The employernot the governmentsets the reimbursement limit. Individual Coverage Health Reimbursement Arrangements ICHRAs.

Small Business Health Insurance Costs Business Cobra

Small Business Health Insurance Costs Business Cobra

States with individual mandates starting in 2020.

Small business health insurance requirements 2020. Annons Health Insurance Designed For Individuals Living Outside Their Home Country. Many businesses that are often classified as small however may fall into the ACAs classification of 50-plus FTEs and need to offer coverage. Help Protect You Your Family When Moving Abroad.

Employers who get these premium rebates must allocate the rebate properly. Annons Private International Health Cover. If your company decides to offer group health coverage after meeting insurance requirements you must report the value.

Annons Private International Health Cover. Similar to a QSEHRA an ICHRA is a company-funded tax-free health benefit allowing businesses to reimburse their employees for personal health care expenses. Fewer than 25 FTEemployees.

The maximum penalty is. Trusted International Health Network with Perfectly Tailored Plans from Cigna Global. The individual coverage health reimbursement arrangement ICHRA was officially created by the federal government in June 2019 and is available as of January 1 2020.

Insurance companies must generally spend at least 80 of premium dollars on medical care. Annons Health Insurance Plans Designed for Expats Living Working in Sweden. In these states if your employees dont have health insurance in 2020 theyll be flagged when they file taxes and will need to pay a fine.

Help Protect You Your Family When Moving Abroad. Health insurance for your business and employees Offering health benefits is a major decision for businesses. Access High Levels of Medical Cover in the UK Abroad.

