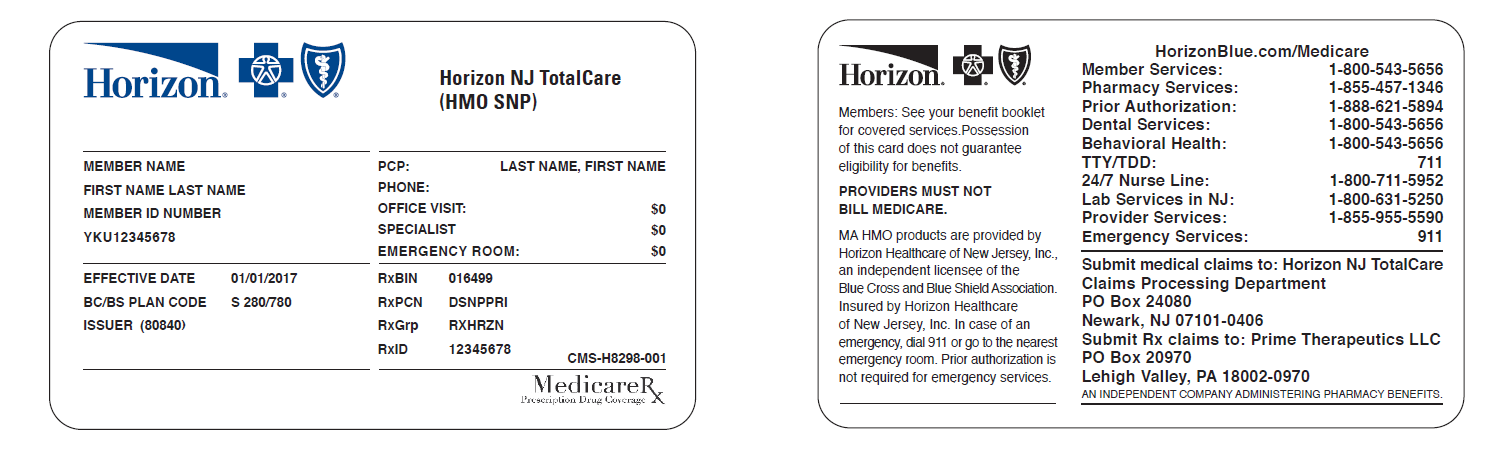

HMO stands for health maintenance organization. Making Sense of Different Types of Health Plans June 07 2018 If youre shopping for a new health plan you may hear a lot about HMO POS PPO and HDHP plans but you may not understand the differences between them.

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

Ppo Vs Hmo Insurance What S The Difference Medical Mutual

You simply pay a fixed copayment each time you visit your PCP.

Ppo vs hmo blue shield. HMO Blue Select 2000 Deductible with Dental Blue Pediatric Essential Benefits. PPO has a wider network but for the providers which overlap between HMO and PPO its not surprising that the HMO would be cheaper. Restrictions and between spending a lot vs.

This infographic lays out the key differences between these four popular health plans. Generally lower out-of-pocket costs for prescriptions. HMO plans may be a good choice and offer a cost-efficient way to maintain your health care if you and your family go to the doctor often.

Having more options costs extra. HMO Blue Saver with Dental Blue Pediatric Essential Benefits. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care.

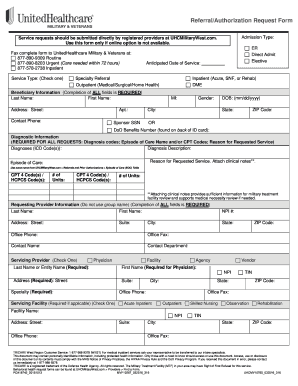

You dont need a primary care physician PCP to coordinate your care. Take the PPO Vs. While a POS plan offers the flexibility of going out-of-network youll pay a greater portion of all out-of-network charges.

Im in Blue Shield CA PPO as well in Covered California. The monthly payment for an HMO plan is lower than for a PPO plan with a comparable deductible and out of pocket maximum. The advantages of HMO plans compared with PPO plans make them a popular choice if youre budget-conscious or if you dont anticipate many doctor visits.

HMO Blue Select 1000 Deductible with Copayment with Dental Blue Pediatric Essential Benefits. A PPO plan has a certain group of health care providers you can use when you need care. Both types of plans have a network of physicians hospitals and other health care professionals that agree to provide medical services at pre-negotiated prices and rates for Blues members.

As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. There are two main types of health insurance plans. You may need a personal doctor to coordinate your care like with an HMO but youll be able to go outside the network to receive care in non-emergent cases like with a PPO.

One kind might work better for you than another. Lower monthly premiums and generally lower out-of-pocket costs. PPO Preferred Provider Organization and HMO Health Maintenance Organization.

