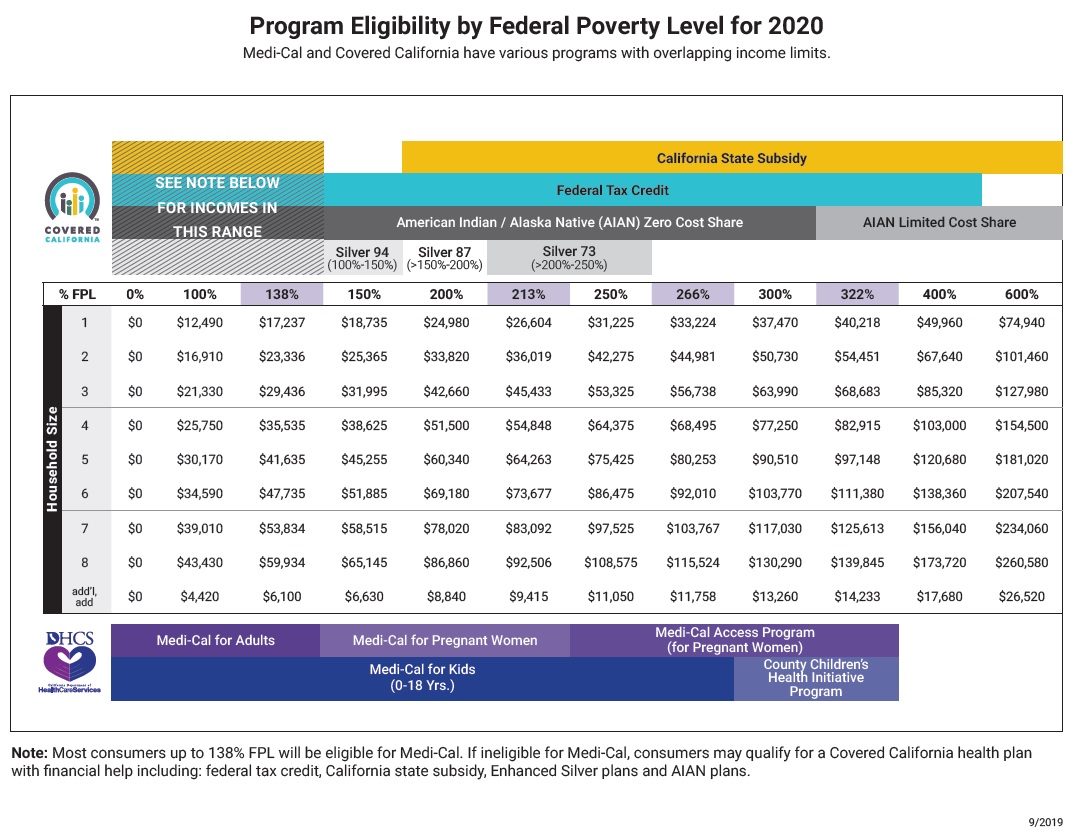

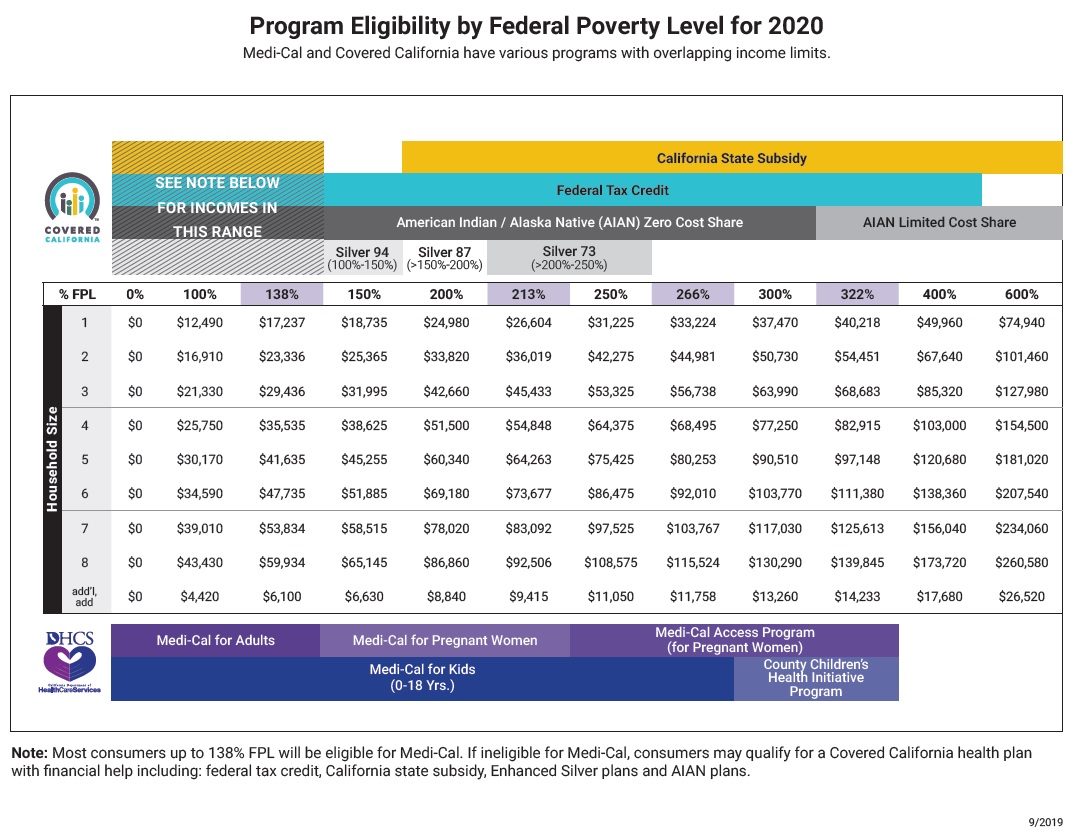

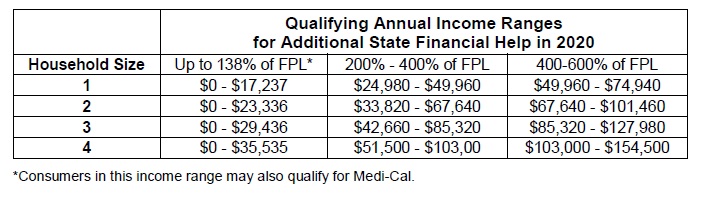

Before the American Rescue Plan California helped people who made too much money qualify for the premium tax credit with a state subsidy. Individuals with income up to 74940.

Health Care Reform Subsidies Explained In Layman S Terms

Health Care Reform Subsidies Explained In Layman S Terms

Households bringing in less than 250 percent of the FPL are also eligible for help with out-of-pocket costs.

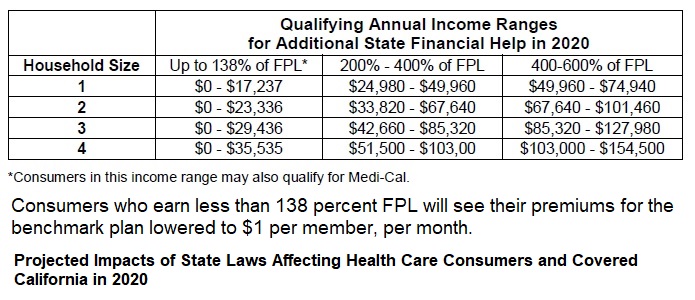

What is california premium subsidy. An eligible individual is a taxpayer whose household income - modified adjusted gross income MAGI - is between 138 percent and 600 percent of the federal poverty level FPL. The State Premium. However starting in 2020 in California those between 400 and 600 of FPL may qualify for state subsidies.

