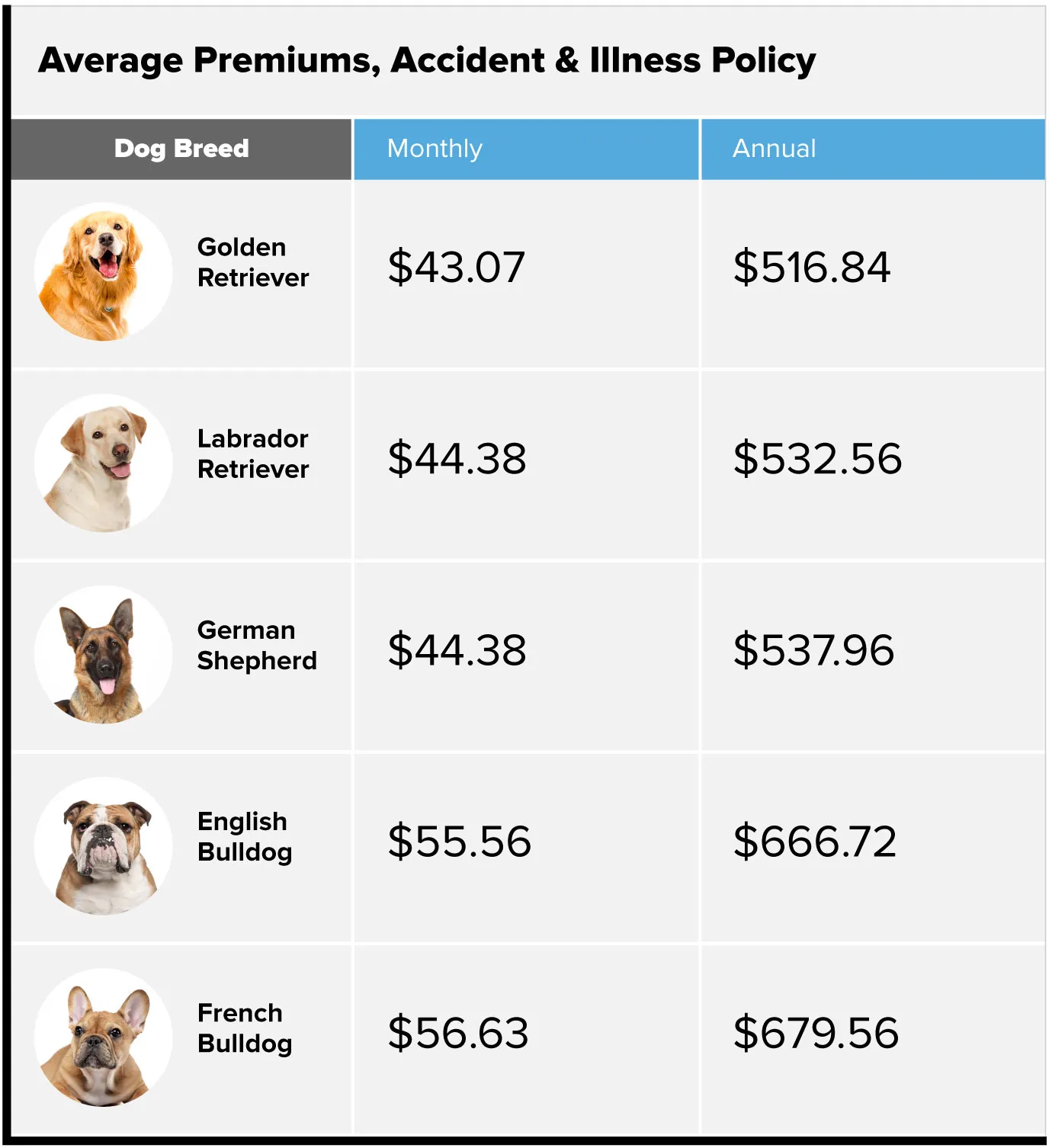

To get insurance you agree to pay a monthly or annual premium in return for a payout when you need it. Private health insurance refers to any health insurance coverage that is offered by a private entity instead of a state or federal government.

What Is A Personal Health Insurance And How Does It Help You Digestley

What Is A Personal Health Insurance And How Does It Help You Digestley

Personal Health Insurance Plans.

What is personal health insurance. Health Insurance is a way to ensure you and your family can get the best medical care without you worrying about the cost. In a health insurance policy the cost of medical treatment of the insured persons is borne by the insurance company. UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors.

Health Insurance Comparison and Offer. Types of personal insurance. Get the Best Quote and Save 30 Today.

Personal health insurance products help lower your risk of being burdened by expenses for preventive care or medical bills as a result of an illness or accident. Get a Free Quote. Compare your current Health Insurance Premiums 2021 in just 2 minutes without obligation.

Insurance brokers and companies both fall into this category. Anzeige Compare Top Expat Health Insurance In Switzerland. Who needs individual health insurance.

What is individual health insurance. Anzeige Compare 50 Health Insurance Plans Designed for Expatriates. - Free Quote - Fast Secure - 5 Star Service - Top Providers.

Or major medical health insurance. Similar exemptions apply depending upon the policy which is bought. While provincial health plans provide coverage for many health expenses there are gaps that can have a significant impact on your finances.

Health Insurance Designed For Individuals Living Outside Their Home Country. What is personal health insurance. Individual health insurance.

Get the Best Quote and Save 30 Today. - Applicable For Foreign Citizens Only - Not for Local citizens students. What is individual health insurance.

Compare your current Health Insurance Premiums 2021 in just 2 minutes without obligation. What is private health insurance. Individual health insurance is coverage that you purchase on your own on an individual or family basis as opposed to obtaining through an employer or from a government-run program like Medicare Medicaid or CHIP.

Get a Free Quote. Health Insurance Comparison and Offer. Anzeige Health Insurance Plans Designed for Expats Living Working in Switzerland.

- Applicable For Foreign Citizens Only - Not for Local citizens students. - Free Quote - Fast Secure - 5 Star Service - Top Providers. Anzeige Compare 50 Health Insurance Plans Designed for Expatriates.

Anzeige Compare Top Expat Health Insurance In Switzerland. A plan that covers one member ideal for single individuals. Anzeige How much can you save in your canton.

Anzeige Trusted International Health Network with Perfectly Tailored Plans from Cigna Global. Anzeige How much can you save in your canton. Personal insurance is any insurance that protects you from having to pay out of pocket for accidents illness or damage to your property.

/invisalign-and-dental-insurance-coverage-7565b48f924b43c7b9f7f7431be4dcbe.png)