HMO POS PPO and HDHP. HMO plan must access covered services through a network of physicians and facilities as directed by their PCP. For example when a PPO member walks in the door he or she will be charged a discounted PPO rate for a scheduled and covered service.

Each one is just a different balance point between benefits vs. Itll depend on how often you visit the doctor where you go to get your care and how much you can pay for it. You pick your winner.

More structured in how you access care. I will mainly compare the Kaiser HMO plan with Blue Shield PPO plan make sure to watch this video until the end as I will share with you the advantages and disadvantages of both Kaiser and Blue Shield okay so lets start with the cost Kaiser only offers HMO plans on the individual market and HMO plans are generally cheaper Blue Shield offers HMO and PPO plans regarding the benefits. Compared to PPOs HMOs cost less.

In exchange for a lower monthly payment an HMO offers a narrower network of available doctors hospitals and specialists. You dont need a referral to see a specialist. All health care plans arent the same.

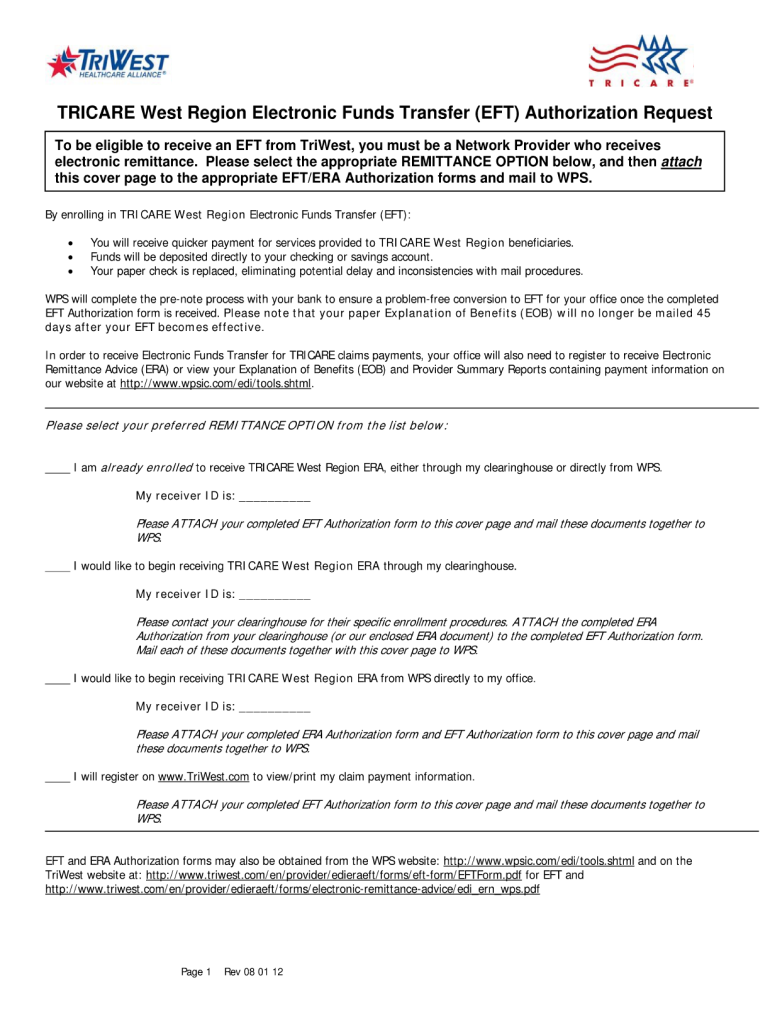

Blue Cross offers associates a Health Maintenance Organization HMO medical plan option and High Deductible Health Plan HDHP Preferred Provider Organization PPO medical plan option. HMO Blue Select 1000 Deductible with Dental Blue Pediatric Essential Benefits. In the PPO world youll find more options and youll likely end up paying more money in monthly premiums to have this choice.

PPO stands for. If youre going PPO that usually means youll be looking at Anthem Blue Cross Covered California and Covered California Blue Shield. Theres no perfect health plan type.

You can get care from in-network or out-of-network providers. CareFirsts PPO plans offer a wide network of providers. Understanding the difference between PPO EPO HMO and POS is the first step towards deciding how to pick the health insurance plan that will work best for you and your family.

PPO stands for preferred provider organization. However PPOs generally offer greater flexibility in seeing. And both can be winners at meeting your healthcare needs.

PPO - Which ones for you. A PPO may be a good choice for you because. With PPO plans you may select.

Its up to you to decide each year which type of plan works best for you. The difference between them is the way you interact with those networks. Tend to have richer benefits less out of your pocket when sick or hurt Can cost more in monthly premium since new ACA law started.