Employer reimbursement The employer pays full COBRA or state continuation premiums and administrative fees. It works like this.

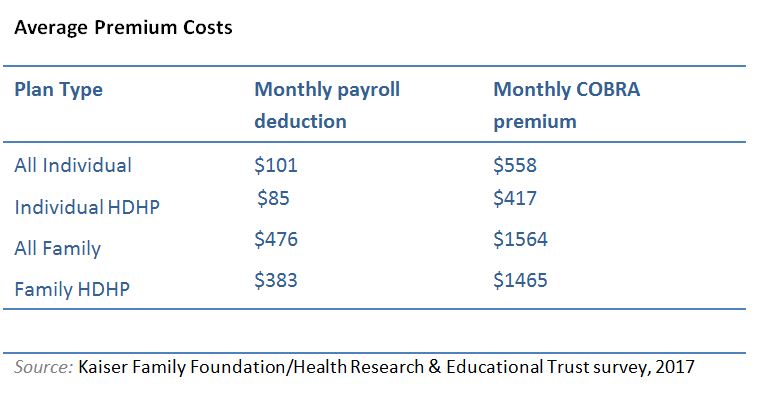

Average Cost Cobra Health Insurance

How the COBRA subsidy works.

Does cobra cost the employer. The employer claims the subsidy amount as a credit against its quarterly Medicare payroll taxes. If an employee provides payment during the subsidy period then. The AEI does not have to pay the COBRA premium and wait to be reimbursed.

If an employers COBRA premium costs for affected plan participants exceed their Medicare payroll tax liability they can. Employers can be reimbursed up to 102 of AEIs COBRA costs through a dollar-for-dollar credit against the employers Medicare tax obligations. If federal COBRA applies the employer pays or waives the AEIs COBRA premium each month.

Employers can be reimbursed through tax credits via. You dont have to pay the cost of the coverage for terminated employees but you must keep them on your. Employers insurers and multiemployer plan sponsors will offset the cost of the entire COBRA premium including the 2 administrative fee.

The exact cost of federal COBRA health insurance depends on how much the general health insurance plan costs the employer. Instead the employer or carrier must pay or waive the AEIs COBRA premium. COBRA continuation coverage is often more expensive than the amount that active employees are required to pay for group health coverage since the employer usually pays part of the cost of employees coverage and all of that cost can be charged to individuals receiving continuation coverage.

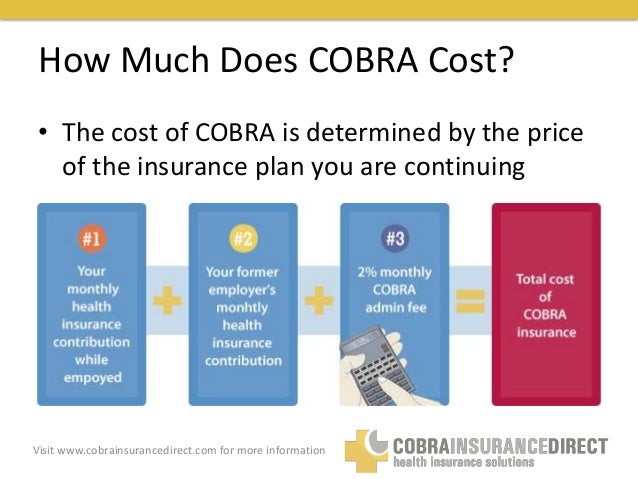

How much does COBRA cost. COBRA the federal program that allows people who have lost their jobs to continue paying for their former employers healthcare plan is free through Sept. The 102 represents the total premium employees share plus the employers share plus a 2 administrative fee.

Employers can require an employee to pay 100 percent of the costs of health insurance under COBRA. If the plan sponsors COBRA premium costs exceed its Medicare payroll tax. The cost of COBRA coverage is usually high because the newly unemployed individual pays the entire cost of the insurance employers usually pay a significant portion of healthcare premiums for.

Its the same health coverage and provider network. Under COBRA the administrator is allowed to charge the terminated worker for the full cost to the employer of the monthly coverage plus a 2 administration fee. The average cost for annual employer-sponsored.

What is COBRA insurance. Who pays for COBRA coverage. The employers or carriers expense will be reimbursed by the federal government.

An employer can require an electing employee to pay up to 102 of the cost of the medical coverage in order to continue coverage under COBRA. The premium that is charged cannot exceed the full cost of coverage plus a two percent surcharge to help the employer or health insurance company cover administrative expenses. May I pay for a terminated employees COBRA.

The one difference is that COBRA can cost four times more than what you pay in premiums under an employer-based plan. The credit includes the entire COBRA premium including the 2 administrative fee. Meanwhile if the employee is subsidized the average COBRA insurance rate is at 398 per month for a family plan and 144 for an individual plan.