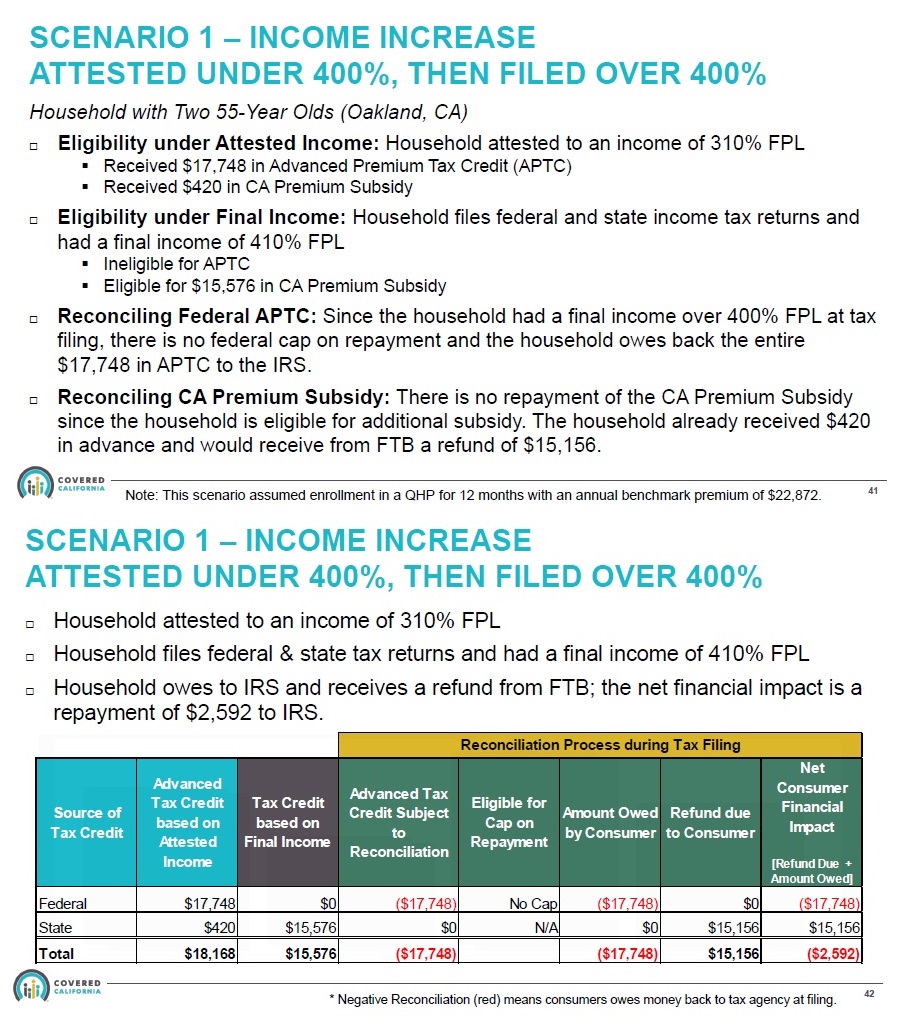

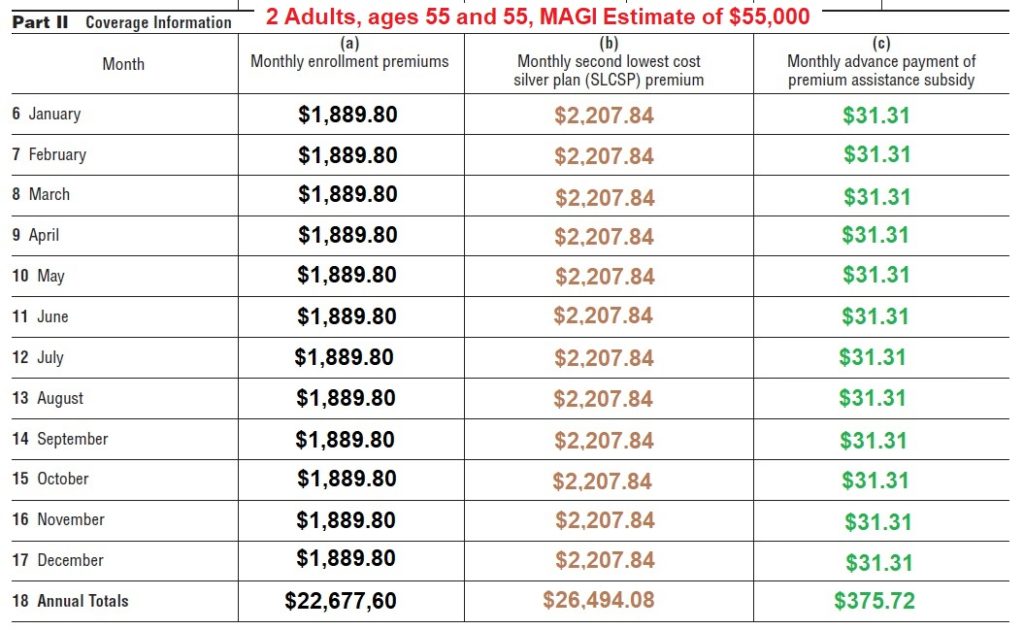

California doesnt conform to federal and you must repay the overpayment of the subsidy to CA. March 31 2021 at 530 am. Maximum contribution is the amount that the consumers household is expected to contribute toward the premium.

The subsidies are in the form of tax credits. California Form 3849 - Premium Assistance Subsidy. The PAS is.