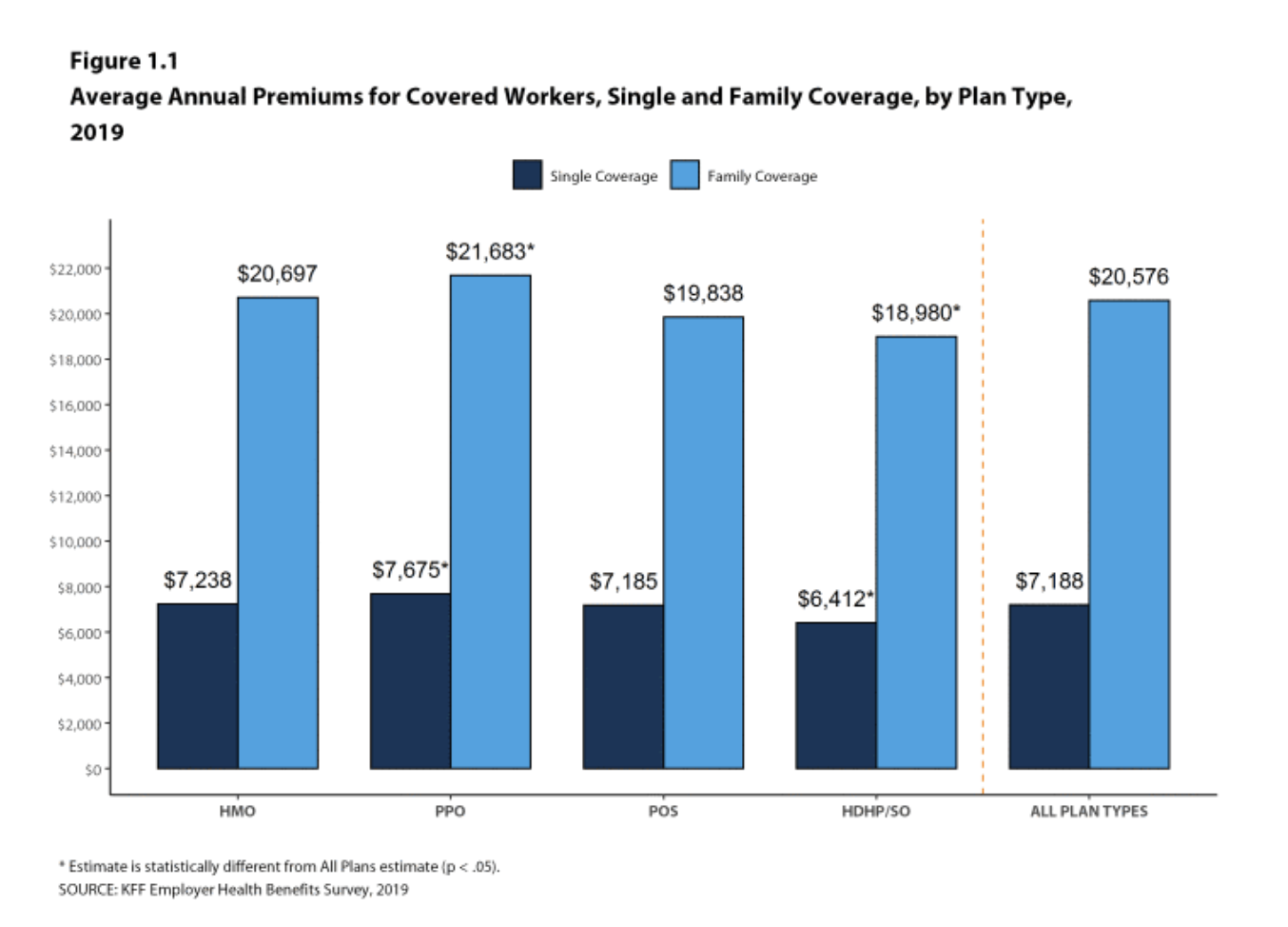

In deciding whether to pay or play keep in mind that penalties will increase by nearly 30 percent in 2020. For 2019 they were 5150 for self-only coverage and 10300 for family coverage. If you have two part-time employees each working 60 hours a month that equals one FTE.

Get a Personalised Quote. Small business health insurance is a solution for small businesses that is designed to provide health insurance to everyone in your company. Trusted International Health Network with Perfectly Tailored Plans from Cigna Global.

Through a group insurance plan your employees can have access to benefits and medical coverage at a discounted rate. There is no legal requirement to provide employees with access to group health coverage if your business is defined as a small business. Multiply the employees lowest hourly wage by 130 which is the ACAs definition of the minimum number of hours that make the employee full-time or FTE.

Multiply that number by 978 for 2020. Get a Personalised Quote. Through an ICHRA businesses set a monthly allowance of tax-free money for their employees to use on individual health insurance and other health care expenses.

What are small business health insurance requirements related to tax reporting in 2021. There are no limits on annual contribution amounts and businesses can offer different amounts to different classes of employees including. Access High Levels of Medical Cover in the UK Abroad.

For businesses with at least 50 employees business owners must offer the minimum essential health coverage thats affordable or pay a penalty. The Affordable Care Act includes a variety of provisions that reform the insurance market and encourage small businesses to offer health insurance. According to the IRS your business is required.

Use HealthCaregov as a resource to learn more about health insurance products and services for your employees. Annons Health Insurance Designed For Individuals Living Outside Their Home Country. Starting in 2020 employers of any size can reimburse employees for their personal health coverage premiums.

Annons Health Insurance Plans Designed for Expats Living Working in Sweden. This number capped at 10179 for 2020 is the maximum monthly premium an. An FTE is considered one or more employees working at least 120 hours a month on average 30 hours a week according to Jonathan Greer a California broker with Rockridge Health Insurance.

Depending on whether you are self-employed an employer with fewer than 25 employees an employer with fewer than 50 employees or an employer with 50 or more employees different requirements of the Affordable Care Act may apply to. California Rhode Island and Vermont. Insurance companies that dont meet this requirement must provide rebates to policyholders usually an employer who provides a group health plan.

