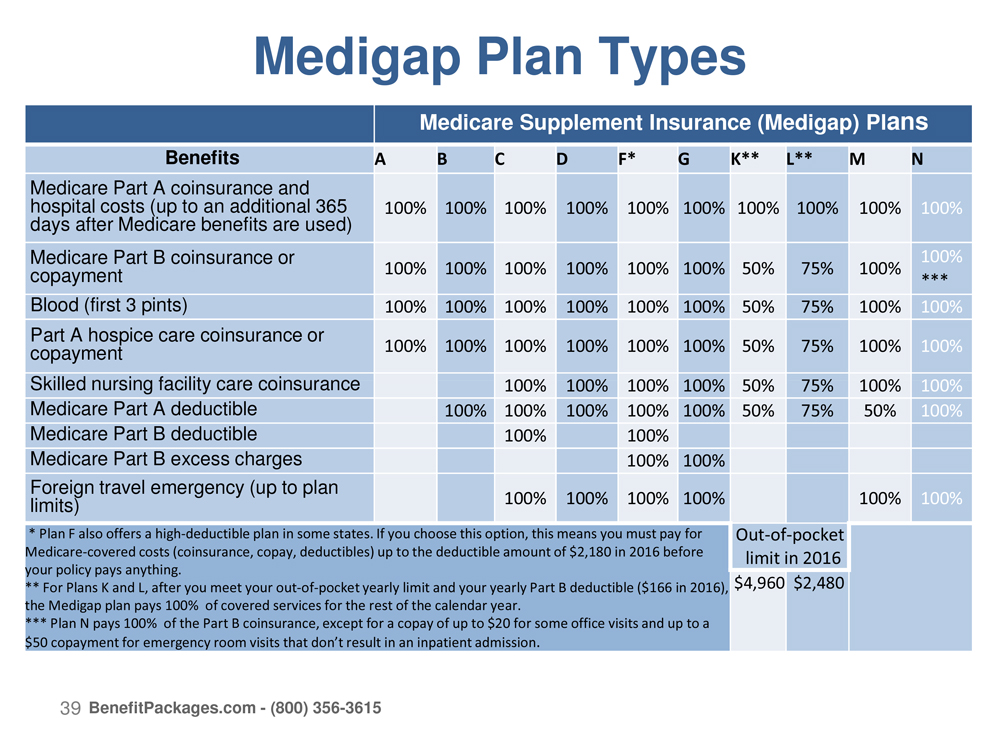

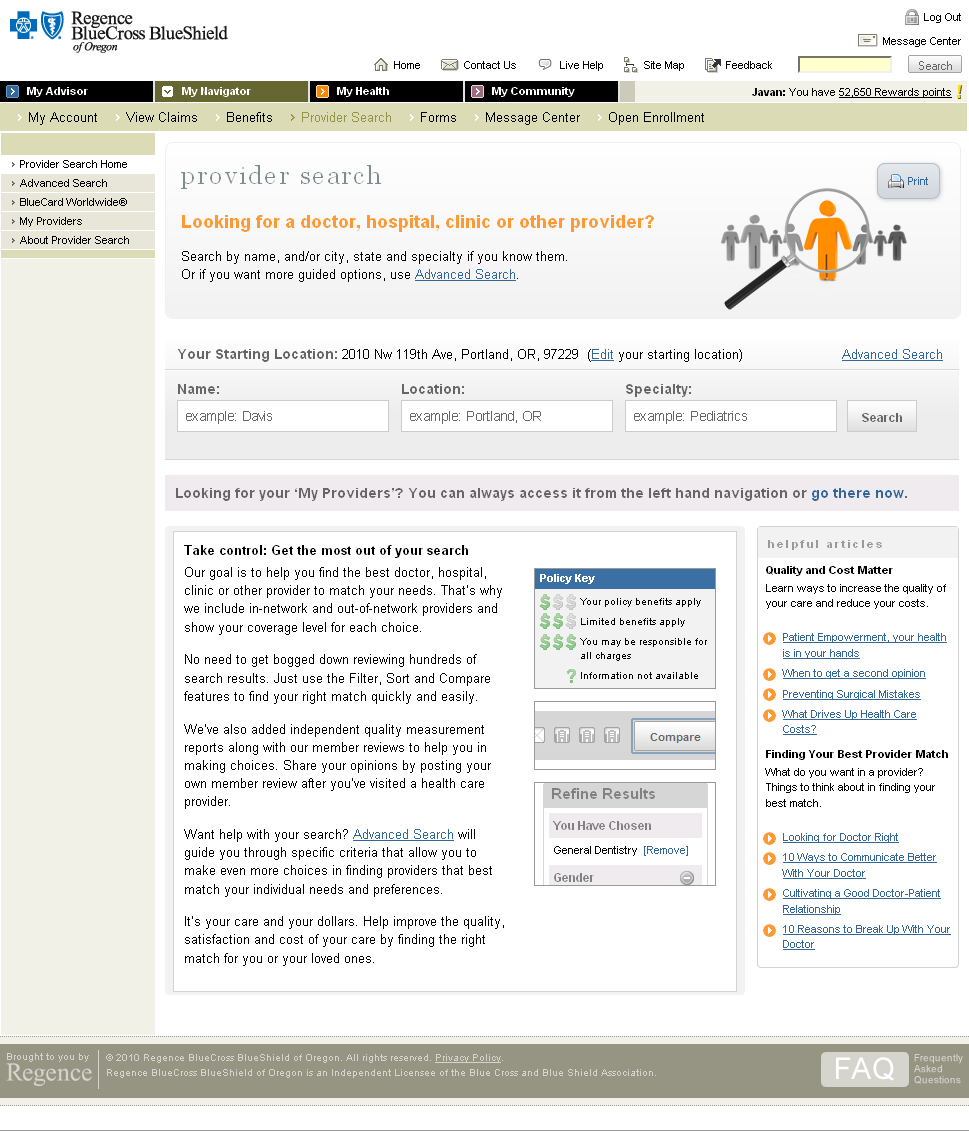

Medicare HMO PPO Medicare also has both PPO and HMO options. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. Compared to PPOs HMOs cost less.

Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan. However unlike an HMO with a PPO you can use doctors clinics and hospitals outside the network at a higher cost. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care.

However visiting an out-of-network provider will include a higher fee and a separate deductible. Making Sense of Different Types of Health Plans June 07 2018 If youre shopping for a new health plan you may hear a lot about HMO POS PPO and HDHP plans but you may not understand the differences between. Referrals arent needed to see a specialist.

With either plan consider checking to see if your preferred providers are already in the network and do your research to ensure you are securing the best coverage for you and your family. Health Insurance Basics HMO POS PPO and HDHP. PPOs dont require you to choose a PCP though having one is always a good idea.

PPO and HMO comparison chart There are a lot of similarities between Medicare Advantage PPO and HMO plans such as the costs of premiums deductibles and other plan. If you are eligible or over the age of 65 you might want to check out Humanas Medicare PPO plan or Humanas Medicare HMO plan. You pay a contracted rate less than full price to see network providers.

Lets take a look at some of the most common differences between these two types of health insurance plans. You can usually visit specialists without a referral including out-of-network specialists. Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it.

PPO plans are typically more flexible and may cost a bit more than HMOs. One kind might work better for you than another. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common.

All health care plans arent the same. If the alphabet soup of health insurance jargon still has you scratching your head take heart. HMOs have lower premiums and out-of-pocket expenses but less flexibility.

As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. PPO - Which ones for you. If playback doesnt begin shortly try restarting your device.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. HMO stands for health maintenance organization. Disadvantages of PPO plans.

7 Differences Between an HMO vs. This additional cost is something to consider.