Which employers are required to offer COBRA coverage. COBRA premiums from April 1 2021 through September 30 2021 must now be paid by employers. For employers whose COBRA premium costs for affected plan participants exceed their.

Your business is covered by COBRA if you have more than 20 employees for more than 50 of the year and you offer company-paid health plan coverage You must offer COBRA coverage to employees who are terminated as well as those who leave voluntarily. COBRA generally applies to all private-sector group health plans maintained by employers that. Employers may require individuals to pay for COBRA continuation coverage.

Premiums cannot exceed the full cost of coverage plus a 2 percent administration charge. The employer insurer or multiemployer plan sponsor will offset the cost through a payroll tax credit against the Section 3111b Medicare tax. The COBRA plan works exactly like your employer plan.

Although many employers do subsidize COBRA especially as part of a severance package this is not required. Theyll do so through a refundable payroll tax credit against the Section 3111b Medicare tax. COBRA insurance stands for the Consolidated Omnibus Reconciliation Act.

It helps people who lose. The employee pays zero. The credit is refundable.

If the total COBRA premium assistance amount is greater than their Medicare obligations the government will pay the employer back.

Cobra Insurance Too High Blind

Cobra Insurance Too High Blind

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Cobra Insurance Guide What Is It How Does It Work Aetna How Much Does It Cost How Long Does It Last More Questions