Small Business Health Insurance A 2021 Guide The Blueprint

Small Business Health Insurance A 2021 Guide The Blueprint

Small Business Health Insurance Plans Best Software Free Download

Small Business Health Insurance Plans Best Software Free Download

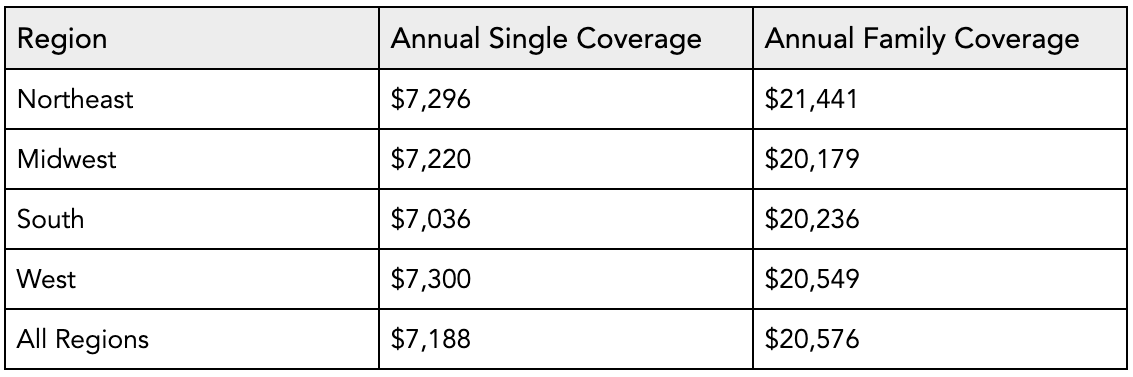

What Are The Costs For Small Business Health Insurance Jackson Jackson Insurance Agents And Brokers

What Are The Costs For Small Business Health Insurance Jackson Jackson Insurance Agents And Brokers

How Much Does Small Business Health Insurance Cost Workest

How Much Does Small Business Health Insurance Cost Workest

Reasons To Offer Small Business Health Insurance

Reasons To Offer Small Business Health Insurance

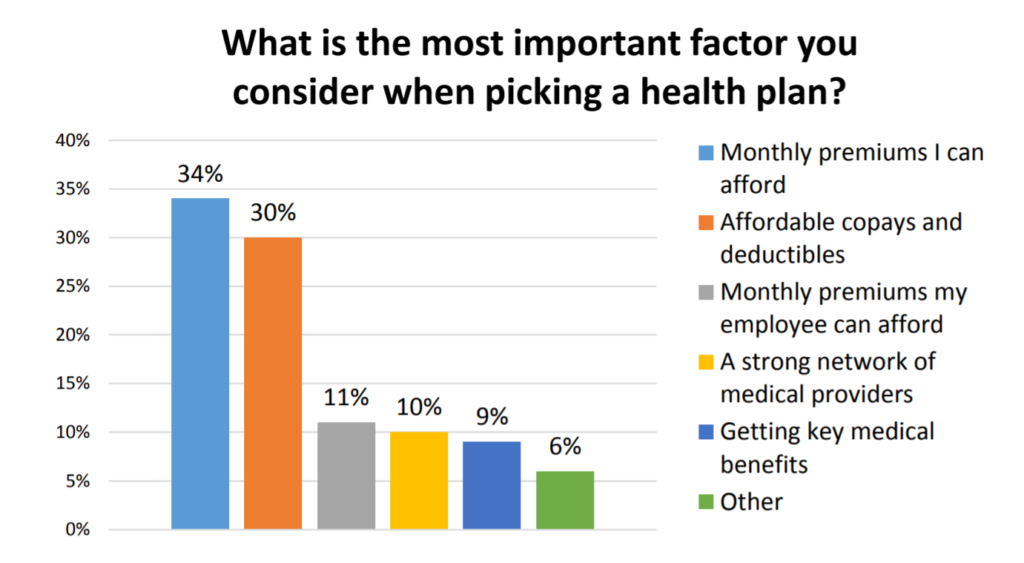

Small Business Health Insurance Trends 2020

Small Business Health Insurance Trends 2020

Small Business Health Insurance Requirements 2021 Ehealth

Small Business Health Insurance Requirements 2021 Ehealth

The Top 5 Small Business Health Insurance Options In 2020

The Top 5 Small Business Health Insurance Options In 2020

Small Business Health Insurance Costs How Pricing Works

Small Business Health Insurance Costs How Pricing Works

Small Business Health Insurance Options Qsehra Ichra More

Small Business Health Insurance Options Qsehra Ichra More

The Top 5 Small Business Health Insurance Options In 2020

The Top 5 Small Business Health Insurance Options In 2020

The Truth About Small Business Health Insurance

The Truth About Small Business Health Insurance

Small Business Health Care Options To Stay Competitive In 2020 Small Business Matters

Small Business Health Care Options To Stay Competitive In 2020 Small Business Matters

Small Business Health Insurance Requirements 2021 Ehealth

Small Business Health Insurance Requirements 2021 Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.