Medicare Part A coinsurance and hospital costs Medicare Part A deductible First three pints of blood used in a transfusion Skilled nursing facility coinsurance Medicare Part A hospice care coinsurance or copays Medicare Part B. Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible.

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Otherwise they function just the same.

Medicare f and g. Part A coinsurance and hospital costs. Plan F covers the Plan B deductible and Plan G does not but Plan F was phased out as of January 1 2020. Plans F G and N are three of the most comprehensive plans.

These two popular plans are the only Medicare Supplement Plans that offer coverage for Part B excess chargesand thats important if. Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used at 100. While Plan G covers the Medicare Part A deductible it doesnt cover the Medicare Part B deductible.

Part A hospice care coinsurance or copayment. 16 Zeilen Medicare Supplement Plans F and J also have a high deductible option. What does Medicare Supplement Plans F and G cover.

In Florida one company charges an annual premium of 2738 for Plan F and 2496 for Plan G a difference of 242. All premiums are different per state per carrier but the benefits remain the same. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G.

In addition to excess charges Medicare Supplement Plans F and. With Plan F youll have zero out of pocket costs outside your monthly premium. Plan F covers one more benefit than Plan G which is the Part B deductible.

With this option you must pay for Medicare-covered costs coinsurance copayments and deductibles up to the deductible amount of 2340 in 2020 2370 in 2021 before your policy pays anything. There are two big differences between Medicare Plan F and Plan G. First Plan G has lower premiums than Plan F.

Skilled nursing facility care coinsurance. A B C D F G K L M and N. Plan G and Plan N premiums are lower to reflect that.

Plan G will typically have higher premiums than Plan N because it includes more coverage. Medigap policies typically donthave their own deductible. Medigap is made up of 10 different plans each designated with a letter.

If you select Plan G youll need to pay your Part B deductible 203 for 2021 yourself. Medicare Supplement Plan G is one of the most popular Medigap plans on the market. Medicare Supplement Plans F and G are the only Medigap insurance plans that cover 100 of Medicare Part B excess charges which are the costs a doctor can charge for a service or procedure if they dont accept assignment.

Benefits that Plans F G and N may cover Medicare Supplement insurance Plan N generally covers. Plan F and Plan G both provide 100 out-of-pocket coverage for. Plans F and G also offer a high-deductible plan in some states.

Blood first three pints. Whats the Difference Between Medicare Plan F vs Plan G vs Plan N When comparing Plan F vs Plan G vs Plan N youll notice they provide similar coverage. Each plan includes a specific set of basic benefits no matter what company sells the.

This can be different for Plan G. Therefore these plans will help protect you from additional out-of-pocket expenses should you need treatment that exceeds what Medicare will approve. Medigap plans help a person pay their out-of-pocket Medicare expenses.

With Medicare Supplement companies there are some differences between Plan F and Plan G. Second you will pay a 203 Part B deductible in 2021. A person can get a Medigap.

Plans C and F arent available to people who were newly eligible for Medicare on or after January 1 2020. After you pay your deductible you have no other out-of-pocket costs just like the Plan F. In Washington a Plan Fs premium is 2568 and the Plan G1896 a.

This plan increased in popularity when Plan F ceased to be available to newly eligible beneficiaries due to. Medicare Plan F and Plan G are similar and offer the same basic coverage benefits which include. Medicare Supplement Plan F is the most comprehensive plan.

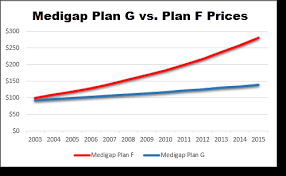

Part B coinsurance or copayment. When you compare the lower premium benefit of Plan G you can save 500 or more. Even though it has similar coverage Medigap Plan Gs monthly premiums are typically much less expensive than those for Plan F.

Medigap Plan F provides many of the same benefits as Plan G with some differences. There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible.

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Best Medicare Supplement Plan 2021 Senior Healthcare Direct

Best Medicare Supplement Plan 2021 Senior Healthcare Direct

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Medigap Plans F G N Going Away Medicare Plan Saver

Medigap Plans F G N Going Away Medicare Plan Saver

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.