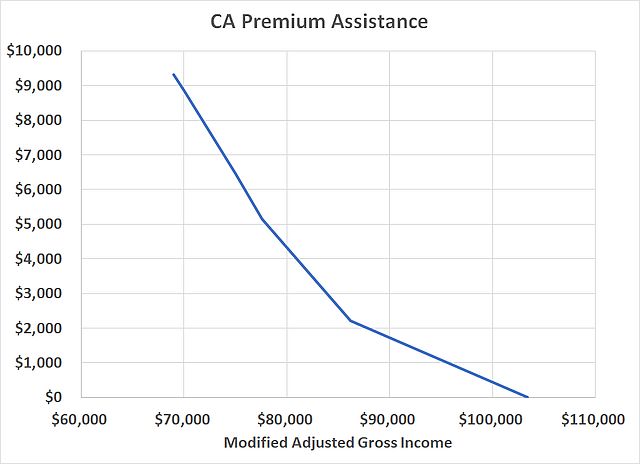

Some consumers between 200 and 400 of the FPL may also get a small amount of extra subsidy to further reduce their health insurance premiums. Why am I getting the healthcare penalty. 4 rijen The California state subsidy is called the State Premium Assistance.

The California Premium Subsidy will be available to households who earn between 401 and 600 of the FPL. Thanks to the American Rescue Plan Californians will get more help paying for their plan from the federal government and even more Californians qualify for the new savings. The subsidy is technically an advance premium tax credit.

Low-income and moderate-income families earning up to 400 percent of the federal poverty level FPL are eligible for subsidies. According to Covered California getting a state subsidy depends on the difference between two numbers. I am a Non Resident of California.

A Covered California subsidy is properly known as an Advance Premium Tax Credit APTC ie a tax credit that is intended to pay part of your insurance premium if you qualify. You can choose to have the federal government pay the insurance company the credit on. Expanded California State Subsidy program begins in 2020.

For example for a household at 500 of FPL the subsidy kicks in at 16 of your income. If your health insurance premiums are over 16 of income then the state of California will cover any additional costs through up-front subsidies. This is based on percentage of income.

Beginning with tax year 2020 California requires residents and their dependents to obtain qualifying health care coverage Individuals who purchase a qualified health care plan through the California health insurance marketplace may be eligible to receive financial assistance to help pay the insurance premiums known as the Premium Assistance Subsidy PAS. The subsidy provides financial assistance to pay the premiums for a qualified health plan through the California health insurance marketplace Marketplace. Premium assistance subsidy PAS.

California Health Care Coverage. Maximum contribution and benchmark premium. Click here to check your eligibility for premium assistance.

What is my residency status for California. The term Marketplace refers to the California state. Covered California Premium Assistance Who is Eligible for Premium Assistance.

Available for certain people who enroll or whose applicable household member enrolls in a qualified health plan. Households newly eligible include 400 up to 600 of Federal Poverty. What is California Form 3849- Premium Assistance Subsidy PAS.

Family of 5 with income up to 181020. Individuals who purchase a qualified health care plan through Covered California the California health. With most tax credits you receive it when you file your tax return.

The Affordable Care Acts premium subsidies were designed to help Americans purchase their own health insurance. How do I complete the 3849 Form. Based on federal guidelines subsidies will be available starting in January to individuals earning up to almost 75000 a year and families of four earning as much as 154500.

Conditions for California Premium Subsidy Consumers will need to have the appropriate citizenship or immigration status You cant be claimed as a dependent on another persons tax return You must plan to file taxes You are not eligible for subsidies if you have affordable employer group insurance. Beginning with tax year 2020 the state of California requires residents and their dependents to obtain qualifying health care coverage also referred to as Minimum Essential Coverage MEC. What is CA premium subsidy.

Family of 4 with income up to 154500.

Faq California Premium Subsidy For Health Insurance

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Http Www Acgov Org Board Bos Calendar Documents Docsagendareg 1 27 20 Health 20care 20services Regular 20calendar 2020 01 27 Joint Health Ssc Item 1 1 Covered California Presentation Pdf

2021 California Aca Health Insurance Premium Subsidy

2021 California Aca Health Insurance Premium Subsidy

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2021 California Aca Health Insurance Premium Subsidy

2021 California Aca Health Insurance Premium Subsidy

State And Federal Subsidies For California In 2020 Health For California Insurance Center

State And Federal Subsidies For California In 2020 Health For California Insurance Center

Faq California Premium Subsidy For Health Insurance

Faq California Premium Subsidy For Health Insurance

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

How Is The California Premium Assistance Subsidy Calculated With Ftb 3895 And 3849

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Do You Qualify For The New California Health Insurance Premium Subsidy

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

Premium Subsidy California To 600 Fpl Federal Poverty Level And New Mandate Penalty

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

New California Policies Make Huge Difference Increasing New Signups During Covered Californias Open Enrollment By 41 Percent

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.