Is Cobra Dead An Employee S View Of Cobra Cost

Is Cobra Dead An Employee S View Of Cobra Cost

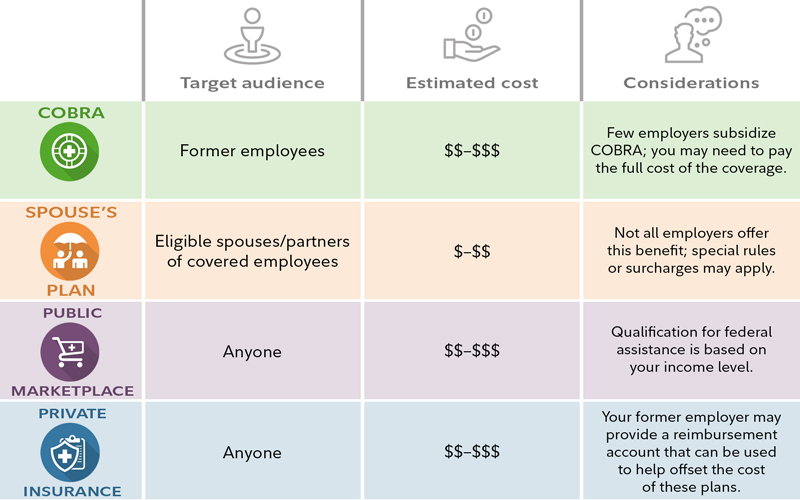

Bridging The Health Care Coverage Gap Fidelity

Bridging The Health Care Coverage Gap Fidelity

Why Is Cobra So Expensive Quora

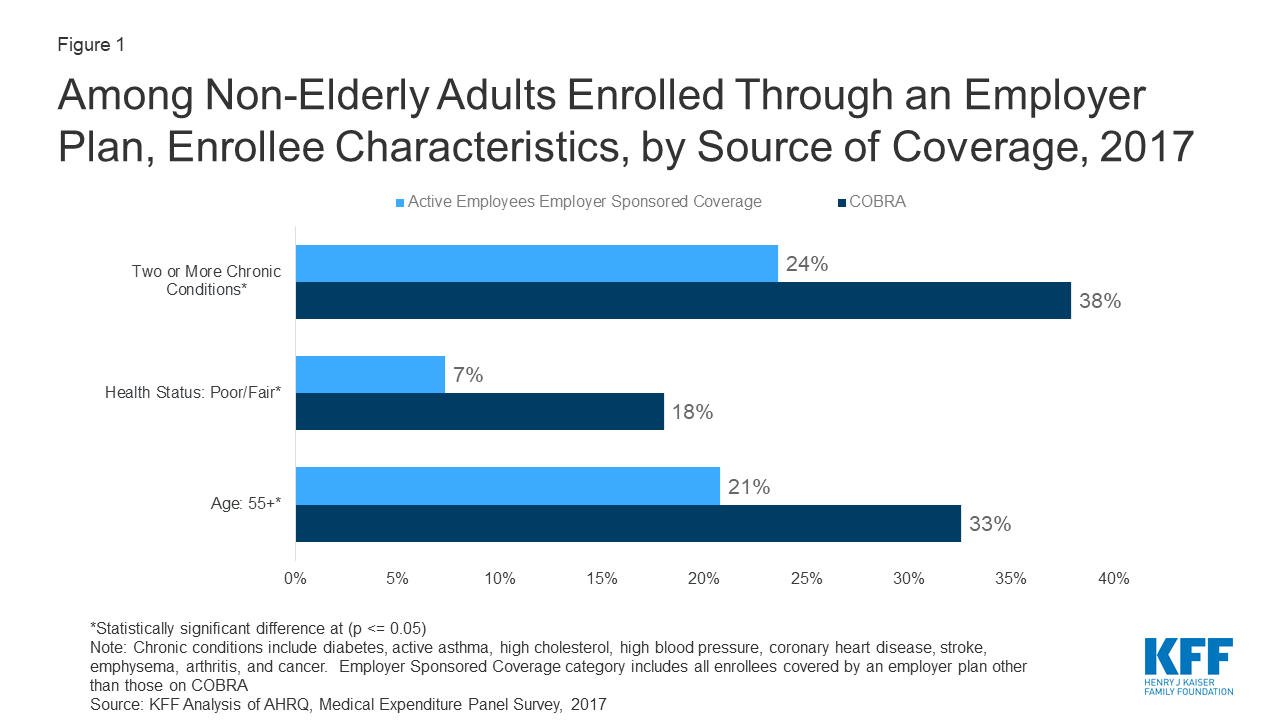

Key Issues Related To Cobra Subsidies Kff

Key Issues Related To Cobra Subsidies Kff

Cobra Insurance Everything You Need To Know

Cobra Insurance Everything You Need To Know

What Is Cobra Health Insurance Requirements Compliance More

What Is Cobra Health Insurance Requirements Compliance More

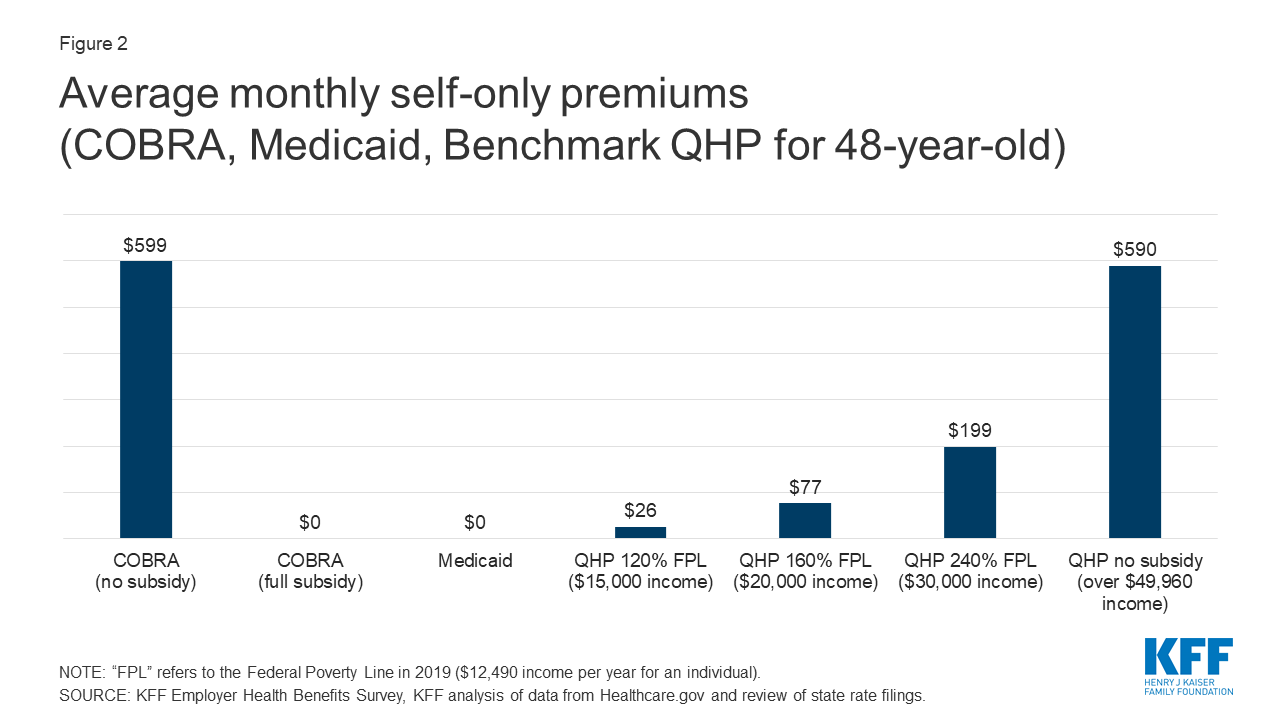

Key Issues Related To Cobra Subsidies Kff

Key Issues Related To Cobra Subsidies Kff

/GettyImages-478439270-ac3965e5103b400aab53ef30a4dfe8b4.jpg) How Much Does Cobra Health Insurance Cost

How Much Does Cobra Health Insurance Cost

What Is Cobra Insurance Ramseysolutions Com

What Is Cobra Insurance Ramseysolutions Com

Employers Now Required To Pay 100 Of Cobra Premiums

Employers Now Required To Pay 100 Of Cobra Premiums

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.